In Brief:

- Hope Now Alliance was created by the Bush administration to save people from foreclosure.

- Due to its ties with the big banks, Hope Now isn't the best foreclosure defense alternative.

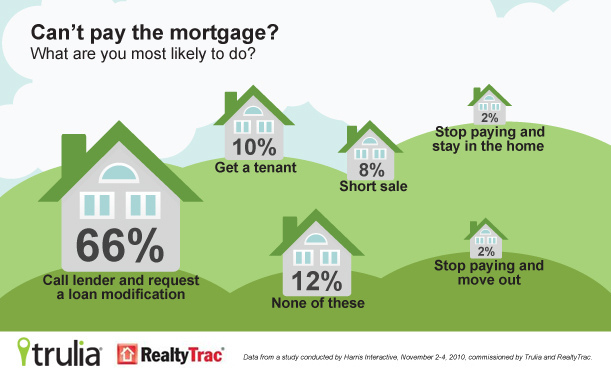

- Homeowners are better off using other methods of foreclosure defense.

In the wake of the foreclosure crisis, it's no surprise that there have been many "foreclosure rescue" schemes- some illegal and some legitamate- that have victimized homeowners in foreclosure, such as what that we've covered here and here. This has been especially true in states such as Illinois, Florida, and New Jersey, where the mortgage crisis was and is still at its worst. While the government has made an extensive effort to reign in illegal schemes, the government has never made a legitimate effort to change its own foreclosure recovery program for the better. Although Hope Now Alliance has assisted hundreds of thousands of homeowners, the question will always be "what if". What if it was more efficient? What if it offered homeowners better solutions? What if it wasn't bankrolled by the large banks? No one will ever know.

A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to

A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to

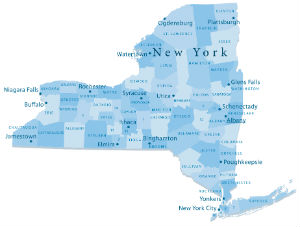

If you weren't sure how to answer any of these questions, then you should take half a minute to download the New York foreclosure timeline, especially if you're at risk for foreclosure or if you're already involved in the

If you weren't sure how to answer any of these questions, then you should take half a minute to download the New York foreclosure timeline, especially if you're at risk for foreclosure or if you're already involved in the