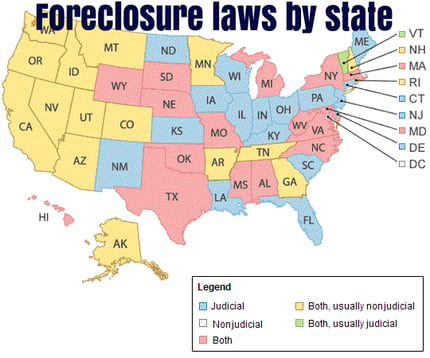

When you do not pay your home loan payments, your lender is required to follow the laws and procedures of your state to take ownership of your home and sell it. Some states require lenders to file a lawsuit in court in order to foreclose, which is known as judicial foreclosure. Other states allow lenders to foreclose without filing a lawsuit in court, which is known as nonjudicial foreclosure. Roughly half of the states have judicial foreclosure rules and half have nonjudicial.

When you do not pay your home loan payments, your lender is required to follow the laws and procedures of your state to take ownership of your home and sell it. Some states require lenders to file a lawsuit in court in order to foreclose, which is known as judicial foreclosure. Other states allow lenders to foreclose without filing a lawsuit in court, which is known as nonjudicial foreclosure. Roughly half of the states have judicial foreclosure rules and half have nonjudicial.

If you are in foreclosure, you will probably find that you have an easier time fighting to keep your home if you live in a judicial foreclosure state. Your right to challenge the foreclosure is automatic, and you don't need to initiate your own lawsuit. But of course, nobody chooses which state to live in based on its foreclosure procedures.

What happens in nonjudicial foreclosure?

If you are unfortunate enough to be behind on your house payments in a nonjudicial foreclosure state, there are some things you should know about how the process works and what you can do to try to keep your home.

- Your lender does not need to sue you to foreclose on your home. This means that the process can happen much more quickly than in judicial foreclosure states. To fight foreclosure, you have to file your own lawsuit in court, and the burden of proof is on you to show why the foreclosure should be stopped.

- If you decide to sue your lender, your suit should ask the court for a temporary restraining order (TRO), which shows the judge that you will suffer irreparable injury if the foreclosure is not stopped immediately. If granted, the TRO will temporarily stop foreclosure proceedings until you can get another hearing and tell a judge why foreclosure proceedings should not continue. You may be responsible for posting a bond to insure the lender from losing money in case you lose your suit.

- The next hearing, if allowed, is the preliminary injunction hearing. The TRO usually lasts until the date of the preliminary injunction hearing. At the hearing, the judge may rule in favor of your lender and dismiss your lawsuit. Or, the judge could decide in your favor and issue a preliminary injunction, which may order that the TRO stays in effect, or that the lender give you an opportunity to get current on your loan. A preliminary injunction is a loss for the lender and, if issued, they may try to settle with you or correct whatever caused the injunction to be issued and then come right back at you. Your lender doesn't want to wait for, and go through proceedings for permanent injunction if they can help it.

All the talk about restraining orders and injunctions probably sounds complex to you unless you're an attorney with experience in this field. It is, and it is also expensive since the burden of proof is on you and you will probably need to provide documents to the court that prove why foreclosure should stop.

Nonjudicial foreclosure could be compared to a legal system where you're considered guilty until proven innocent. Foreclosure is considered warranted unless you can prove otherwise. You're responsible for bringing your own lawsuit to court, proving your assertions, and paying for all of the expenses along the way. Simply put, fighting nonjudicial foreclosure is a nightmare. Many homeowners choose not to fight foreclosure for those reasons.

How is judicial foreclosure different?

In states that require judicial foreclosure, the lender must file a lawsuit in court to begin the foreclosure process. The lender is required to notify you of their intentions by serving you with a summons and complaint. The important point to remember is that you have a right to respond to the lawsuit filed against you within a certain period of time. This is a right you don't have in nonjudicial states, so take advantage of it.

In states that require judicial foreclosure, the lender must file a lawsuit in court to begin the foreclosure process. The lender is required to notify you of their intentions by serving you with a summons and complaint. The important point to remember is that you have a right to respond to the lawsuit filed against you within a certain period of time. This is a right you don't have in nonjudicial states, so take advantage of it.

Failure to respond to the lawsuit means that foreclosure will probably go through. Understand that if you do not respond, you are essentially giving up on keeping your home. You may be wondering if you could get some extra time by not opening the envelope the lawsuit was delivered to you in, and then tell the judge that you forgot to open the mail. The answer is no. Burying your head in the sand will not work.

If you want to keep your home, or just stay in it until you can find somewhere else to live, you should respond to the lawsuit. Judicial foreclosure usually takes months to complete, and the longer if you fight it, the more time you have in your home. The extra time is a luxury those in nonjudicial foreclosure states don't have, and it can allow you to save money and plan for the future.

There are a number of defenses to foreclosure that can be used whether you live in a judicial or nonjudicial state, such as:

- The lender used unfair lending practices

- The lender can't prove it owns the mortgage

- Proper procedures weren't followed

- You're on active military duty

Or, you may be able to show that you only fell behind on your mortgage because of a hardship that was beyond your control, and that you will be able to afford your loan if it is modified.

Ideally, unless you're an attorney or a real estate professional, you would never need to know very much about foreclosure at all. Ideally. In reality, things happen that require you to become well-versed in unpleasant, boring, and complicated subjects because they affect you, like foreclosure. Experiencing a hardship that causes you to fall behind on your mortgage requires that you become educated on the foreclosure procedures in your state so you can navigate the process.

It's important to be aware that there are con artists who specialize in taking advantage of distressed homeowners. And not all attorneys have the knowledge, skills, and experience to help you determine what defense is most likely to be successful for you. To give yourself the best chance of achieving the outcome you want, choose a law firm that focuses on foreclosure defense and has a proven record of getting results for people like you. The services of a reputable law firm can be obtained at a reasonable rate and are well worth the expense.

Map from Bankrate.com. Image courtesy of Ambro at FreeDigitalPhotos.net