If you want to get out of your Federal Housing Administration (FHA) insured home loan through a short sale you should be aware of the differences between an FHA short sale and a regular short sale.

If you want to get out of your Federal Housing Administration (FHA) insured home loan through a short sale you should be aware of the differences between an FHA short sale and a regular short sale.

The Federal Housing Administration (FHA) is a government agency that insures loans. It is part of the Department of Housing and Urban Development (HUD). Their goals are to “improve housing standards and conditions, provide an adequate home financing system through insurance of mortgage loans, and stabilize the mortgage market.”

As a government agency, the FHA is subject to regulations that other mortgages (or investors) aren't.

In a traditional short sale you list your property for sale, receive an offer from a buyer, then take that offer to your lender and ask them to approve it.

With FHA-backed loans you must first receive approval to participate in the HUD pre-foreclosure sale procedure (PFS) and then get an offer from a buyer. The FHA will not approve a sale until you're accepted into the program.

You can find out how to apply for a short sale by contacting your loan servicer.

Requirements to participate in the HUD Pre-foreclosure Sale Program include, but are not limited to:

- The home is owner-occupied.

- The home must be listed for sale with a licensed Realtor unrelated to the borrower.

- The short sale must be an “arm's length” transaction, which means that the buyer cannot be a member of the seller's family, a business associate, or other favored party.

- Borrower is at least 31 days behind on mortgage when property is sold.

- Borrower must provide documentation that shows they are unable to make mortgage payments.

Getting Approval to Participate

If your application is approved the FHA will enter into a contract with you called an Approval to Participate in the HUD Pre-Foreclosure Sale procedure. It's form HUD-90045.

At this point you can advertise your property as a "pre-approved short sale".

The Approval to Participate (ATP) letter will include specific requirements for selling the property, including that the sale price be at or near the appraised value and a deadline to sell the property by.

If a signed contract of sale from a qualified buyer is not obtained by a certain date, a foreclosure sale or a deed-in-lieu of foreclosure agreement will be recommended.

The program also has criteria for occupancy and property maintenance, which includes obligations to cut the grass, remove snow, immediately repair broken doors and windows, and pay utility bills.

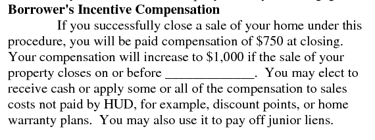

The last paragraph in the ATP is about borrower's incentive compensation. Borrowers can receive up to a thousand dollars for successfully closing the sale of within a certain period of time.

The Approval to Participate is a short sale pre-approval contract required to short sell a property insured by the Federal Housing Administration. Once an ATP is issued the lender must postpone foreclosure until an acceptable offer is made or no offer is made for so long that a short sale has to be abandoned.

Don't Settle for a Short Sale If You Don't Have To

Some homeowners accept a short sale when what they really want is to find a way to keep their home. When their loan modification application is denied and their lender suggests a short sale they give up on keeping their property. What they don't know is that most homeowners who apply for a loan modification on their own are denied, and there may be something they could do to get approved.

It's possible to be denied for a loan modification because your income was short by $40 a month. There are ethical and legal ways to present your application so that you have a better chance of getting what you want. But you have to take advantage of the experience of professionals who know what they're doing.

Your home is too valuable of an asset to not consult with the pros before you make a decision to give it up in a short sale.