We posted a blog yesterday stating that loan modifications that reduced principal for borrowers with loans insured by Fannie Mae and Freddie Mac were being considered by their regulator, the Federal Housing Finance Authority (FHFA). Since then, Fannie Mae has announced the Fannie Mae Principal Reduction Modification Program. According to their website:

We posted a blog yesterday stating that loan modifications that reduced principal for borrowers with loans insured by Fannie Mae and Freddie Mac were being considered by their regulator, the Federal Housing Finance Authority (FHFA). Since then, Fannie Mae has announced the Fannie Mae Principal Reduction Modification Program. According to their website:

[fa icon="clock-o"] Tuesday, April 19, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, negative equity, fannie mae

Read More »

Home equity is how much more your home is worth than what you owe on it. Negative equity, also called being underwater or upside down, means you owe more on your mortgage loan than the home is worth. The value of a home changes based on things like supply and demand for real estate and the health of the economy.

Obviously everyone wants equity in their home. If you have enough, you have the option of selling your home for a profit. Negative equity is bad and most homeowners never anticipated having it.

[fa icon="clock-o"] Wednesday, March 2, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, negative equity, underwater

Read More »

The rate of American homeowners with negative equity fell to 13.4% in the third quarter of 2015, according to real estate company Zillow. That's down one percentage point from the second quarter of 2015 and represents the 14th consecutive quarter of falling negative equity rates.

It's good news that the positive trend continues, but millions of homeowners remain in negative equity and in need of a solution.

Negative equity is also called being underwater or upside down, and it means that the market value of your home is less than the amount you owe on the loan. That means the home can't be sold unless you pay the difference between the home's sale price and what you owe on the loan. If you don't have that much cash, you're stuck in the home.

[fa icon="clock-o"] Tuesday, January 26, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] negative equity, underwater

Read More »

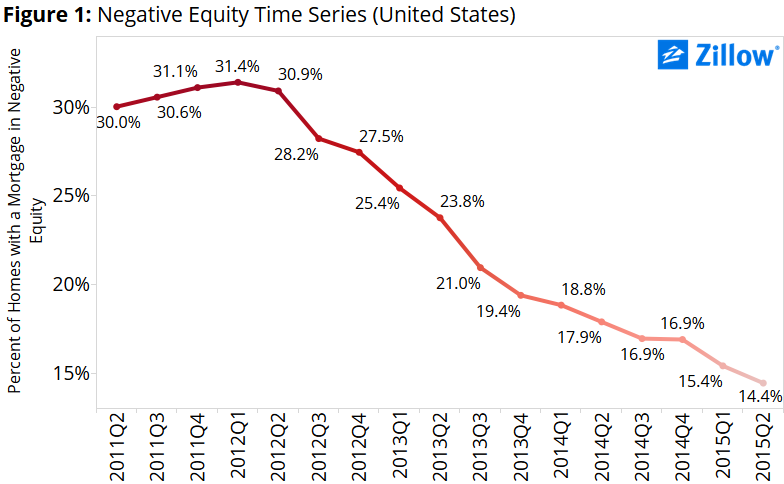

The percentage of Americans with negative equity in their homes, also known as being underwater, continued to fall in the second quarter of 2015 to 14.4%, according to a report from the real estate company Zillow. The rate of homeowners with negative equity has been dropping since the first quarter of 2012 when a high of 31.4% of homeowners were underwater.

[fa icon="clock-o"] Wednesday, December 2, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, housing market, negative equity

Read More »