[fa icon="clock-o"] Thursday, July 10, 2025 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, loan modification lawyer, loan modification attorney, loan modification, foreclosure defense, loan modification help, foreclosure, mortgage, foreclosure glossary, lawyer, foreclosure crisis, foreclosure defense attorney, avoiding foreclosure, loan modification application

Read More »

10th anniversaries are traditionally celebrated with gifts of tin or aluminum. But for the 10th anniversary of the foreclosure crisis, real estate data and analytics company CoreLogic has released a report analyzing a decade of foreclosures. How romantic! CoreLogic knows us so well.

It's called “10-year retrospect of the U.S. residential foreclosure crisis”. It shows that the housing market has improved dramatically from the worst of the crisis and “started to normalize, recording approximately 22,000 completed foreclosures a month.”

[fa icon="clock-o"] Wednesday, April 5, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure, foreclosure crisis

Read More »

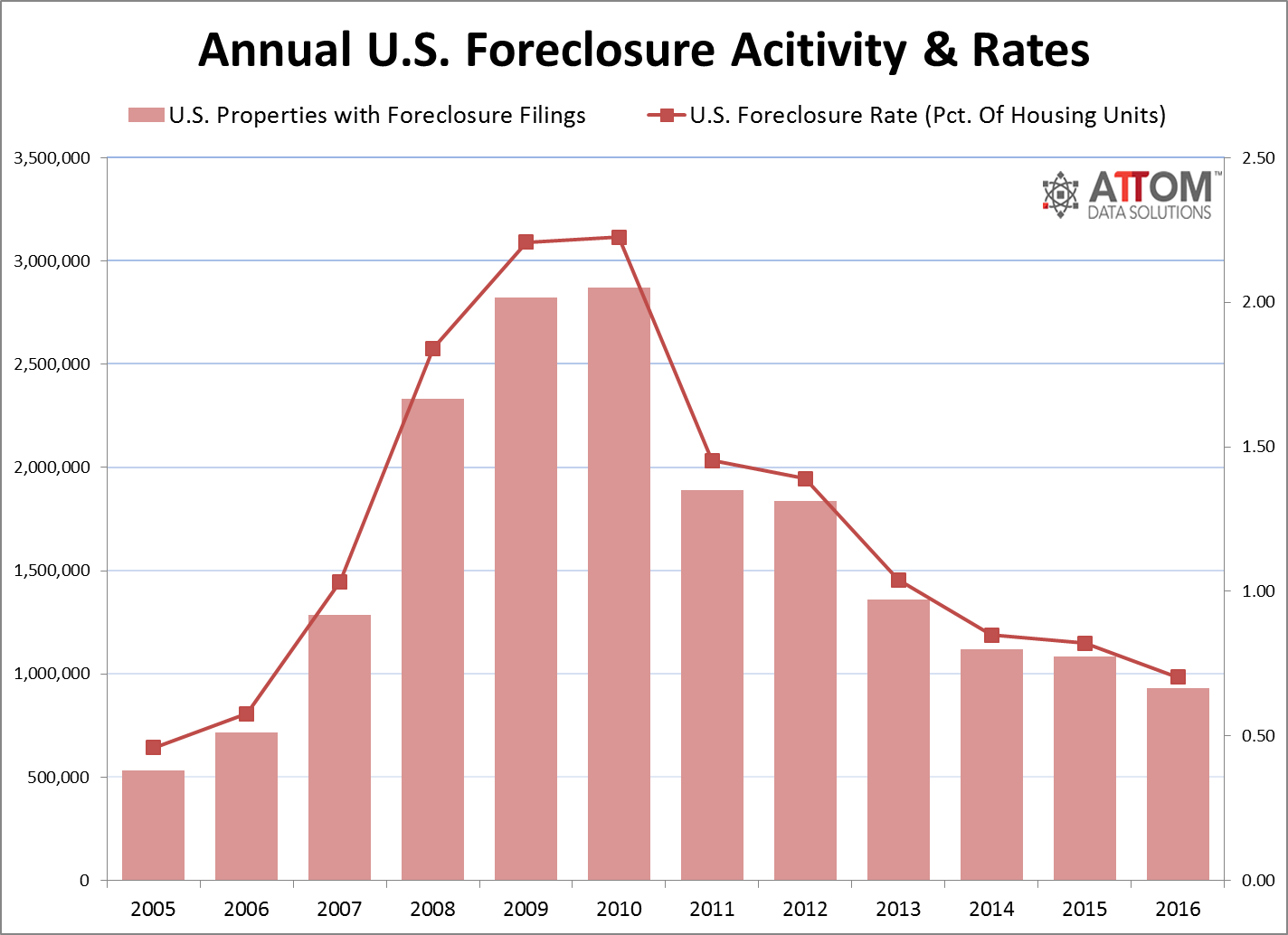

Foreclosure filings in 2016 were at their lowest level in ten years according to ATTOM Data Solutions Year-End 2016 U.S. Foreclosure Market Report.

The report shows 933,045 default notices, scheduled auctions, and bank repossessions for 2016, which is a 14% drop from 2015 and the lowest number of foreclosure filings since 2006, which had 717,522 foreclosure filings.

This is a continuation of a positive trend. Since 2014 the rate of foreclosure has been in an “historically normal range.”

[fa icon="clock-o"] Tuesday, January 24, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure, foreclosure crisis

Read More »

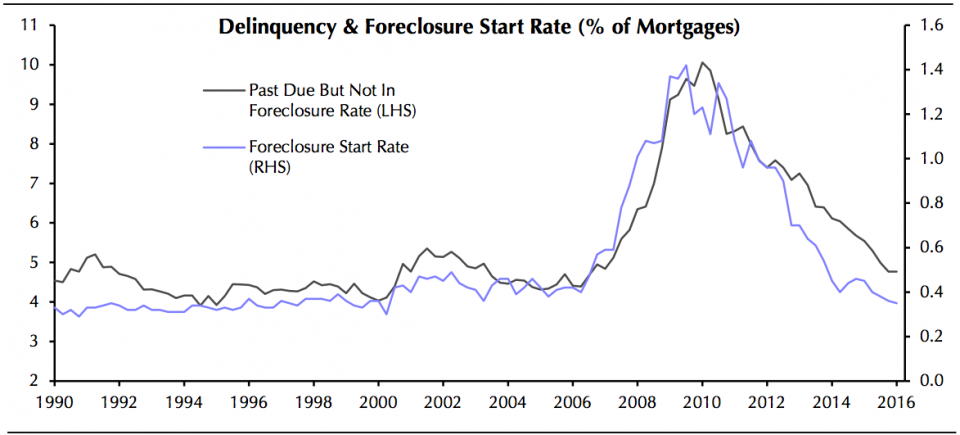

The recent financial crisis, housing crisis, and recession really did a number on homeowners. You didn't have to be an economist or real estate expert to know that there was a sharp increase in the number of foreclosures. All you had to do was turn on the news and you'd hear about it, or drive through any residential neighborhood and see the signs in front yards.

About seven million homeowners have experienced foreclosure since the start of the crisis. The wealth homeowners held in their homes evaporated as jobs were lost. That left many homeowners in the terrible position of being unable to afford their mortgage payment or sell their home because they owed more on it than it was worth.

[fa icon="clock-o"] Thursday, August 25, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure defense, housing market, foreclosure crisis

Read More »

Are you financially secure? What do you think the odds are that things will be worse in the near future? Is the country about to repeat 2008?

Those are the questions on the minds of many Americans who are afraid the economy is poised to enter a recession.

A recession is defined as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale retail sales."

According to a recent Business Insider article, economists and stock analysts have had to address worry about a recession a lot this year. People are feeling insecure, and parts of the economy have been slowing down.

So are we in a recession, or about to be in one?

[fa icon="clock-o"] Tuesday, May 31, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure, foreclosure grief, foreclosure crisis, recession

Read More »

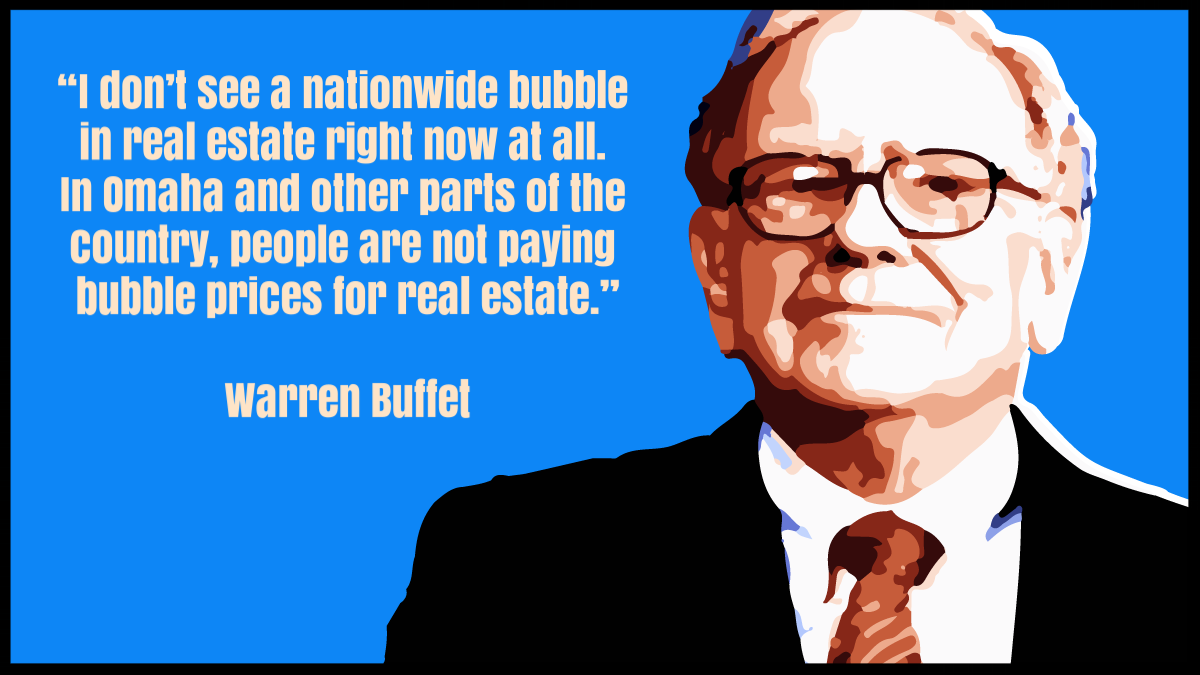

Warren Buffet is the most successful investor in the world and one of the richest people alive. As the chairman and CEO of Berkshire Hathaway, a holding company with more than half a trillion dollars in assets, people listen when he talks.

[fa icon="clock-o"] Friday, May 13, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure crisis, housing bubble

Read More »

It wasn't that long ago that everyone was talking about foreclosure and people were losing their homes in numbers that hadn't been seen since the Great Depression. At one point one out of every 248 households in the country had received a foreclosure notice.

Right now though, in 2016, you don't hear all that much about foreclosure. There are some good reasons for that. It's not as big of a problem as it used to be, home values have risen significantly, unemployment is down, and the Great Recession is technically over.

It's good that things have improved so much from where they were, but there's still a long ways to go before we can say these problems are behind us. Not all of the country's wounds have completely healed from the recession, and those that have left scars.

[fa icon="clock-o"] Monday, March 21, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure, foreclosure crisis

Read More »