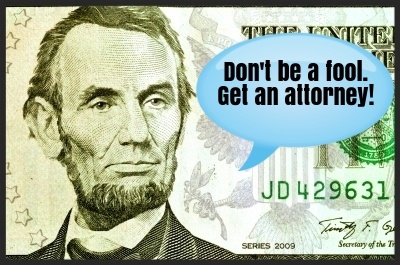

Abraham Lincoln said “He who represents himself has a fool for a client.”

Honest Abe was talking about legal representation when he said that, and a century and a half later his advice still rings true. President Lincoln was a lawyer himself and knew that it just doesn't make sense to act as your own attorney, even if you are one.

But some people have been doing exactly that in recent years while trying to avoid losing their most valuable investment, their home, through foreclosure. Seven million homeowners have experienced foreclosure since the housing crisis began and many of them don't have a clue about how to deal with it.

Their bewilderment is completely understandable. Foreclosure was never part of any homeowner's plan. Unfortunate circumstances beyond the control of any individual homeowner has made foreclosure something that millions of homeowners have been forced to learn about.

Some look into it and think they can handle everything on their own. “How hard could this be? I can answer a complaint and fill out a request for modification assistance without a lawyer.”

Others learn about the laws pertaining to foreclosure and the ways to avoid it and conclude that having an experienced attorney on their side is essential. While every person's situation is different, there are important reasons for everyone with mortgage problems to seriously consider hiring an experienced attorney:

W

W