If you're having trouble with your mortgage, you're probably aware of the possibility of getting a loan modification to avoid foreclosure and keep your home. A loan modification is a permanent change to one or more of the terms of your mortgage loan, such as the interest rate, term length, or principal.

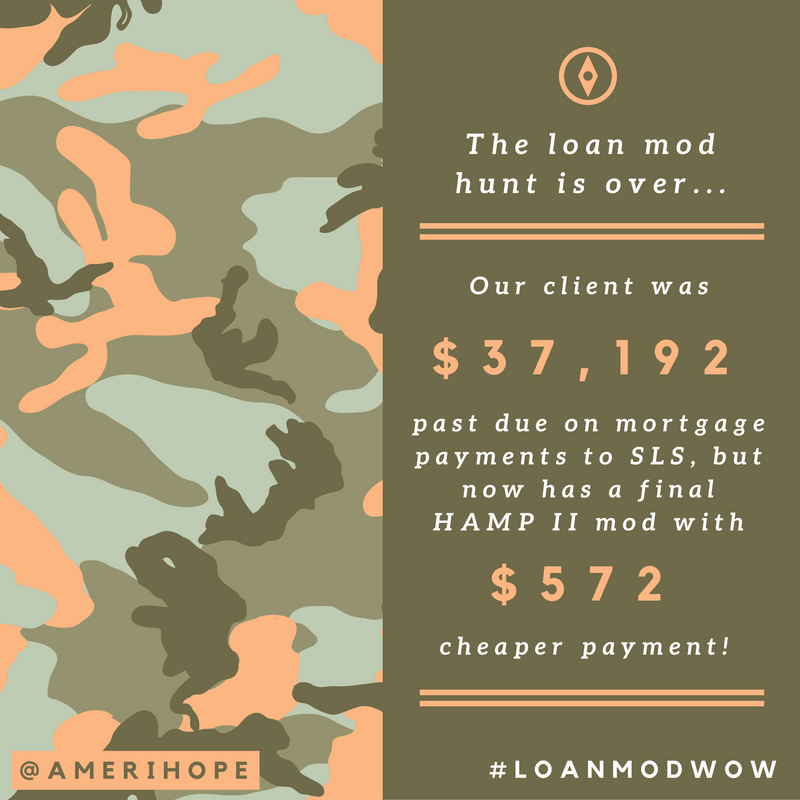

The most well-known loan modification program is the federal government's HAMP (Home Affordable Modification Program), which was created in 2009 to help homeowners avoid foreclosure and get a more affordable payment.

But there's another type of loan modification that can be just as good as HAMP. It's called an in-house, or traditional, modification.

An in-house loan modification is not a modification that allows you to stay in your house while your mortgage is being modified. You can do that no matter what type of loan mod you're applying for. (You only have to move out after your house is sold and you've been evicted.)

An in-house loan modification is a proprietary loan mod done by your bank, not through a government program. It's also called traditional because in-house mods have been around since before HAMP was created.