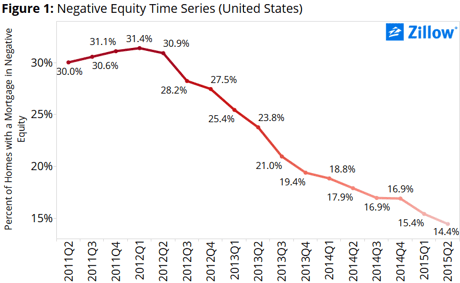

The percentage of Americans with negative equity in their homes, also known as being underwater, continued to fall in the second quarter of 2015 to 14.4%, according to a report from the real estate company Zillow. The rate of homeowners with negative equity has been dropping since the first quarter of 2012 when a high of 31.4% of homeowners were underwater.

The percentage of Americans with negative equity in their homes, also known as being underwater, continued to fall in the second quarter of 2015 to 14.4%, according to a report from the real estate company Zillow. The rate of homeowners with negative equity has been dropping since the first quarter of 2012 when a high of 31.4% of homeowners were underwater.

Lower Value Homes More Likely To Be Underwater

Negative equity is not affecting all properties equally. 24% of properties in the bottom third of home values are underwater, versus only 8.1% of homes in the top third. However, this is still an improvement, and appreciation of homes in the bottom third of value accounts for much of the decline in negative equity.

Condos Worse Than Other Homes

Zillow's report states that condos are a bigger problem than single-family homes on average, with nearly 20% in the nation being in negative equity. But some areas have much higher rates. Las Vegas, Chicago, and Orlando have the highest rates of condos with negative equity, with all at 30% or higher. From the market's peak to its bottom, condos lost 34.5% of their value, compared to 20.6% for single family homes.

While the trend is that homes are gaining value, and pulling more homeowners out of negative equity, the rate that homes prices are rising is slowing. Prices rose by 3.4% last year, but Zillow estimates a 2.4% rise from June 2015 to June 2016. That's not the news homeowners who are deep underwater want to hear, but that's what their data show.

Although it's certainly good news that millions of people have been lifted out of negative equity by rising home values, those numbers don't tell the whole story. Zillow also measures the number of homeowners with “effective negative equity,” which is when there's not enough equity to actually sell the home, pay closing costs, and put a down payment on another home. The number of Americans in that situation is 31.4%, more than twice the number who are considered to have negative equity, and almost a third of all homeowners. That's a lot of people who are stuck in their homes, unable to sell them if they wanted. This limits peoples ability to move to find work, or choose different housing.

A home with negative equity can't be sold unless a short sale is approved by the bank, or the homeowner has the cash to pay off the balance of the loan. Rather than do that, many homeowners just wait and hope that their property will eventually rise in value. This stalemate prevents first time home buyers from buying lower-priced, entry-level homes, which are more likely to be stuck in negative equity. And the owners of these homes are less likely to be able to sell them and buy more expensive homes, if they are able. So, a stagnation occurs, where the owner has to wait for property values to rise, or they pay off enough of the mortgage to lift it above water.

Negative Equity Was Never Part Of The Plan

It's a difficult situation to have negative equity in one's home. Most people buy a home with the hope that it will start increasing in value immediately, and continue on its upward trajectory until they sell it for a huge profit, of course using the proceeds to buy an even nicer home. They expect the rise in their home's value to be surpassed only by the rise in their salary, the quality of their social life, and the happiness of their family. That's the hope. Historically, home prices have risen much less than stocks or bonds, and just slightly more than inflation, which means enough to keep their value and a little extra. This modest increase in value can create healthy gains because of the leverage most homeowners use to buy their homes, which is another way of saying they take on debt for many times the amount of their down payment. When you make a highly leveraged bet that wins, it pays off very handsomely. But when you make a leveraged bet that fails, you can lose more than you ever had.

It's a difficult situation to have negative equity in one's home. Most people buy a home with the hope that it will start increasing in value immediately, and continue on its upward trajectory until they sell it for a huge profit, of course using the proceeds to buy an even nicer home. They expect the rise in their home's value to be surpassed only by the rise in their salary, the quality of their social life, and the happiness of their family. That's the hope. Historically, home prices have risen much less than stocks or bonds, and just slightly more than inflation, which means enough to keep their value and a little extra. This modest increase in value can create healthy gains because of the leverage most homeowners use to buy their homes, which is another way of saying they take on debt for many times the amount of their down payment. When you make a highly leveraged bet that wins, it pays off very handsomely. But when you make a leveraged bet that fails, you can lose more than you ever had.

The sudden and steep decrease in housing prices means that many homeowners have seen their leveraged bets on their homes fail, and they don't have the money to get back to zero. Home prices are rising now, but not fast enough to get them to where they need to be. Homeowners with negative equity can wait it out, assuming they can still afford their payment. Or, they can attempt to get a loan modification that reduces their negative equity and lowers their interest and monthly payment. To be eligible for a loan modification, a homeowner must have experienced a hardship that caused them to miss some mortgage payments, and must be able to show that the hardship has passed, and that they will be able to afford their loan under the proposed modified terms.

Loan modifications are a great option for homeowners who are eligible, and the only way to potentially get rid of some of the negative equity they have. Applications for a loan modification require the submission of multiple financial documents, and a net present value statement. The application can be difficult for many people to understand, and they are often denied. To have the best chance for a successful loan modification, it is recommended that you work with a law firm that has experience with them. Some law firms provide foreclosure defense in addition to loan modification assistance and can help you stay in your home for as long as possible while working to make your loan more affordable.

Image courtesy of iosphere at FreeDigitalPhotos.net