Editor's note: This article was originally published June 2013, and has been updated in November 2015. Some reported facts are from 2012 and 2013, but HAMP information is current as of this date.

In May 2013, the credit reporting agency TransUnion reported that the percentage of mortgage holders with mortgages 60 days or more delinquent decreased 12% from the fourth quarter (Q4) of 2012 to 4.36% and a 21% drop from Q1 2013. Both numbers represent the biggest declines since TransUnion started tracking mortgage delinquency data.

Nonetheless, too many homeowners continue to have difficulties making their mortgage payments each month and suffer financial hardship. Due to a lack of accurate information, a large number of these borrowers do not realize that they may be eligible for financial relief under the federal government’s Making Home Affordable loan modification program.

Here are six of the most misunderstood aspects about the Making Home Affordable Program.

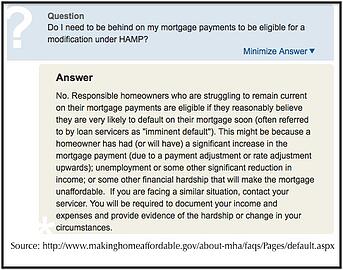

1) I must be behind on my mortgage payment.

This is one of those myths that has prevented many borrowers from taking decisive action to save their home. When the federal government initially introduced the option few years ago, homeowners had to demonstrate a risk of default.

Consequently, many individuals intentionally fall behind on their payments—damaging their credit along the way—to increase their chances of an approval. Revisions have eliminated this and other impediments.

Fast Fact: Although HAMP's guidelines are clear, the big banks act as if a homeowner who hasn't missed a payment still has the "ability to pay," and they prolong review of the file until the homeowner actually misses a payment. Is this ethical? No Way!

2) I need a higher credit score to apply & qualify.

Your credit score does not play any role in determining whether you can qualify for a loan modification. Unlike a standard mortgage refinance, which requires you to have excellent payment history and have a pristine credit score, modifying a loan only requires the lender to change the terms of your existing loan, such as interest rate or the amortization period.

In addition, completing a loan modification can actually enhance your credit score over time, especially if it prevents you from missing future payments, entering into foreclosure or filing for bankruptcy.

Modifying the terms of your home loan will not hurt your credit score. In fact, if your payments are already delinquent, renegotiating the terms of your home loan can help you get your payments current again. The bottom line: a modification would impact your credit profile far less than going through a foreclosure.

3) Principal reduction is an automatic component of the process.

It’s not unheard of for a lender to forgive a portion of the principal owed on a home loan as part of the process, but it’s not guaranteed. The primary objective of a loan modification is to reduce your monthly mortgage payment. Some lenders lower the principal balance of the loan over time as you make your new modified mortgage payments. Others may forgive late payments or tack on the delinquent mortgage payments to the end of the mortgage term without charging interest on the late monies.

4) Your mortgage lender must modify your loan.

The Making Home Affordable Program is not a law. The voluntary program encourages lenders to participate by offering them a financial incentive to modify your loan if you qualify according to the guidelines. Remember, most mortgage companies would prefer to modify your loan rather than foreclose on your home.

5) I cannot qualify for a loan modification because I received a foreclosure notice.

Even if your lender has started the foreclosure process, you can request a loan modification at any stage of the proceedings. Understand, the further along in the foreclosure process, the fewer the options (and time!) you have to remedy the situation. It’s important to act quickly and take advantage of the fact that your lender wants to avoid foreclosure. Sending a loan modification application does not guarantee that your foreclosure will be stopped, but it's one tool to use in a legal foreclosure defense strategy.

6) You must have a Fannie Mae or Freddie Mac loan.

You do not need to have a mortgage insured by one of these government agencies to qualify for the program. Many, many lenders including Chase, Bank of America, Wells Fargo, & Citi all participate in the HAMP program. Those who don't participate often have internal or "in house modification" programs to modify loans for their borrowers.

These are just a few of the myths about the federal loan modification program that keep eligible borrowers from obtaining relief from the financial hardships causing them to miss their mortgage payments. If you are unsure about whether you qualify for a modification, speak to an expert to help clarify your options and avoid foreclosure.

photo credit: Jenn and Tony Bot via photopin cc