You may think that once the awful foreclosure process is over you will not hear from your lender ever again. However, if there is a deficiency judgment form the foreclosure sale, this may not be the case. The bank can come after you if your home does not sell for the full value of the debt owed. This is called a deficiency judgment. How exactly can the bank collect this judgment? Read on to find out how.

[fa icon="clock-o"] Thursday, September 17, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] life after foreclosure, debt collections harassment, debt settlement, deficiency judgment, foreclosure grief, foreclosure fees

Read More »

Right Instead of Wrong - How Important Are High Ethical Standards?

The first two definitions found on Dictionary.com are:

- Pertaining to or dealing with morals or the principles of morality; pertaining to right and wrong in conduct.

- Being in accordance with the rules or standards for right conduct or practice, especially the standards of a profession.

Here at Amerihope Alliance Legal Services we believe that treating our clients and others in the communities we service with the highest of ethics, professionalism, and sensitivity are very important. Which is why we are very proud to be honored with the 2015 Highest in Ethical Standards and Professional Excellence Award from The Legal Network. These awards are substantiated by the stellar reviews from thankful clients.

Providing clients with an informed knowledge of the their legal rights, obligations and explaination of their practical implications.

Asserting the client's position under the rules of the adversary system.

Negotiating results advantageous to the client but always within the requirements of honest dealing with others.

[fa icon="clock-o"] Tuesday, May 19, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] illinois foreclosure lawyer, new york foreclosure attorney, foreclosure defense attorney new jersey, florida foreclosure attorney, debt collections harassment, law firm awards

Read More »

If you have high credit card debt, you might be able to settle the debt for less than the full amount. If you plan to do-it-yourself there are dangers you should be aware of.

Credit card settlement involves negotiating with the creditor company via an offer to settle the amount you owe with a lesser amount. In the event that the creditor accepts, you must be prepared to pay the entire negotiated settlement amount up front, in one lump sum.

[fa icon="clock-o"] Tuesday, April 21, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] debt collections harassment, debt settlement, credit cards

Read More »

I’m attorney Nick Murado. I sue debt collectors and can fix your credit rating – for FREE!

If you have any debts in collections, you know the types of tactics the debt collector scum are willing to use:

- They have no problems insulting you, abusing you, or cursing you out.

- They love to call you at work, which can threaten the status of your employment.

- They cherish those early morning or late night calls, designed to disorient you and wear down your willpower, hoping you'd just pay them so they would go away and let you sleep.

- They relish those times they call your family, your neighbors, or your friends, attempting to convert them into tools of war to be used against you.

- They enjoy placing false, fraudulent, or otherwise incorrect information on your credit reports, tanking your credit rating.

[fa icon="clock-o"] Friday, March 6, 2015 [fa icon="user"] Nicholas Murado, Esq. [fa icon="folder-open'] debt collections harassment

Read More »

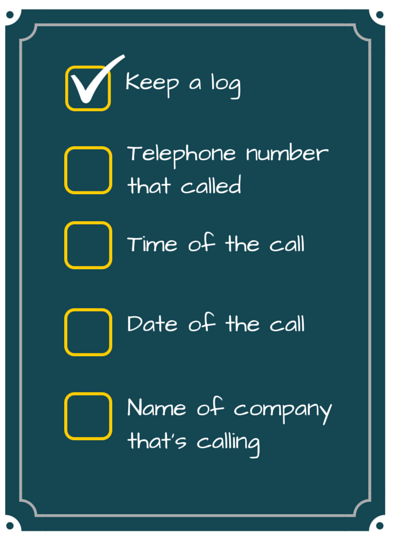

When a debt collector calls you, it's important to keep a record of what happened, especially if you think your rights may have been violated.

Consumer law attorneys need, at a minimum, the following information to begin a prosecution of your rights under the FDCPA, FCCPA, or TCPA:

- The number that called

- The time of the call

- The date of the call

- The name of the company calling, if known.

Any time a new number calls you, it is important to answer the phone at least once to make sure that a given phone number belongs to the same debt collection company. Once you have this information, you can hang up. Any future calls from that particular phone number can be logged as belonging to that same company.

[fa icon="clock-o"] Tuesday, February 24, 2015 [fa icon="user"] Nicholas Murado, Esq. [fa icon="folder-open'] debt collections harassment

Read More »