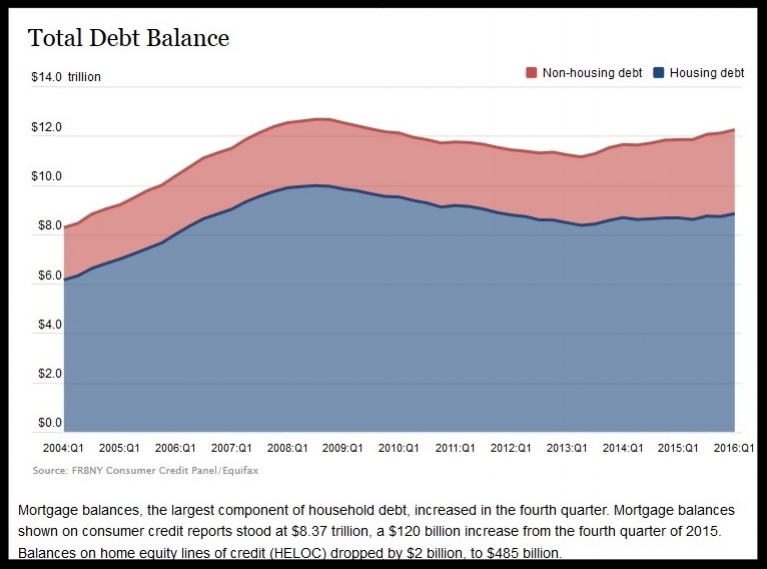

If you were eligible to receive money under the Independent Foreclosure Review Payment Agreement but didn't cash your check, it's too late. All the money that went unclaimed is now being redistributed to those who did cash their checks.

The Federal Reserve Board has announced that money leftover from the $3.9 billion Independent Foreclosure Review Agreement will be paid to the nearly 650,000 borrowers who already got their money. The borrowers who didn't cash their checks before the deadline are out of luck.

The Fed has given borrowers every chance to claim the money they were entitled to under the Independent Foreclosure Review Payment Agreement. Those who had not cashed their checks were given until December 31, 2015 to ask for a replacement check, and had to cash those checks by March 31, 2016.