Your mortgage servicer is not perfect, and sometimes they make mistakes just like everyone else. It is important to review all of your documents and communications with your servicer to check for mistakes. If something doesn't look right, it may not be. You should alert your mortgage servicer immediately if you think your account may be reporting incorrectly. Here are some of the common mortgage servicer mistakes to look out for:

[fa icon="clock-o"] Saturday, November 14, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] mortgage servicers, mortgage debt, mortgage servicing, normal servicing

Read More »

Approximately 250,000 families enter into foreclosure every 3 months due to delinquent home loan payments or delinquent property taxes. Each of these homeowners has one thing in common: they have to make the decision of whether or not to fight for their home. However, if you want to fight the foreclosure and keep your home, it's time to find a foreclosure defense attorney. Here are some reasons why:

[fa icon="clock-o"] Sunday, October 18, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] stop foreclosure, loan modification lawyer, how to stop foreclosure, loan modification denied, loan modification attorney, successful loan modifications, foreclosure defense, prolong foreclosure, foreclosure, mortgage, lawyer, foreclosure defense attorney, mortgage debt, dos donts of foreclosure, foreclosure lawsuit, avoiding foreclosure, default judgment, consent to foreclosure, legal aid

Read More »

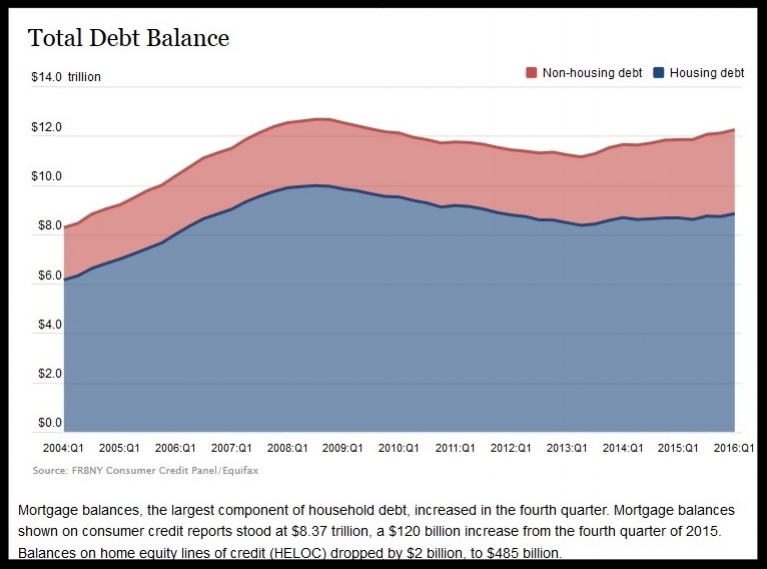

The amount of debt American householdsowe on their mortgages increased in the first quarter of 2016 to its highest level in four and a half years, according to the Federal Reserve Bank of New York's Quarterly report on Household Debt and Credit.

Delinquency rates, however, continued improving and remain at low levels, according to the report.

[fa icon="clock-o"] Wednesday, June 15, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure, mortgage debt

Read More »