On Tuesday, May 2, 2016 a Manhattan federal court convicted Dionysius Fiumano of “orchestrating a massive mortgage modification scheme through which he and his conspirators defrauded more than 30,000 American homeowners out of a total of approximately $31 million,” according to Christy Goldsmith Romero, the Special Inspector General for the Troubled Asset Relief Program (SIGTARP).

Dionysius Fiumano, aka “D”, and his co-conspirators oversaw a sales staff of 65 telemarketers and managers from 2011 to 2014. Fiumano was the general manager of sales at Vortex Financial Management, Inc, which was also known as Professional Marketing Group (PMG), and Professional Legal Network. The company was based in Irvine, California and claimed to offer mortgage modification services.

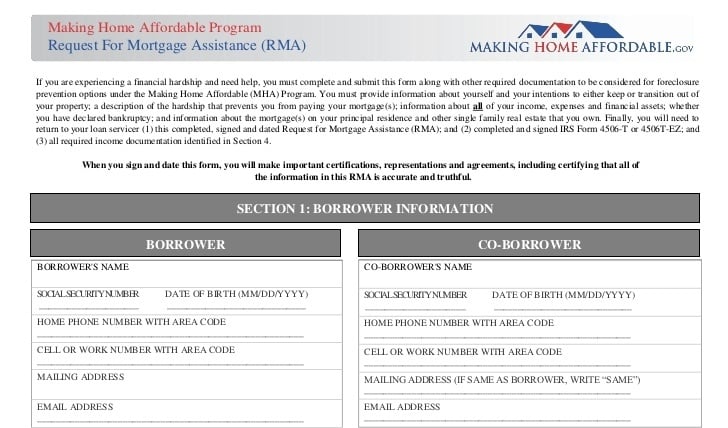

PMG operated somewhat like a legitimate company, buying leads that gave them the contact information of homeowners who were behind on their mortgage payments and in danger of foreclosure and trying to get them to buy their "services."