Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

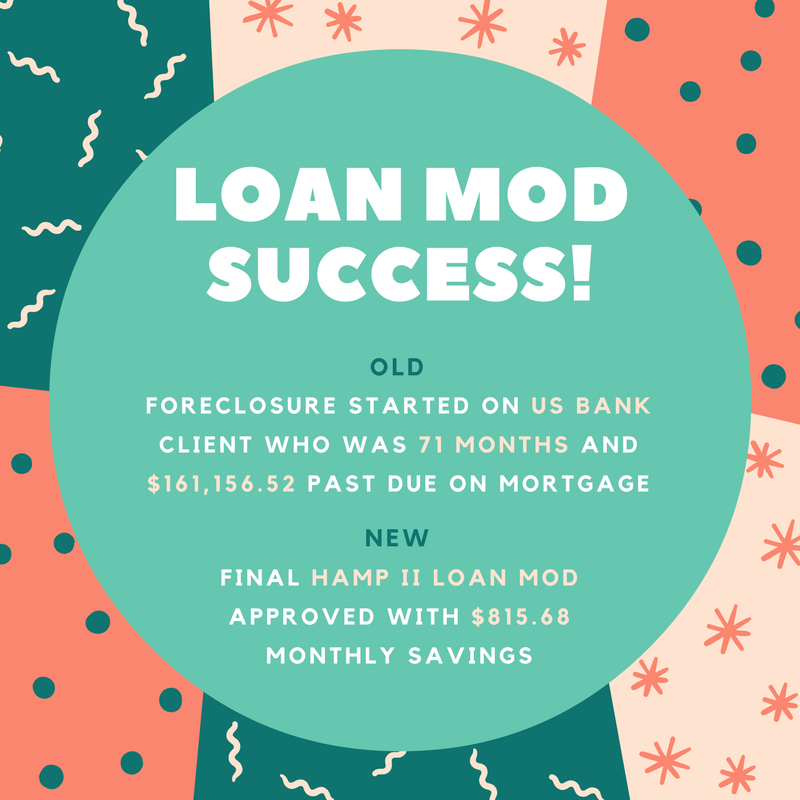

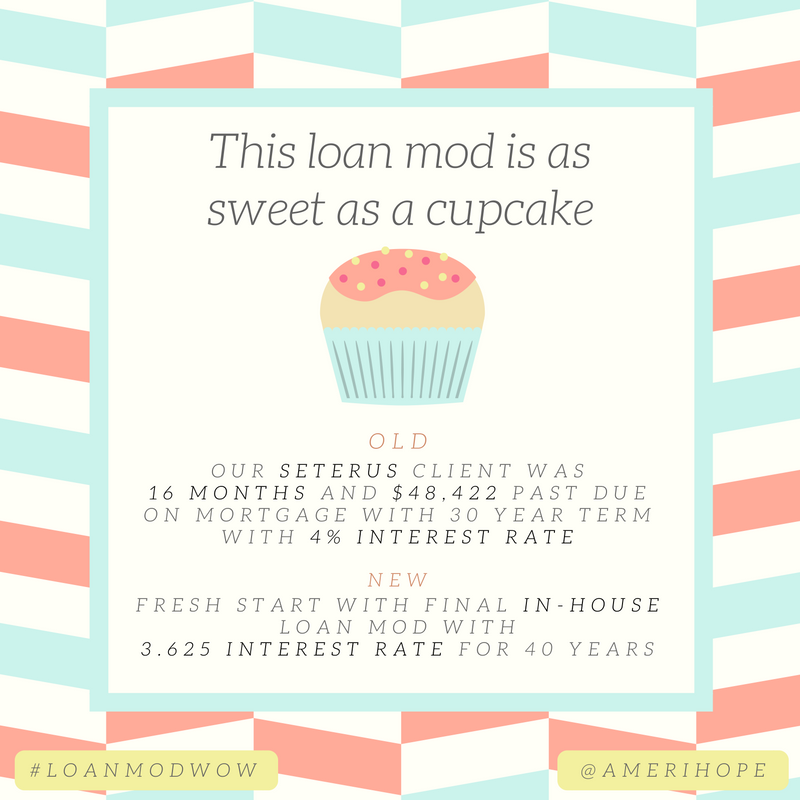

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen, Cenlar, Chase, and US Bank:

Ocwen

Yes! Our Ocwen clients were $7,024.07 past due on their mortgage, but we helped them get a permanent loan modification with $160.79 cheaper monthly payment and incredible $28,553.86 in principal forgiven!