Florida Attorney General Pam Bondi has announced that a settlement was reached with Nationstar Mortgage, doing business as Mr. Cooper, that “resolves allegations regarding Mr. Cooper’s servicing misconduct in the aftermath of Hurricane Irma.”

(If you're in foreclosure, or being threatened with foreclosure after a hurricane, contact our firm for a free Hurricane Hardship Review.)

Mr. Cooper's Misconduct

Mr. Cooper/Nationstar is a mortgage lender and servicer based in Texas which services mortgages nationwide. Their misconduct related to Hurricane Irma is similar to stories we've heard from homeowners with loans serviced by many servicers after the hurricane. It goes like this:

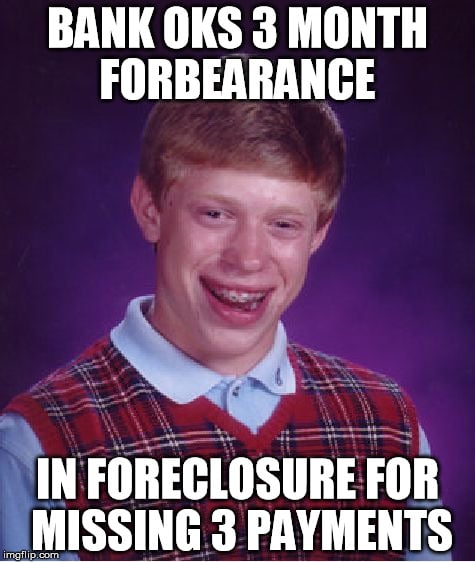

A mortgage servicer tells a homeowner that they can postpone 3-6 months of mortgage payments to recover from the financial impact of Hurricane Irma.