Do you remember what the country was going through in the late 2000s? You couldn't turn around without hearing something about collateralized debt obligations, credit default swaps, and subprime mortgages. Our financial system was collapsing. Something had to be done.

The government created the Emergency Economic Stabilization Act of 2008, often called 'the bailout,' and the American Recovery and Reinvestment Act of 2009, known as the 'stimulus' or 'recovery act.' The main purpose of the Acts is to protect home values and savings, preserve homeownership, and promote job and economic growth.

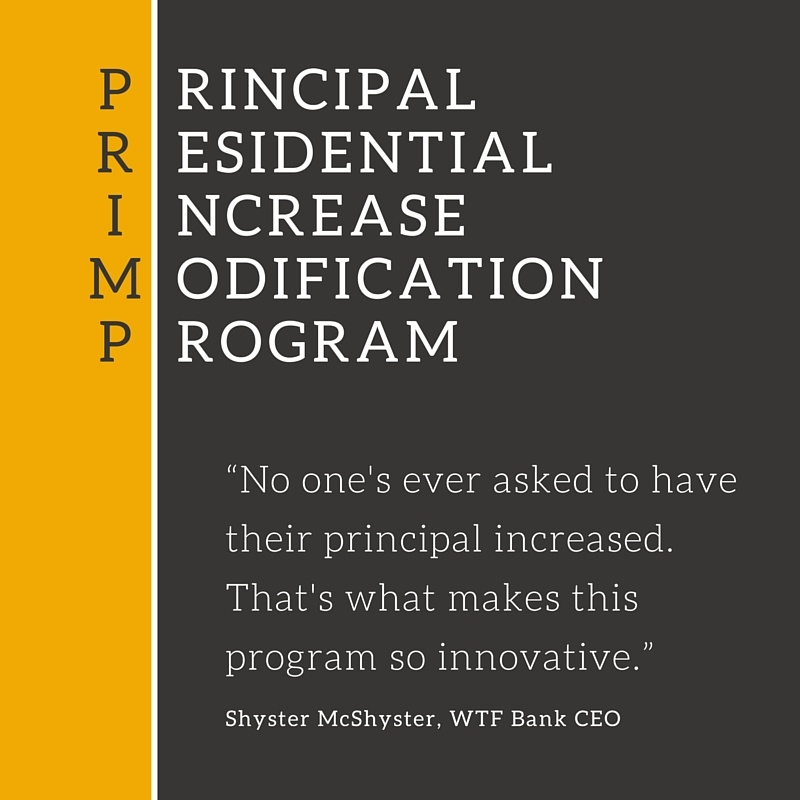

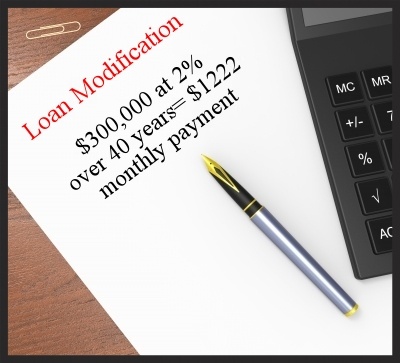

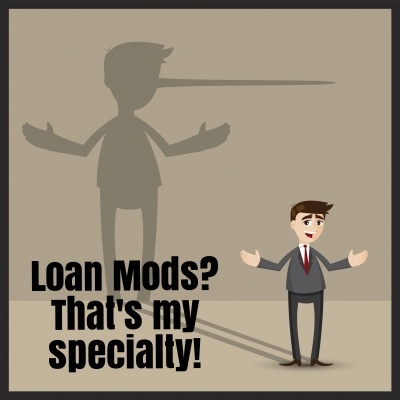

To that end, Making Home Affordable (MHA) was created by the U.S. Treasury Department.MHA contains numerous programs intended to help distressed homeowners avoid foreclosure. The programs in it include: