You've only got one family, and supporting them when times are tough is the right thing to do. After all, they'd do the same for you.

But what if a member of your family has a problem that's too big for you to solve, like difficulty with their mortgage?

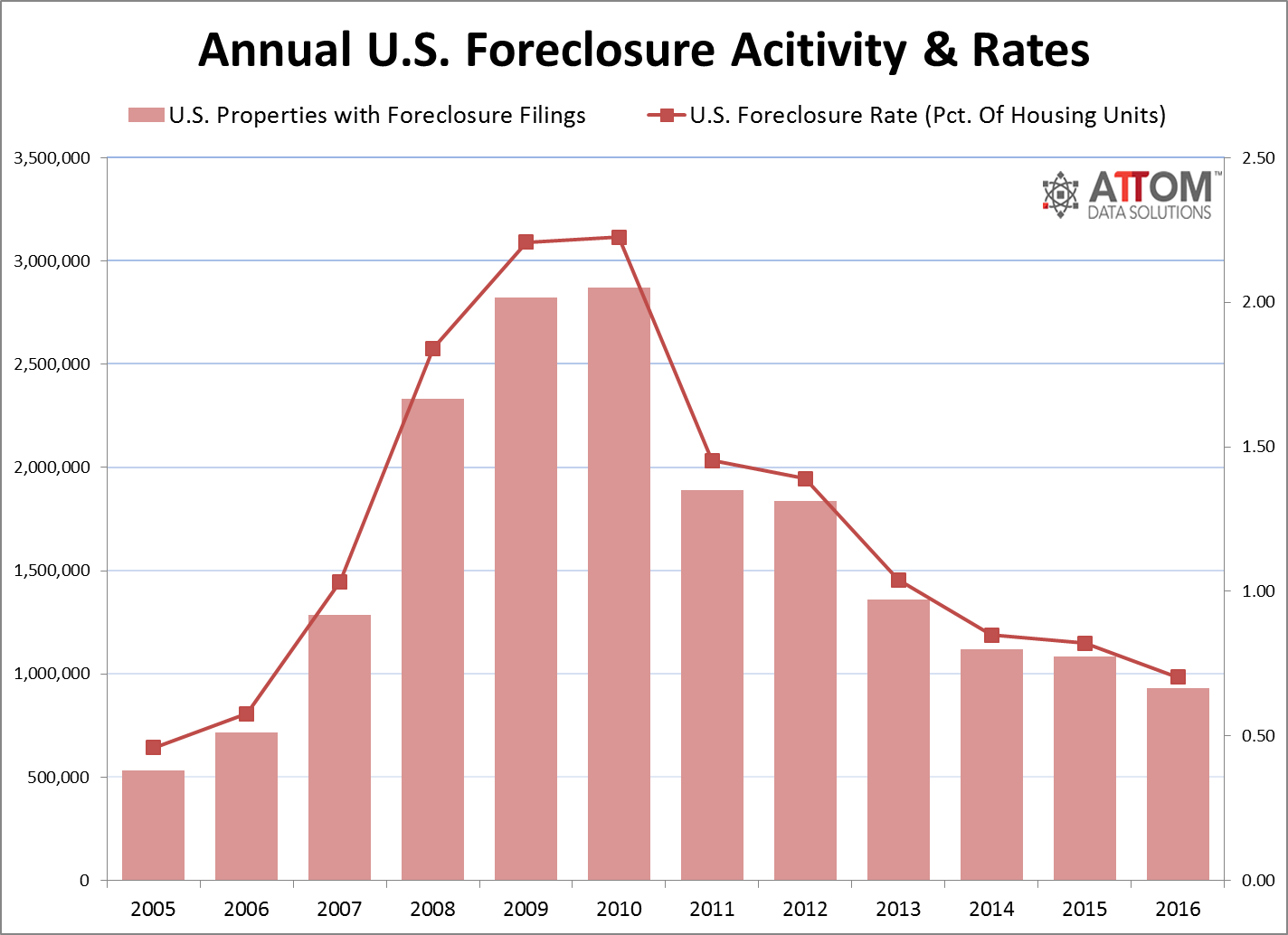

Over the past decade millions of people have been in just that situation. Since the Great Recession began, seven million homes have been in foreclosure! That's a lot of affected families.

And the foreclosure crisis isn't over. There are still thousands and thousands of homeowners either in foreclosure or on their way to it.