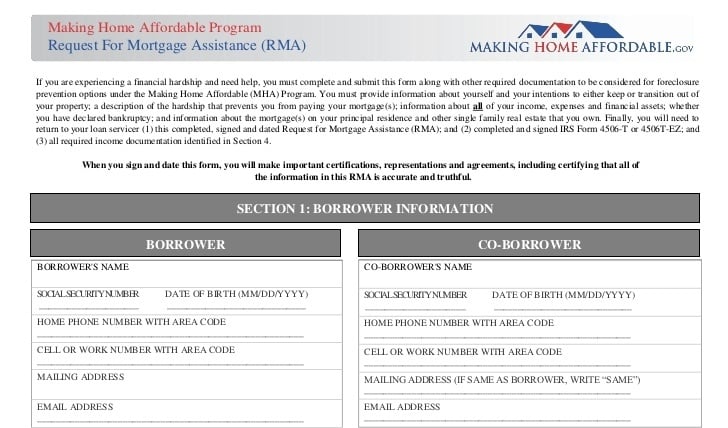

If you're at risk of foreclosure, a loan modification is your best bet for keeping your home. It allows you to reinstate your loan with a lower payment and keep your property. That's a wonderful thing. The process of getting a loan modification, however, is frustrating and stressful for many homeowners who struggle to understand and complete their applications, then have it denied while the threat of losing their home looms.

What is a Loan Modification?

A loan modification is a permanent change to one or more of the terms of a mortgage loan such as the interest rate, length of the loan, and principal. They have existed for a long time, but have only recently been needed for millions of homeowners.

When the country was hit with the worst recession since the great depression and was hemorrhaging jobs, millions of homeowners became unable to pay their mortgages, and foreclosures started in unprecedented numbers.