If you're having problems with your mortgage, it's a good idea to communicate with your bank to see if you can work with them for some sort of agreement to stay out of foreclosure.

Your bank can choose to give you an unemployment forbearance that temporarily suspends your mortgage payments because of a job loss, for example. Or, if you're already behind on your mortgage payments due to a hardship, you may be able to get a loan modification that reinstates your mortgage with a more affordable payment.

Loan modifications are the only option many homeowners have to keep their home. The terms of the loan, such as the length of the loan, the interest rate, and the principal balance can be changed.

Loan modifications are a life saver for those who get them. Unfortunately, many Wells Fargo borrowers end up disappointed when they don't get the results they're looking for after trying to deal with the bank on their own. And Wells Fargo has a reputation as one of the most difficult banks to work with for a loan modification.

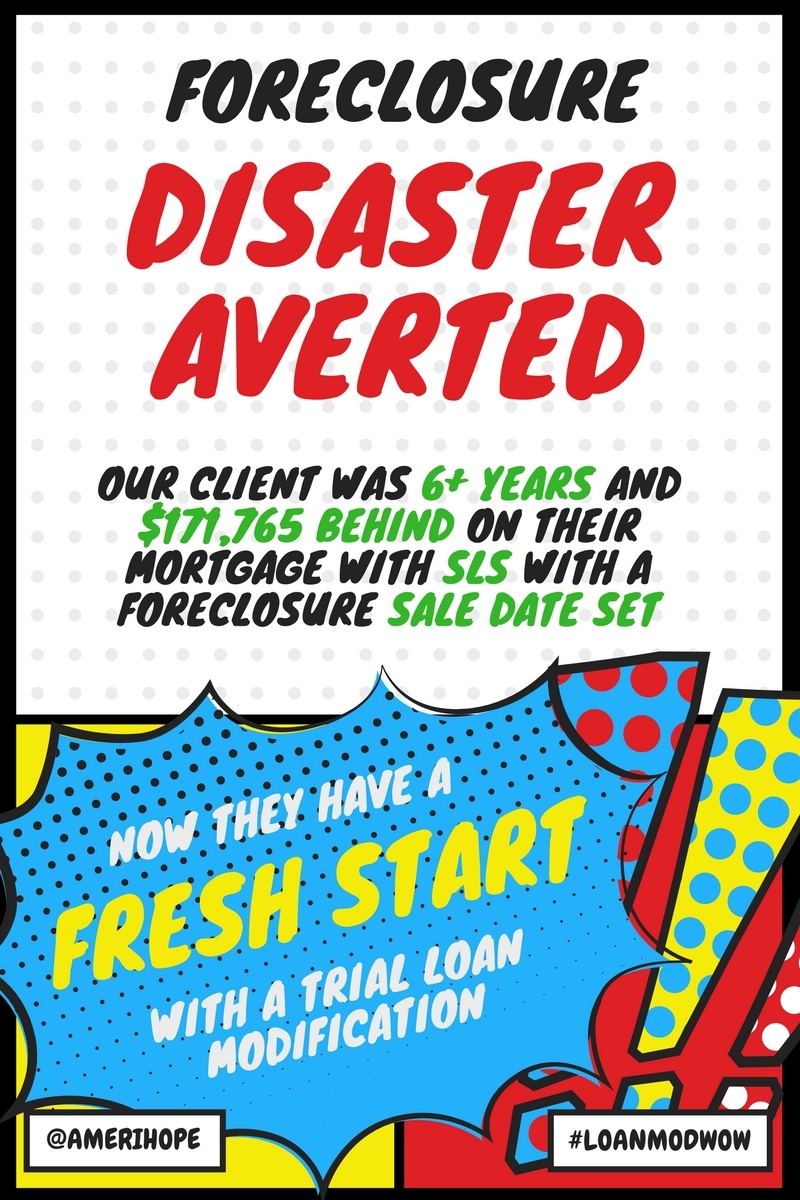

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week, which include results from Bayview, US Bank, Seterus, and SunTrust:

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week, which include results from Bayview, US Bank, Seterus, and SunTrust:

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on