If you live in New York and have missed more than 3 mortgage payments. You are at serious risk of foreclosure. You have probably heard the news that New York's foreclosures are moving at a snail's pace, but the the fact is: they're speeding up.

Many of our clients are currently being referred to Foreclosure Settlement Conferences in New York courts every 30 days! This is the court's way of making sure the homeowners (our clients) are working toward a solution, and making sure that the big, bad banks are being cooperative. We have appeared at Foreclosure Settlement Conferences several times now whether the judge orders the bank's attorneys to finish a loan modification review within the next 30 days. (Thank you, Judge!)

Back to the foreclosure summons and complaint, it is full of legalese and sends homeowners through a confused tailspin. We know that it can be scary.

You have 20-35 days to respond

If you have your summons in front of you, look at the date written on the front page, and now look for the line that says "You have XX days to respond" and mark it on your calendar. In New York, this is usually 20-35 days. If you plan to defend yourself, or have an attorney represent you -- the clock just started ticking. Start your research (if you haven't already).

In New York, the foreclosure summons and complaint provides some information homeowners (it's not meant to frighten you!).

NOTICE

YOU ARE IN DANGER OF LOSING YOUR HOMEIf you do not respond to this summons and complaint by serving a copy of the answer on the attorney for the mortgage company who filed this foreclosure proceeding against you and filing the answer with the court, a default judgment may be entered and you can lose your home.

Speak to an attorney or go to the court where your case is pending for further information on how to answer the summons and protect your property.

Sending a payment to the mortgage company will not stop the foreclosure action.

YOU MUST RESPOND BY SERVING A COPY OF THE ANSWER ON THE ATTORNEY FOR THE PLAINTIFF (MORTGAGE COMPANY) AND FILING THE ANSWER WITH THE COURT.

There are also very specific rules from the NYDFS about a Help For Homeowners Notice that MUST be provided to you with the Summons and Complaint.

According to the New York Department of Financial services

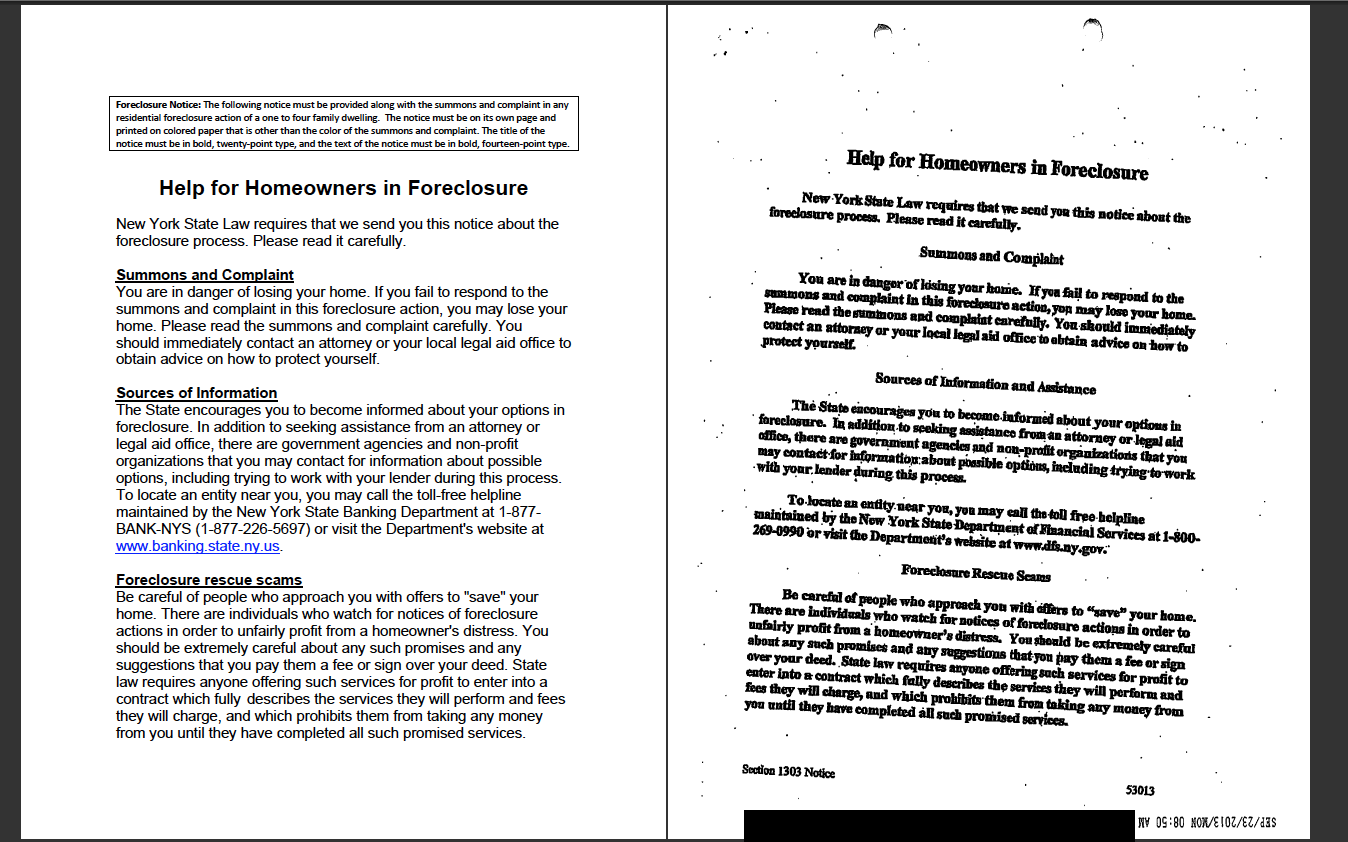

Foreclosure Notice: The following notice must be provided along with the summons and complaint in any residential foreclosure action of a one to four family dwelling. The notice must be on its own page and printed on colored paper that is other than the color of the summons and complaint. The title of the notice must be in bold, twenty‐point type, and the text of the notice must be in bold, fourteen‐point type.

Below, you can see the template provided by the State and a copy of one that our client recently received. (you can also view the full-size pdf here)