By Ralph R. Roberts, RISMedia Guest Columnist

[fa icon="clock-o"] Wednesday, August 28, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, how to stop foreclosure

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

What would you do if you were emerging from the shadows of bankruptcy, had already lost one of your cars to repossession, and your house was now in danger of being foreclosed? If you're like this couple, then you fight back.

Emerging From The Shadows

We met this married couple when they retained (hired) us in late 2011. They couldn't afford to pay their $2,600 mortgage payment and were several months behind.

[fa icon="clock-o"] Saturday, August 24, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] successful loan modifications, foreclosure defense

Read More »

[fa icon="clock-o"] Friday, August 23, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense

Read More » In 2009, President Obama introduced the Home Affordable Modification Program (also known as HAMP). The program was designed to help struggling homeowners either to refinance their mortgage or modify their existing mortgage. The program was designed with incentives to the servicers/mortgage lenders and homeowners. However, many servicers were not seeing the program through, and as a result, many homeowners experienced multiple obstacles in getting a HAMP loan modification.

In 2009, President Obama introduced the Home Affordable Modification Program (also known as HAMP). The program was designed to help struggling homeowners either to refinance their mortgage or modify their existing mortgage. The program was designed with incentives to the servicers/mortgage lenders and homeowners. However, many servicers were not seeing the program through, and as a result, many homeowners experienced multiple obstacles in getting a HAMP loan modification.

HAMP adapts to protect homeowners from foreclosure

The HAMP program, unveiled in 2009, was considered by many to be a failed experiment (in part due to the servicers lack of participation and implementation of the rules as well as many stringent program guidelines). Due to many failed modifications, in June of 2012 the Obama administration unveiled HAMP Tier 2 in an attempt to provide assistance to struggling homeowners. Tier 2 came with some much needed eligibility changes.

[fa icon="clock-o"] Thursday, August 22, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] HAMP, hamp loan modification

Read More »

By Barbara Pronin, RISMedia Columnist

With home prices languishing and mortgage interest rates still at historic lows, this may be the year you will want to buy your first home. But getting a mortgage can be a daunting process, especially if the terms associated with getting a loan are new to your vocabulary.

[fa icon="clock-o"] Tuesday, August 20, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] understanding credit, loan modification help

Read More »

This is the final installment in a three part series about free loan modifications. You can read Part 1: Free Loan Modifications: Hope Now and Part 2: Free Loan Modifications: NACA Know How?

In Brief:

- Hope Now, NACA, and other free loan modification services have helped thousands of homeowners.

- There are 3 main drawbacks to these free services.

- These companies can't help you the way a foreclosure defense attorney can.

Are Homeowners Being helped by Free Loan Modification Programs Hope Now and NACA?

[fa icon="clock-o"] Monday, August 19, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

A single, mature homeowner was attempting to get her home loan modified and was having issues with Bank of America. She had been involved in an auto accident with an uninsured driver which had created financial difficulties, which eventually led to her not being able to pay her mortgage on time. Even though BOA had promised to help the homeowner, they strung her along for over a year, and the homeowner was now being threatened with foreclosure. This homeowner was paying a mortgage payment of over $2000 monthly with a high 9.375% interest rate, and was over $20,000 behind on her mortgage. Once she hired Amerihope Alliance Legal Services, her entire situation began to change.

[fa icon="clock-o"] Saturday, August 17, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification, successful loan modifications

Read More »

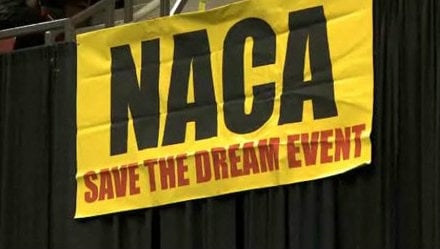

This is a three part series about free loan modificaitons. See last week's article: Free Loan Modifications - Part 1: Hope Now Alliance

In Brief:

- NACA started as a grassroots homeowner advocacy group.

- Like Hope Now Alliance, NACA has ties with the big banks.

- Homeowners are better off using other methods of foreclosure defense.

NACA's Story

The Neighborhood Assistance Corporation of America, or NACA for short, is as different from Hope Now (the subject of our last blog post) as can be. NACA started in the late 1980's as a local grassroots organization in Boston. It worked in concert with local trade organizations and unions to help rehabilitate neighborhoods and change housing laws, and the results of its work created positive ripples for homeowners throughout the United States. NACA continued to expand into a national entity into the mid 2000's, and forged agreements with most of the USA's top lenders to create favorable situations for homeowners in need. NACA even took the step of creating their own "fair" mortgage for homeowners, which was backed by the same big banks that NACA had signed agreements with.

[fa icon="clock-o"] Thursday, August 15, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

Many homeowners are reducing their living expenses and applying those savings to their monthly mortgage payments. Others are seeking a mortgage loan modification, which can be a lifeline for any homeowner faced with foreclosure.

"It's critical that homeowners understand exactly what they can afford because a loan modification that is ultimately unaffordable hurts everyone," says Michelle Jones, Senior Vice President of Counseling for Consumer Credit Counseling Service (CCCS) of Greater Atlanta. "We help consumers create a lean, sustainable budget that will support the family's housing costs."

Here are some simple steps that many homeowners have taken to help qualify for a loan modification:

[fa icon="clock-o"] Wednesday, August 14, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

This client hired our law firm when her investment property was facing foreclosure. Her daughter and grandchildren were currently living in this house. The client had fallen six months behind on her Wachovia/Wells Fargo mortgage, but at the conclusion of our services, Wachovia had forgiven her mortgage completely. Here's her story:

[fa icon="clock-o"] Saturday, August 10, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] wells fargo loan modification, successful loan modifications, foreclosure defense

Read More »