Is it possible to make too much money? You might think that it's not any more possible than being too good looking, too smart, too healthy, or too happy. Having too much of any of those positive things is what most of us would call a high quality problem, so the question is too much for what? If you're trying to get a mortgage loan modification, the answer is yes, you can make too much money to qualify.

Is it possible to make too much money? You might think that it's not any more possible than being too good looking, too smart, too healthy, or too happy. Having too much of any of those positive things is what most of us would call a high quality problem, so the question is too much for what? If you're trying to get a mortgage loan modification, the answer is yes, you can make too much money to qualify.

First, let's briefly define what a loan modification is and who it's for. A loan modification is a permanent change to one or more of the terms of an existing mortgage loan. The loan term, interest rate, and amount of principal can be changed to make the payment more affordable for a homeowner who has experienced a financial hardship. If refinancing, which replaces the old loan with a new one, is not an option because the homeowner has missed payments, a loan modification can help them avoid foreclosure.

When Too Much Money Is A Problem

Let's examine a common scenario where making too much money can prevent you from obtaining a loan modification.

Say that a homeowner experiences a hardship, such as losing their job, and can't pay their mortgage for six months, so their servicer initiates the foreclosure process. Then the homeowner gets a job that pays very well, so they ask their lender if they can start making payments again to get their mortgage back on track and keep their home. No they may not just resume making monthly payments, the lender says. More than three months of payments have been missed, and they don't want want monthly payments. They had to pay lawyers to start foreclosure and have missed out on thousands of dollars the homeowner was supposed to pay them. So they want one payment for the value of all the missed payments plus fees, and they'd like it now, please. Only then will they reinstate the loan, stop the foreclosure process, and allow monthly payments to resume like normal. But the homeowner doesn't have enough cash on hand to make a multi-thousand dollar payment. After all, they've only recently gotten a good job and started to rebuild their finances. So they ask for a loan modification that would spread out the amount they owe over time, but their current income is too high, relative to the value of their mortgage payment. Now they are stuck in a no man's land where they have too much income to get a loan modification, but not enough money to reinstate.

To be eligible for most loan modifications your mortgage payment has to be more than 31% of your monthly gross income. In the scenario described above, the homeowner either makes too much money, or has too small of a mortgage payment. Either way you look at it, they're below the cutoff point and won't qualify for a loan modification. There are limited funds with which to give loan modifications, and although the 31% payment-to-income ratio may be arbitrary, there have to be some specific terms set to identify those who have the greatest need for help.

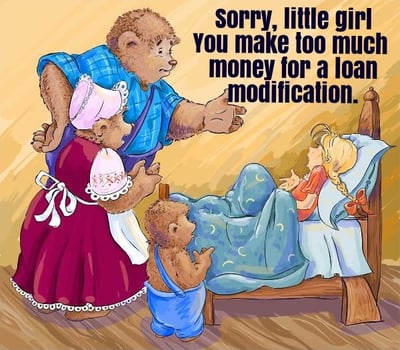

The Loan Modification Goldilocks Range

Of course, lenders will also deny a loan modification if the borrower's income is insufficient to afford the loan. There's no point in giving a modification to someone who doesn't have the income to afford their home even under favorably modified terms. Your income and mortgage payment need to fall into the Goldilocks range to be eligible for a loan modification. Not too much income, but not too little. Not too high of a mortgage payment, but not too low. Just right. If you're not in that range, you won't be eligible and could end up in foreclosure.

Fortunately, someone experienced with loan modifications can help you present your income so that it is in the Goldilocks zone. It's not done by breaking the law or doing anything unethical. Experienced and reputable attorneys simply know from experience what the bank needs to see to approve the loan modification and show them. For example, people who are self-employed and/or don't have a regular salary are commonly denied for a loan modification even when they could afford a modified payment. Our staff has, on many occasions, fought with the banks to get them to recognize all of a homeowner's income and the fact that their application should be approved.

Most people who apply for a loan modification on their own are not successful. Many homeowners mistakenly assume that they are out of options and ineligible for a loan modification when they receive a denial letter or think their income puts them outside of the Goldilocks range. It's possible that they are, but they don't negotiate with the banks or apply for loan modifications for a living, so they can't know for sure.

If you truly can't, or don't want, to save your home, there are still ways to make the best of a tough situation. You may be able to get approved for a short sale or deed in lieu of foreclosure with a deficiency judgment waiver that allows you to leave your home with no debt. You could stay in your home for months or years without making payments, which allows you to save money and plan what you'll do after you leave. Whatever you do, it's important to work with someone who's well-versed in the area of your problem. Their knowledge and experience gives you the best chance of getting you what you want, and the peace of mind of knowing you're doing everything you can.