[fa icon="clock-o"] Thursday, July 10, 2025 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, loan modification lawyer, loan modification attorney, loan modification, foreclosure defense, loan modification help, foreclosure, mortgage, foreclosure glossary, lawyer, foreclosure crisis, foreclosure defense attorney, avoiding foreclosure, loan modification application

Read More »

A loan modification can allow you to keep your home and avoid foreclosure after falling behind on your mortgage, but it's not necessarily all roses. In fact, there are some downsides to loan mods that your lender may not go out of their way tell you about.

If you don't know, a loan modification is a permanent change to one or more of the terms of your mortgage, such as the term, interest rate, and monthly payment.

A loan modification is often the only hope many homeowners have to keep their home following a default. They can be great, however if you need one, you should be aware of the following:

[fa icon="clock-o"] Sunday, July 12, 2020 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

Getting out of foreclosure is only half the battle. The other half is staying out.

After months or years of not making house payments and trying to avoid foreclosure, some homeowners have been able to reinstate their mortgage with a permanent loan modification that gives them the opportunity to keep their home and avoid foreclosure for good.

Unfortunately, some of these homeowners have stopped making mortgage payments again and ended up back in foreclosure.

That's called a repeat foreclosure, and it's been a big problem since the housing crisis began. ATTOM Data Solutions recently reported data on repeat foreclosures. The results show very high rates in some parts of the country.

[fa icon="clock-o"] Wednesday, August 16, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, loan modification help, personal finance

Read More »

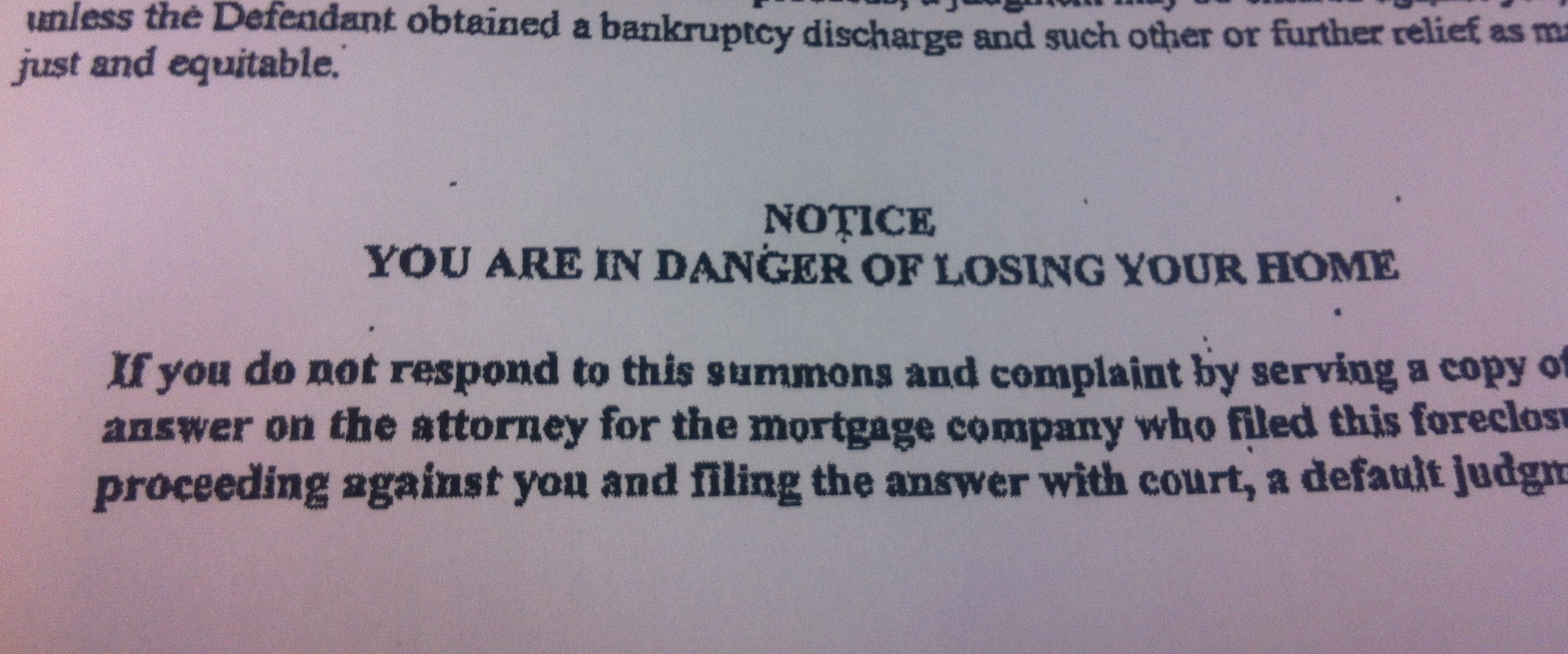

Falling behind on your mortgage doesn't mean losing your home to foreclosure is a foregone conclusion. What happens and when depends in large part on how you respond to your situation. You may be able to keep your home or at least exit it under the best circumstances. But to do that you have to act on good information and avoid the mistakes that are often made by homeowners in foreclosure, which include:

1. Assuming your lender is going to help you.

Though your lender has the power to help you, you should not assume that they will. You and your lender's goals don't always align. Following a default, you probably want to keep your home but with a lower payment. The bank simply wants to make as much money as possible from the loans in their portfolio. Sometimes helping you keep your home is also the best way for the bank to make the most money, sometimes not.

[fa icon="clock-o"] Tuesday, July 25, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, foreclosure defense, loan modification help

Read More »

As a result of the ongoing housing crisis, mortgage loan modifications have become popular with distressed homeowners who need to reinstate their loan and get a more affordable payment. But not everyone who could benefit from modifying their mortgage understands what's actually involved and how to go about getting one. And some assume or have been told incorrect information.

What is a Loan Modification

A mortgage loan modification is a permanent change to one or more of the terms of your existing loan, such as the interest rate, term length, and principal balance. The purpose is to lower the monthly payment to an affordable portion of your income and allow you to avoid foreclosure. It is different from a refinance, which replaces your old loan with a completely new one.

Loan modifications are the only hope many people have for avoiding foreclosure and staying in their home. However, there are some common misconceptions, such as:

[fa icon="clock-o"] Monday, August 8, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, hamp loan modification, loan modification help, foreclosure

Read More »

Money is a very personal issue. So much so that it's often considered in bad taste to talk about it in polite society. Especially when you're talking about problems with money. And foreclosure is the mother lode of money problems since most people's largest asset is their home.

But unfortunate events beyond the control of any homeowner have caused millions of people to have to reckon with foreclosure. The credit crisis, recession, and housing crisis have caused foreclosures on a scale that the country hasn't seen since the Great Depression.

If you're in danger of losing your home to foreclosure, you're likely experiencing some seriously negative emotions. Fear, uncertainty, shame, guilt, and anger are common. These emotions are completely understandable and just as useless. You have to get a handle on them to keep from going crazy and find the best resolution.

Here are some ways to do that:

[fa icon="clock-o"] Wednesday, August 3, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification help, foreclosure, foreclosure grief

Read More »

Many homeowners have lost wages or experienced some hardship or hardships that caused them to fall behind on their mortgage payments. They're in desperate need of a solution before they're foreclosed on. Searching for any hope in a sea of despondence, they wonder if there's a way they could get their house for free.

These homeowners want to know if there's any way their house could be given to them as a form of retributive justice for all the illegal and unethical things their bank has done. There certainly doesn't seem to be a shortage of that. We've all heard the stories about predatory lending, robo-signing, and fraudulent foreclosure. Could that somehow be cause for a free house?

No. You won't get your home for free because of any bad behavior by the bank.

However, there is a technicality that could allow a homeowner to get their home for free.

[fa icon="clock-o"] Wednesday, July 27, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help

Read More »

Many homeowners find that something strange happens when they stop paying their mortgage: nothing much. After missing payments they get letters from their bank telling them that they have to pay up or else lose their home. They don't pay because they can't, but still nothing happens for a long time.

Some homeowners go many years without making a payment, falling behind by tens or hundreds of thousands of dollars, and yet their house isn't sold at a foreclosure auction, the sheriff doesn't tell them to vacate the premises, and they're not thrown to the curb. Sometimes the collections calls even stop!

However, just because nothing seems to happen doesn't mean that the gears of foreclosure aren't turning or that the bank forgot that your loan isn't performing for them. Rest assured that they haven't forgotten about you and the money you owe them.

[fa icon="clock-o"] Tuesday, July 5, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] new jersey foreclosure process, foreclosure process in new york, loan modification, florida foreclosure process, loan modification help, foreclosure

Read More »

Home values are expected to grow about 3 to 4 percent a year in the coming years according to the panelists in the most recent Zillow Home Price Expectations Survey. Their expectations, however, are less optimistic when considering a Donald Trump or Bernie Sanders presidency.

The survey asked 107 economists, real estate experts, and academics across the nation what they expected from home prices over the next four years and how the election of different candidates would affect their forecast.

45 percent of those surveyed who had an opinion said that the election of presumptive Republican nominee Donald Trump “would impact their expectations for future home value growth either very negatively or somewhat negatively, compared to just 16 percent who said their expectations would be impacted somewhat or very positively.”

[fa icon="clock-o"] Wednesday, June 22, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help, housing market

Read More »

If you're at the point in the loan modification process where your loan servicer is asking you to make trial modification payments, then you've almost reached your goal. But this is no time to take your foot off the gas. You still have a little ways to go before your loan is permanently modified.

Being asked to make trial modification payments is a good thing. It means that your request for modification assistance has been accepted. You're on your way to achieving your objective.

But banks don't just approve an application and return your loan to normal servicing like nothing ever happened. You have to prove that you're able to make the payments, and then you'll be offered a permanent modification.

[fa icon="clock-o"] Friday, May 27, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help, trial modification

Read More »