If you're at the point in the loan modification process where your loan servicer is asking you to make trial modification payments, then you've almost reached your goal. But this is no time to take your foot off the gas. You still have a little ways to go before your loan is permanently modified.

If you're at the point in the loan modification process where your loan servicer is asking you to make trial modification payments, then you've almost reached your goal. But this is no time to take your foot off the gas. You still have a little ways to go before your loan is permanently modified.

Being asked to make trial modification payments is a good thing. It means that your request for modification assistance has been accepted. You're on your way to achieving your objective.

But banks don't just approve an application and return your loan to normal servicing like nothing ever happened. You have to prove that you're able to make the payments, and then you'll be offered a permanent modification.

Crime and Punishment

It's kind of like when someone commits a crime and goes to jail. After serving their sentence, they're released on parole and have to check in with a parole officer for a period of time to make sure they're not going back to their old ways. If they stay on the right side of the law for long enough, they go back to being a regular citizen who doesn't have to report to anyone.

A trial modification is like parole for a homeowner who's defaulted on their mortgage. Your servicer is your parole officer and you have to show them that you're willing and able to walk the straight and narrow before they allow you to go back to the way things were.

Of course, this all starts when you stop paying your mortgage and foreclosure proceedings begin. If you're not successful in finding an alternative, your home will be sold at a foreclosure auction or repossessed by the bank, which is equivalent to getting a life sentence with no chance of parole. There's really no undoing it.

Mortgage problems don't need to result in a life sentence. If you don't have the income to keep your home, even with a reduced payment, a short sale or deed in lieu of foreclosure agreement can get you out of your home without going through foreclosure.

Law and Order: Loan Modification Unit

But if you want to keep your home, a loan modification may be your only option. It can allow you to keep your home and reinstate your loan with a lower payment. That's achieved by reducing your interest rate, extending the term of the mortgage to as many as 40 years, and/or reducing your principal.

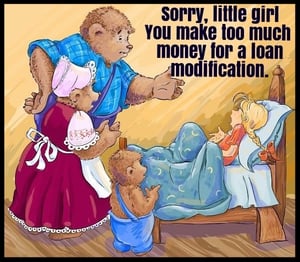

Homeowners who want to modify their mortgage have to complete an in-depth application that proves to the bank that you need help and could actually afford the home under the new terms. I've called this the Goldilocks zone because showing too rosy a financial picture can make you look like you don't need assistance, but making your finances look too bad will lead the bank to believe you can't afford the property. It has to be just right.

Homeowners who want to modify their mortgage have to complete an in-depth application that proves to the bank that you need help and could actually afford the home under the new terms. I've called this the Goldilocks zone because showing too rosy a financial picture can make you look like you don't need assistance, but making your finances look too bad will lead the bank to believe you can't afford the property. It has to be just right.

Many homeowners fail to show that their income puts them in the Goldilocks zone and their applications are denied. $50 too much or too little can make all the difference. It's confusing and frustrating if you don't have a lot of experience with it.

But if you are able to get your request for modification assistance approved, your loan servicer will require you to make trial payments before offering you a permanent modification. The trial modification period typically lasts three months. Failure to make these payments on time will jeopardize your modification. If you can't even make three payments on time, why would the bank trust you to make timely payments for the next 40 years? It's like robbing a liquor store while you're out on parole. They're going to send you back to where you were.

That's why it's so important to not screw up your trial payments. Take a look at our post about how to ensure that your trial payments go through smoothly here.

A trial modification period is required for the government's HAMP program and most in-house bank loan modification programs. If you make your trial payments on time, you should be offered a permanent mod, which you will have to sign, notarize, and send to your servicer. Only then will your loan return to normal servicing and things will be back to normal.

People can and do mess up their trial payments and even their permanent modification offer. But you'll never get to that point until the bank approves you for a trial modification in the first place. That's where the help of a qualified professional can make all the difference.

A foreclosure defense attorney who offers loan modification assistance as an ancillary service can help you stay in your home and work for a permanent loan modification simultaneously. Their knowledge and experience is valuable and can help you achieve the best outcome.