The government's Home Affordable Modification Program (HAMP), is expiring at the end of 2016, and the mortgage industry has ideas about how to replace it.

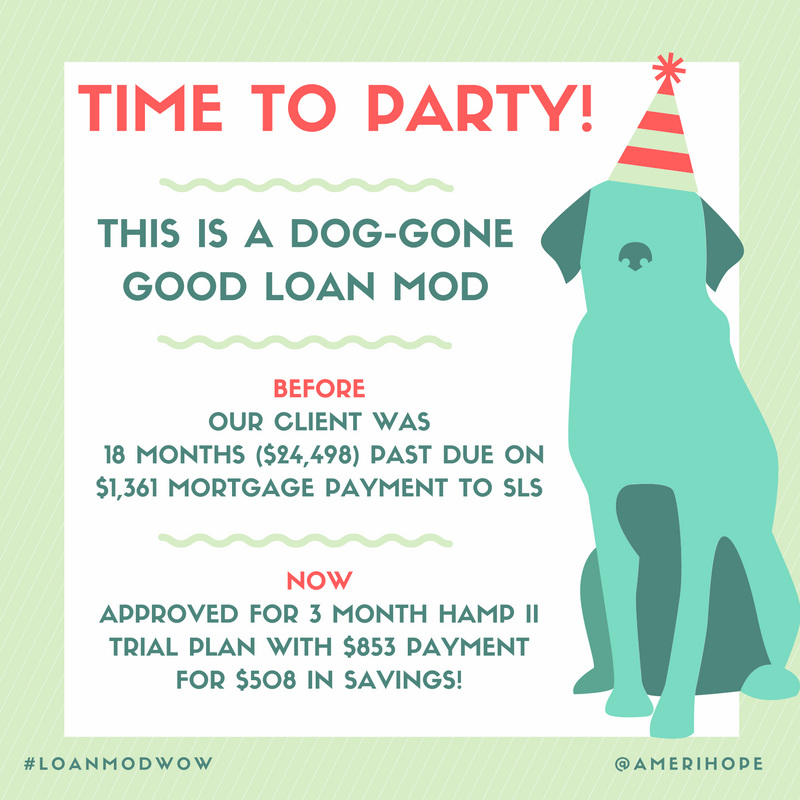

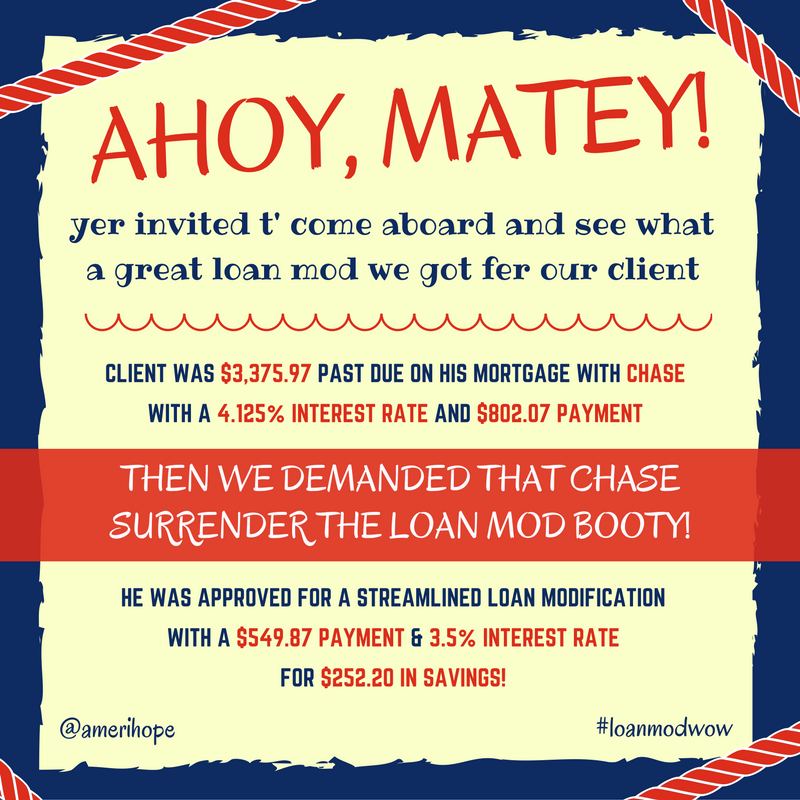

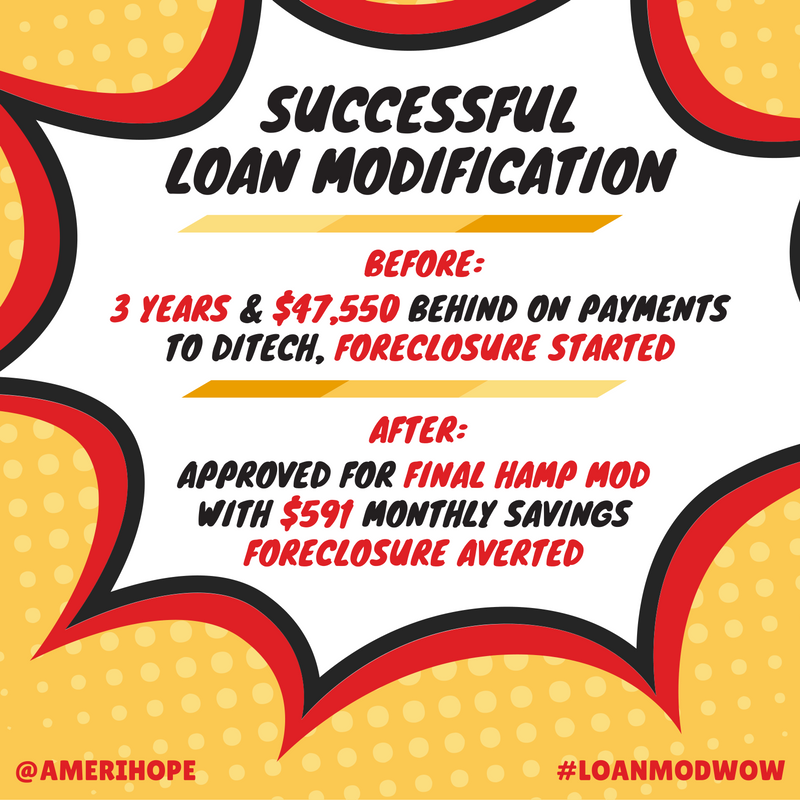

HAMP, sometimes referred to as the Obama plan, became available to distressed homeowners in 2009 in response to the financial and foreclosure crises. Its goal has been to help delinquent borrowers keep their home with a more affordable monthly mortgage payment.

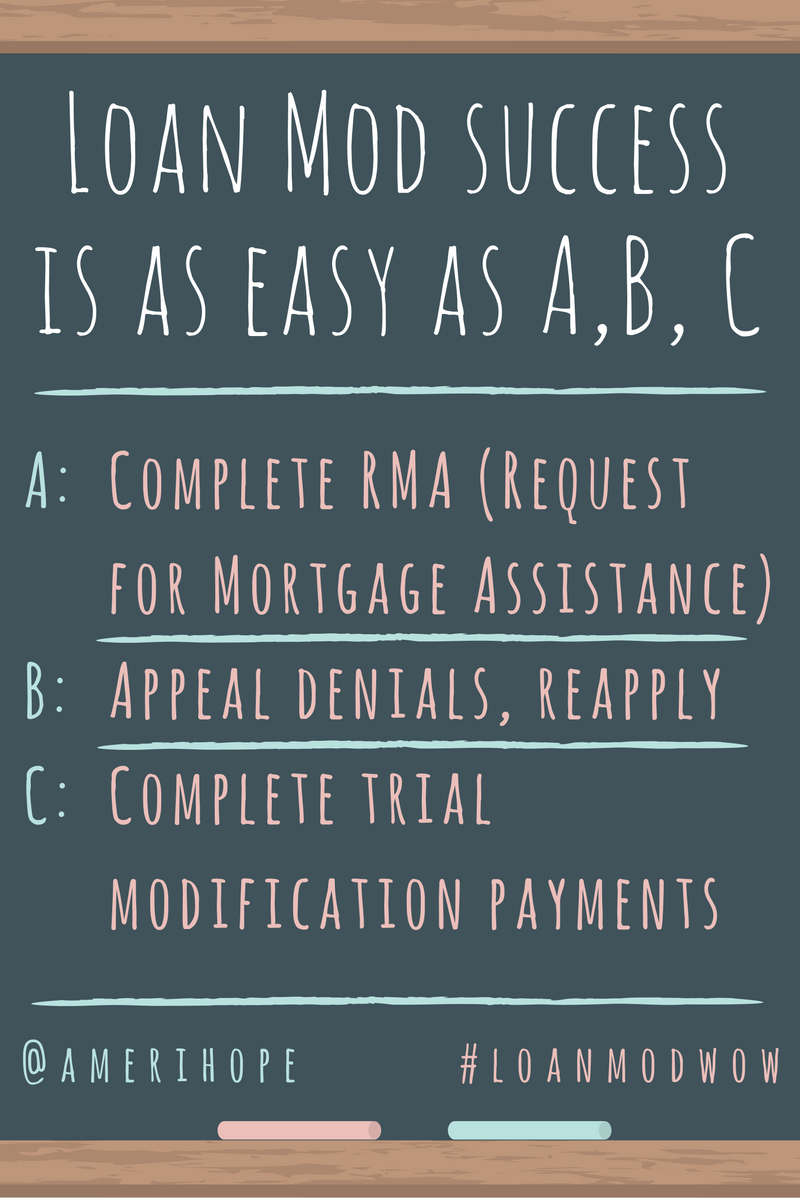

Now the Mortgage Bankers Association, a trade group representing the real estate finance industry, has released its own suggestions for how loan modifications should be implemented in a post-HAMP world in 2017 and beyond. It's called One Mod, short for One Modification.