[fa icon="clock-o"] Tuesday, July 29, 2025 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] loan modification lawyer, loan modification attorney, foreclosure defense, lenders, foreclosure defense attorney

Read More »

[fa icon="clock-o"] Thursday, July 10, 2025 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, loan modification lawyer, loan modification attorney, loan modification, foreclosure defense, loan modification help, foreclosure, mortgage, foreclosure glossary, lawyer, foreclosure crisis, foreclosure defense attorney, avoiding foreclosure, loan modification application

Read More »

Approximately 250,000 families enter into foreclosure every 3 months due to delinquent home loan payments or delinquent property taxes. Each of these homeowners has one thing in common: they have to make the decision of whether or not to fight for their home. However, if you want to fight the foreclosure and keep your home, it's time to find a foreclosure defense attorney. Here are some reasons why:

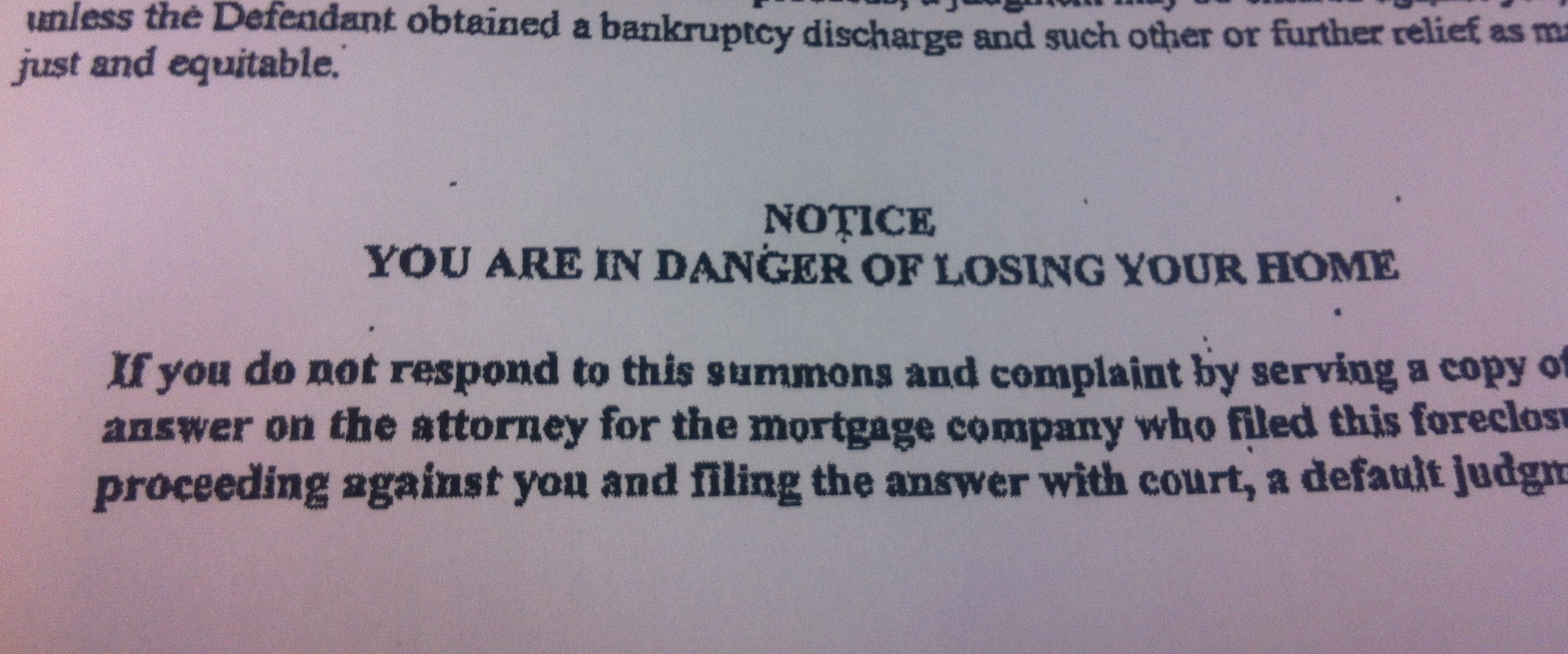

[fa icon="clock-o"] Sunday, October 18, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] stop foreclosure, loan modification lawyer, how to stop foreclosure, loan modification denied, loan modification attorney, successful loan modifications, foreclosure defense, prolong foreclosure, foreclosure, mortgage, lawyer, foreclosure defense attorney, mortgage debt, dos donts of foreclosure, foreclosure lawsuit, avoiding foreclosure, default judgment, consent to foreclosure, legal aid

Read More »

You've been served with foreclosure documents and now you're wondering: What's my next move to fight this action? Once you are served with foreclosure papers there are two options. You can be reinstated or you can request a loan modification.

[fa icon="clock-o"] Tuesday, August 11, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] loan modification lawyer, dual-tracking, reinstatement, loan modification application, loan modification terms

Read More »

If you are fortunate enough to be granted a loan modification, it is such a relief to know that you have saved your home! Almost losing your home to a foreclosure can be a scary wake up call that you hope to never have to go through again. Some people unfortunately do face foreclosure more than once, and when this happens there are many things to consider. One of them is whether you can modify your loan again.

[fa icon="clock-o"] Tuesday, August 4, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] stop foreclosure, loan modification lawyer, loan modification application

Read More »

Falling behind on your mortgage doesn't mean losing your home to foreclosure is a foregone conclusion. What happens and when depends in large part on how you respond to your situation. You may be able to keep your home or at least exit it under the best circumstances. But to do that you have to act on good information and avoid the mistakes that are often made by homeowners in foreclosure, which include:

1. Assuming your lender is going to help you.

Though your lender has the power to help you, you should not assume that they will. You and your lender's goals don't always align. Following a default, you probably want to keep your home but with a lower payment. The bank simply wants to make as much money as possible from the loans in their portfolio. Sometimes helping you keep your home is also the best way for the bank to make the most money, sometimes not.

[fa icon="clock-o"] Tuesday, July 25, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, foreclosure defense, loan modification help

Read More »

If you're considering hiring an attorney to help you avoid foreclosure and/or get a loan modification, you may be wondering what specifically an attorney will do to help you keep your home. You know your mortgage issues are too important to try to handle alone, but how exactly does an attorney help?

Do they just show up in court and say something in Latin “Your honor, the corpus juris, et cetera, entitle my client to keep their house. Also, carpe diem, and liberum domum (free house), please.”

Of course not. So what does an attorney actually do when you hire them to defend you from foreclosure and assist you in getting a loan modification?

[fa icon="clock-o"] Monday, September 19, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] new jersey foreclosure attorney, florida foreclosure defense, pennsylvania foreclosure defense, illinois foreclosure lawyer, loan modification lawyer, loan modification, foreclosure defense, new york foreclosure attorney, foreclosure defense attorney

Read More »

If you're having problems with your mortgage, it's a good idea to communicate with your bank to see if you can work with them for some sort of agreement to stay out of foreclosure.

Your bank can choose to give you an unemployment forbearance that temporarily suspends your mortgage payments because of a job loss, for example. Or, if you're already behind on your mortgage payments due to a hardship, you may be able to get a loan modification that reinstates your mortgage with a more affordable payment.

Loan modifications are the only option many homeowners have to keep their home. The terms of the loan, such as the length of the loan, the interest rate, and the principal balance can be changed.

Loan modifications are a life saver for those who get them. Unfortunately, many Wells Fargo borrowers end up disappointed when they don't get the results they're looking for after trying to deal with the bank on their own. And Wells Fargo has a reputation as one of the most difficult banks to work with for a loan modification.

[fa icon="clock-o"] Tuesday, September 6, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, wells fargo loan modification, loan modification denied, loan modification

Read More »

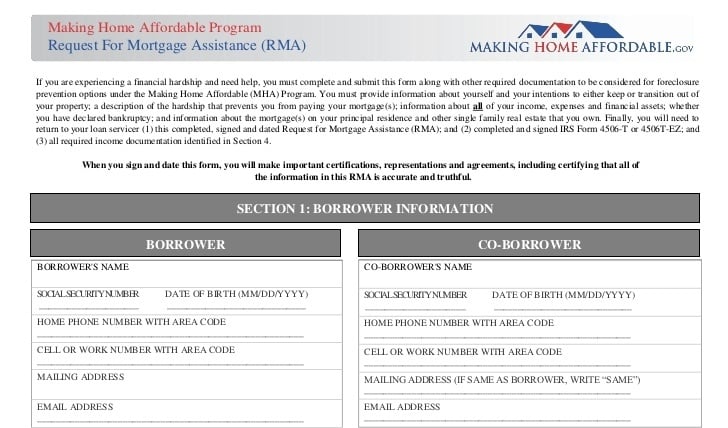

If you need help with your mortgage, you're not alone. Millions of Americans have experienced hardships caused by factors beyond their control that made their mortgage payment unaffordable.

If that's happened to you, there is assistance available that can help you keep your home and avoid foreclosure. But to get that assistance, you'll need to complete a Request for Mortgage Assistance.

[fa icon="clock-o"] Friday, February 26, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, loan modification, HAMP, hamp loan modification, loan modification help

Read More »

Anyone who drives a car has noticed that gas prices are dramatically lower than they've been in years due to lower oil prices. While we're all happy that filling up our tanks is easier on the wallet, there is a down side: cheap oil can cause people who make a living in the oil industry to lose their jobs, and their homes to foreclosure.

When the price of oil plunges, companies in the oil business or businesses that service or support them, lay off some workers or pay them less. Those workers are more likely to be unable to afford their mortgages payments and fall into foreclosure. The oil business is employs a lot of people, so when it suffers, a lot of workers can suffer.

[fa icon="clock-o"] Wednesday, February 24, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, foreclosure, foreclosure grief

Read More »