If you need help with your mortgage, you're not alone. Millions of Americans have experienced hardships caused by factors beyond their control that made their mortgage payment unaffordable.

If you need help with your mortgage, you're not alone. Millions of Americans have experienced hardships caused by factors beyond their control that made their mortgage payment unaffordable.

If that's happened to you, there is assistance available that can help you keep your home and avoid foreclosure. But to get that assistance, you'll need to complete a Request for Mortgage Assistance.

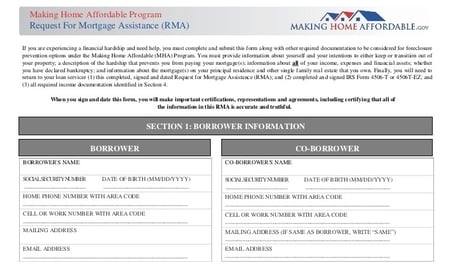

A Request for Mortgage Assistance (RMA) is the application you have to fill out to be considered for a mortgage loan modification. Before examining all that's needed to apply, let's briefly look at what a loan modification is, how it can help someone save their home, and what the eligibility requirements are.

A loan modification involves permanently changing one or more terms of your mortgage loan. The interest rate can be lowered, the term length extended, or principal reduced to bring your monthly payment down to an affordable portion of your income. Modifications can be made under the terms of the government's Home Affordable Modification Program (HAMP), which is often called the "Obama program".

One of the great things about loan modifications is that you don't need to have a good credit score to get approved for one. That's not the case with refinancing, which involves getting an entirely new loan to replace your old one.

Requirements to be eligible for a loan modification under HAMP include:

You are having difficulty or are unable to make your mortgage payments because of a financial hardship.

You are having difficulty or are unable to make your mortgage payments because of a financial hardship.- You obtained your mortgage on or before January 1, 2009.

- Your property has not been condemned.

- You owe up to $729,750 on your primary residence or one to four unit rental property.

If your bank is not participating in HAMP, they may still have an in-house modification program that could help you get a lower payment and avoid foreclosure. Each bank will have their own guidelines for in-house programs.

Whatever type, a loan modification is the only hope many homeowners have to reinstate their loan and avoid losing their home to foreclosure. It's a big deal. It probably won't fix the problem of your home being underwater, but it can remove the threat of foreclosure and return your loan to normal servicing. So, what do you need to know to fill out the RMA?

The RMA will include a form you need to completely fill out that's usually about 10 pages long. It asks for information including your loan number, address, if you've filed for bankruptcy, if you're a servicemember, if you've contacted a credit counseling agency for help, what you had for breakfast yesterday, are there additional liens or judgments on the property, if you've had a HAMP modification before, and detailed information on your income and household expenses.

It's a thorough application, but it shouldn't be terribly difficult to complete. What will probably take more time and effort is compiling all the supporting documentation, and doing it right can make the difference between approval and denial.

Some of the documents you will need to show your lender include:

- Copies of your federal tax returns and W-2 forms for the past 2 years.

- Pay stubs and bank statements for the past 2 months.

- A hardship affidavit that explains what circumstances caused you to fall behind on your mortgage and why they have been resolved.

- A statement of Net Present Value (NPV) that.

- A debt To Income Ratio (DTI) that takes into account all your debts and income.

It takes some work to apply for a loan modification, and calculating NPV and DTI confuses many people who don't have experience with finance. The majority of people who apply without the help of an experienced professional are denied. You have a better chance of getting approval when you hire a law firm to assist you that has a verifiable record of helping distressed homeowners. They will be able to defend you from foreclosure while working for a permanent modification.

Getting a loan modification is hard enough, but some homeowners have been held back by simple oversights when applying. Some people have made the mistake of just filling out their name and address on the first page of the RMA, then flipping to the last page and signing. Your bank can reject your application not just because you don't qualify, but for missing information as well.

Image courtesy of Sira Anamwong at FreeDigitalPhotos.net