“Abandon ship!”

“Abandon ship!”

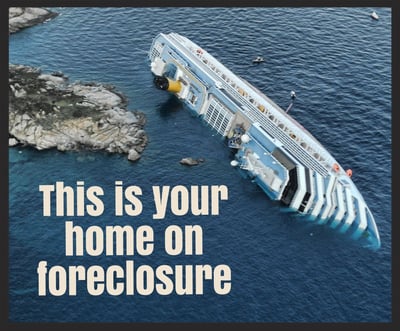

That's the thought some homeowners have when they miss a few mortgage payments and realize they will not be able to keep their home. If the ship's going down, it's better to get off sooner rather than later, they reason.

Just because you can't afford your mortgage payment doesn't mean you need to leave your home right away. You have the right to stay in your home until the foreclosure process is finished, which can take months or years.

A little knowledge of the process can help you to stay in your home as long as possible without making mortgage payments and land on your feet if and when you do leave.

When It All Starts to Go Wrong

Typically, sometime after missing three payments your bank will send you a letter telling you that you're in default, detailing the amount of money you owe, and demanding that you pay the money within a certain period of time, or else they'll start foreclosure.

Typically, sometime after missing three payments your bank will send you a letter telling you that you're in default, detailing the amount of money you owe, and demanding that you pay the money within a certain period of time, or else they'll start foreclosure.

When you don't bring the loan current in the required time period, foreclosure will be happening at some point. If you live in a judicial foreclosure state (like New Jersey, New York, Pennsylvania, Florida, or Illinois) that means you'll be sued. Notification of this will come from being served a summons and complaint, but it doesn't mean it's time to abandon ship.

You need to respond to the lawsuit letting them know that you intend to fight it, even if you know you can't afford to keep the home, which will give you more time. Not responding to the summons and complaint means losing the suit and expediting foreclosure.

Although being served is scary, it's still not time to panic. There's time to save your home, and for your own sake, you should try to work with your bank. They may be more willing to try for a mutually beneficial resolution than you expect.

Why the Bank Will Work with You

The bank wants to spend as little time and money as possible getting a performing loan behind your home. To do that, they may be willing to help you stay or pay you to leave.

One way for that to happen is with a cash for keys agreement. In this foreclosure alternative you agree to give up ownership and leave the home on a certain date and in agreed upon condition in exchange for some money. That way they don't have to evict you, and you get some much needed cash to secure a new place to live.

It's also possible to receive money for relocation expenses with a short sale agreement. Through the government's Home Affordable Foreclosure Alternatives Program (HAFA), homeowners can receive $10,000 in relocation assistance funds.

If you and your bank agree to one of these foreclosure alternatives you will know exactly when to leave and will be able to plan for it.

If you and your bank do not reach an agreement, they will attempt to sell the home in a foreclosure auction. Even with a sale date set, it's not time to run away. If you act soon enough, you can still challenge the validity of the foreclosure, apply for a loan modification, or file bankruptcy, which will delay the sale.

If you don't stop the foreclosure sale, your home will become the property of the highest bidder or the bank. They will be given title and the sheriff will post a writ of possession on your door notifying you that you have 24 hours to vacate. There's not much that can be done after your home has been sold at auction, which is why it's so important to take action before that.

What If You Can Save Your House?

If you want to keep your home, you should consider a loan modification. Loan modifications lower your mortgage payment by lowering the interest rate, extending the term of the loan, and/or reducing the principal. It's like a refinance but with no costs and no credit check. You can apply even when you're not current on your payments and when you have a sale date.

Whether you want a loan modification or a way out of your house, the services of an experienced attorney are invaluable. There are permanent solutions and ways to stall foreclosure if you understand how the process works.

Time is of the essence, and there is a point of no return when the ship has to be abandoned, but you won't know when that is unless you happen to be an expert on the subject or consult with someone who is. There is more information on this site about the foreclosure process in different states, foreclosure alternatives, and loan modifications. Take some time to educate yourself and make the best decision about how, when, and if to move out of your home.