If you were eligible to receive money under the Independent Foreclosure Review Payment Agreement but didn't cash your check, it's too late. All the money that went unclaimed is now being redistributed to those who did cash their checks.

If you were eligible to receive money under the Independent Foreclosure Review Payment Agreement but didn't cash your check, it's too late. All the money that went unclaimed is now being redistributed to those who did cash their checks.

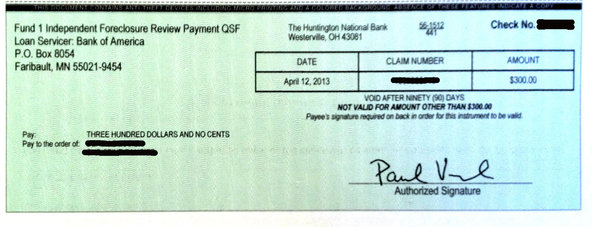

The Federal Reserve Board has announced that money leftover from the $3.9 billion Independent Foreclosure Review Agreement will be paid to the nearly 650,000 borrowers who already got their money. The borrowers who didn't cash their checks before the deadline are out of luck.

The Fed has given borrowers every chance to claim the money they were entitled to under the Independent Foreclosure Review Payment Agreement. Those who had not cashed their checks were given until December 31, 2015 to ask for a replacement check, and had to cash those checks by March 31, 2016.

It's after March 31, and there are over $80 million dollars left over to be redistributed. So the Fed has directed paying agent Rust Consulting to redistribute the money to the people who cashed their checks by the deadline.

Each loan will receive $124.30. Checks were mailed out in the first two weeks of August 2016. Borrowers receiving a redistribution payment can request a name on a payment to be changed, a payment to be split, or a payment to be reissued. Those requests must be received by Rust Consulting by September 30, 2016. In early November those checks will be mailed.

The redistribution checks will expire December 31, 2016.

The servicers who participated in the payment agreement are: Aurora, Bank of America, Citibank, Goldman Sachs, HSBC, JPMorgan Chase, MetLife Bank, Morgan Stanley, PNC, Sovereign, SunTrust, U.S. Bank, and Wells Fargo, or one of their subsidiaries or affiliates.

What is the Independent Foreclosure Review?

According to the Independent Foreclosure Review website:

“As part of consent orders with federal banking regulators, the Office of the Comptroller of the Currency (OCC), the Office of Thrift Supervision (OTS), and the Board of Governors of the Federal Reserve System (FRB), the Independent Foreclosure Review was established to determine whether eligible homeowners suffered financial injury because of errors or other problems during their home foreclosure process between January 1, 2009 and December 31, 2010.”

In 2013, the 13 mortgage servicers listed above came to agreements with federal banking regulators that ended the Independent Foreclosure Review for those servicers by agreeing to make payments to eligible borrowers.

For questions about redistribution payments, the Independent Foreclosure Review website suggests calling the paying agent toll free at 1-877-456-1188.

Did you receive a check from the Independent Foreclosure Review?

Share your experience in the comments below.