Are you having a hard time paying your mortgage? Have you already defaulted? If you want to keep your home you should look into getting a loan modification to avoid foreclosure and get your mortgage back to normal. A loan modification can even result in a lower monthly payment and principal forgiveness or forbearance.

To get a loan modification you'll need to work with your loan servicer, which is the company that takes your payments, credits your account, and forecloses on you when you stop paying.

But your servicer isn't necessarily the owner of your loan. That's the investor, and they're the one that has the power to approve or deny your loan modification application.

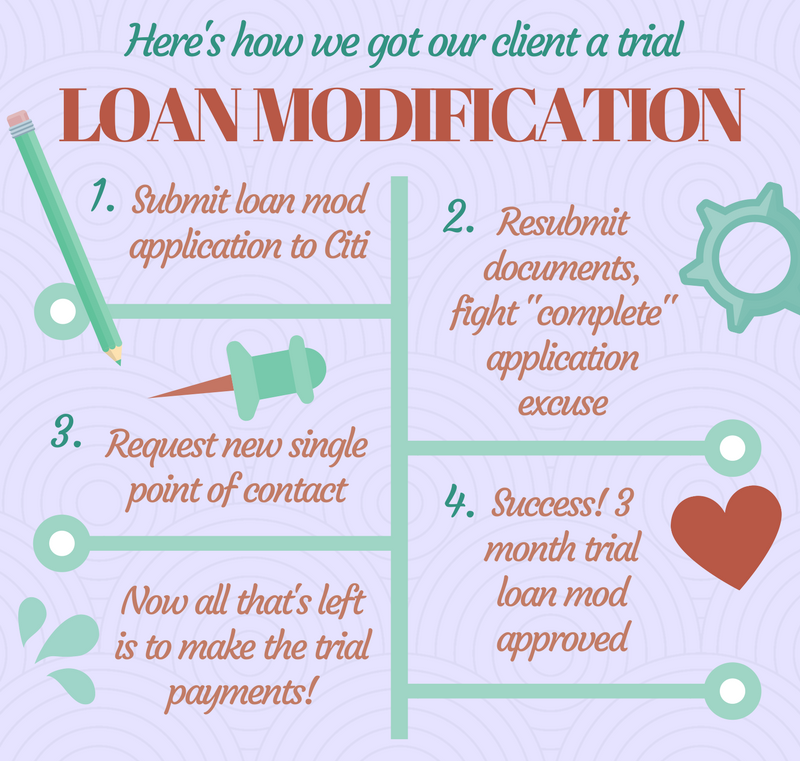

Some companies, like Ocwen, only service loans, and don't invest in any loans. But some banks, like Citi (aka Citigroup or Citibank), could be both the servicer of and investor in a mortgage, or just one and not the other.

Citigroup is one of the “big four” banks in the U.S. along with Wells Fargo, Bank of America, and JPMorgan Chase. Citi is involved in a lot of mortgages, many of which have defaulted on at one point. We've helped many homeowners who have a mortgage with Citi save their their home through a modification.

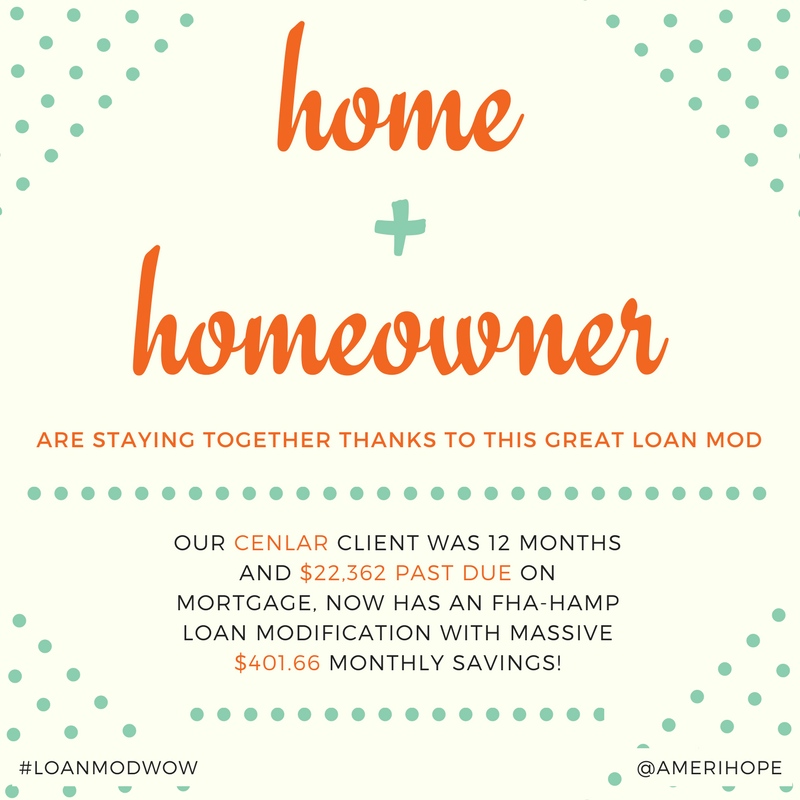

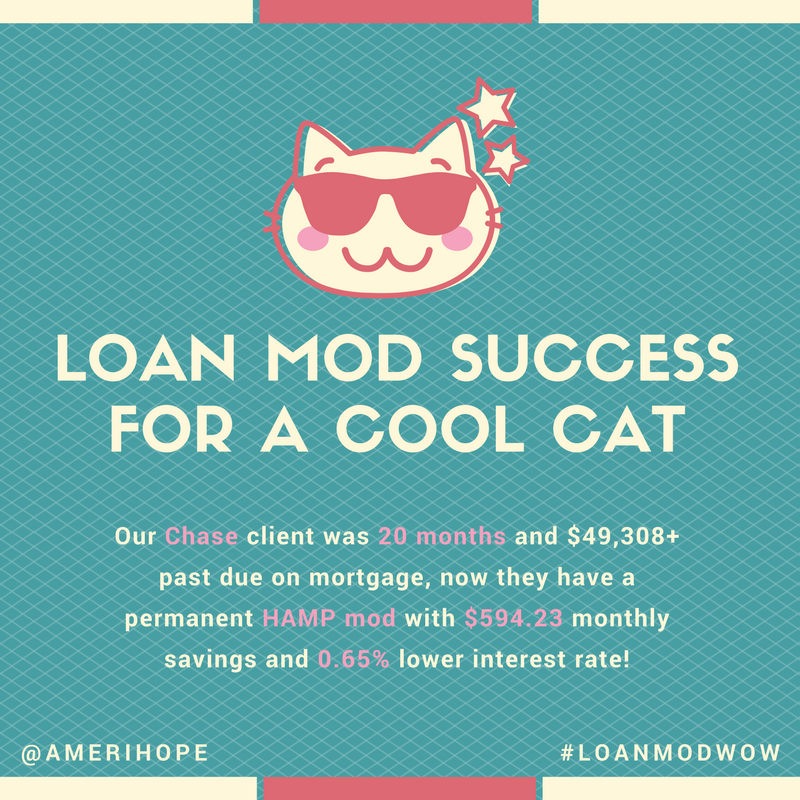

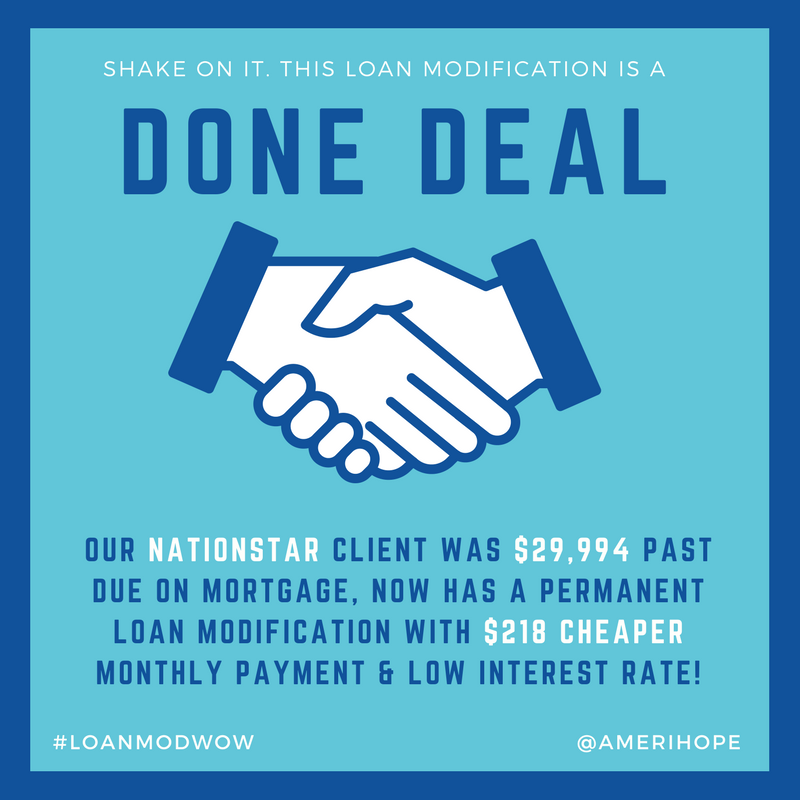

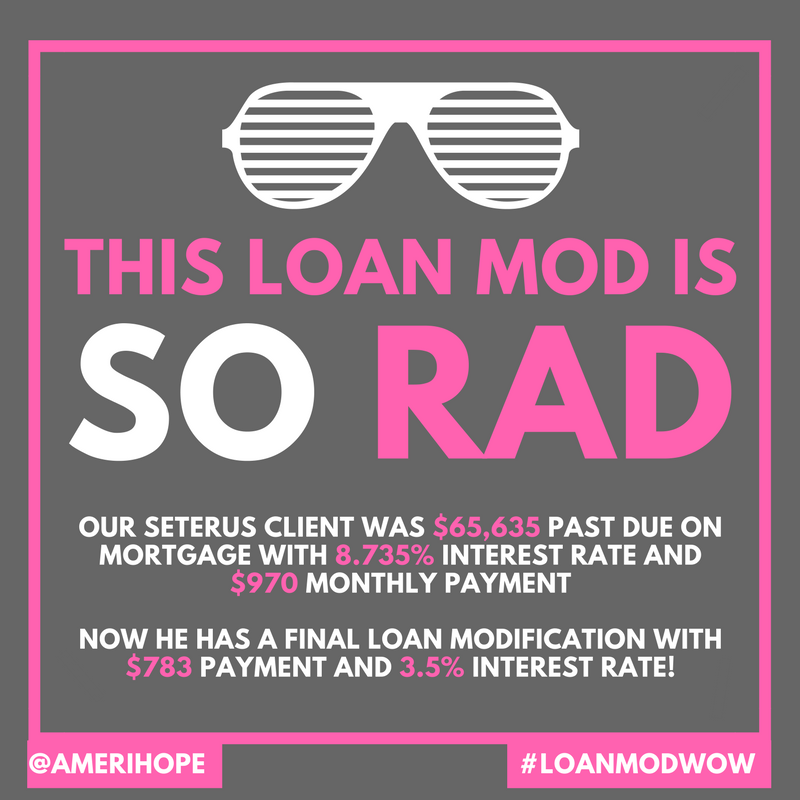

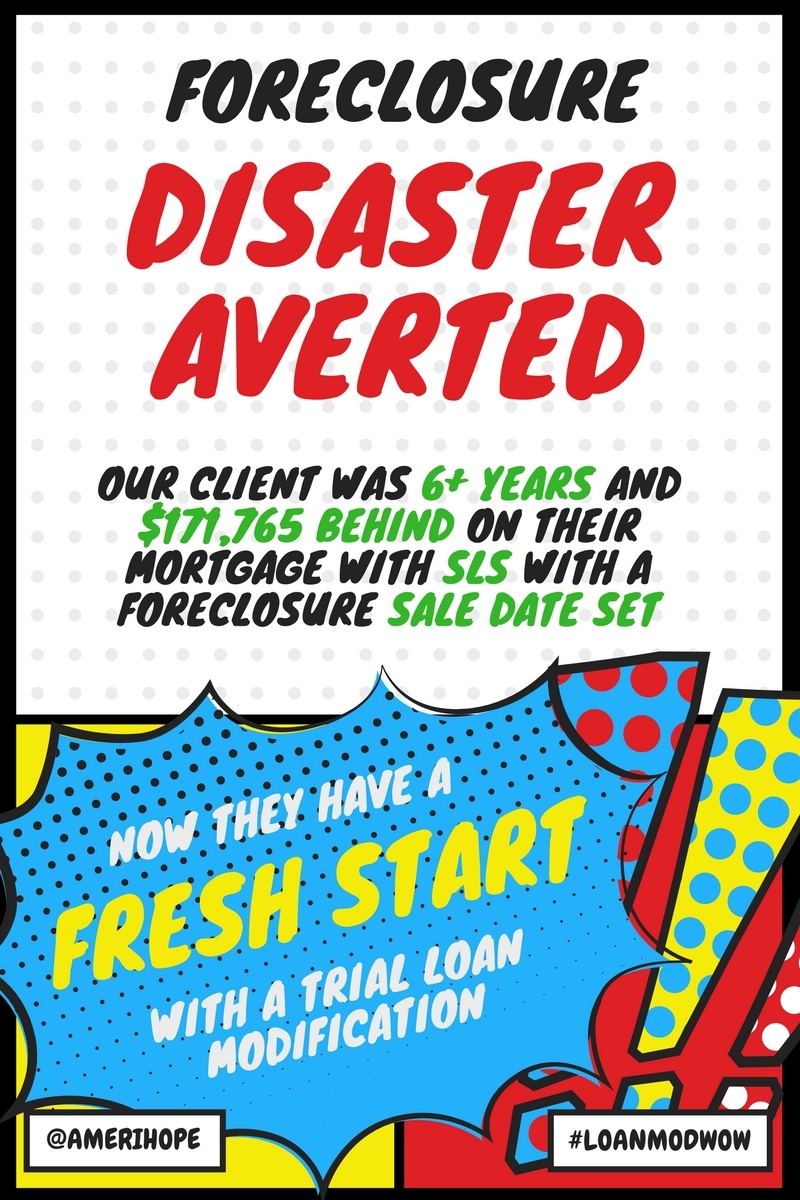

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on