Claiming it is the most common sense and profitable solution to the ongoing foreclosure crisis, WTF Bank has announced the creation of an innovative loan modification program that actually increases the amount of principal owed by homeowners facing foreclosure.

Claiming it is the most common sense and profitable solution to the ongoing foreclosure crisis, WTF Bank has announced the creation of an innovative loan modification program that actually increases the amount of principal owed by homeowners facing foreclosure.

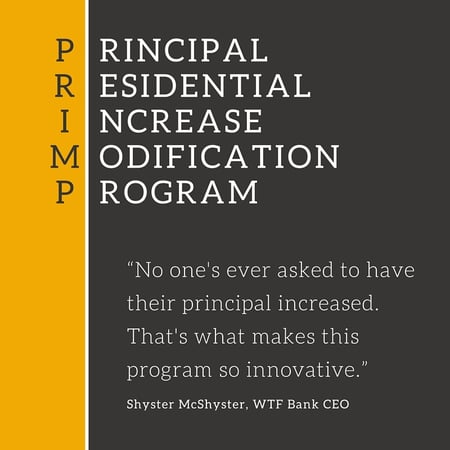

According to WTF Bank's CEO, Shyster McShyster, the Principal Residential Increase Modification Program, or PRIMP, offers underwater and distressed homeowners a solution for getting even deeper underwater and more distressed.

Under the terms of PRIMP, homeowners who owe more on their mortgage loan than the home is worth and can't afford their monthly payments will have up to $125,000 added to their principal balance, making the payment even more unaffordable.

Modifications up to this point, including the federal government's Home Affordable Modification Program (HAMP), which is part of the Making Home Affordable program, have helped homeowners by lowering their monthly payment. This is done by lowering the interest rate, extending the term of the loan, and sometimes even reducing the principal owed.

Modifications up to this point, including the federal government's Home Affordable Modification Program (HAMP), which is part of the Making Home Affordable program, have helped homeowners by lowering their monthly payment. This is done by lowering the interest rate, extending the term of the loan, and sometimes even reducing the principal owed.

“Loan modifications have helped millions of families save their home and avoid foreclosure. But far too little has been done to help banks squeeze more money out of homeowners before they are foreclosed on and thrown in the street.” McShyster said.

And that's where PRIMP comes in.

PRIMP is not a second mortgage or a loan to make home improvements. It simply increases the amount of money you owe on your mortgage loan. The primary benefit to you is that you will be foreclosed on much sooner than if you hadn't got a PRIMP modification. An additional benefit is that you will be sued for even more of a deficiency judgment after losing your most valuable investment.

“No one's ever asked to have their principal increased. That's what makes this program so innovative. Best of all, there's no cost to the consumer for adding six figures to your loan...except for the six figures we add to your loan.” the WTF Bank chief said.

Applying for a PRIMP modification is easy. You do not need to prove that you endured a hardship. If you haven't already experienced one, you're about to. There are no documents to submit like with a HAMP modification. Simply read the 45-page agreement, initial and sign where instructed, and mail to the Cayman islands address on the provided envelope. Postage is not included.

Keep in mind that you're not just helping the bank when you get a PRIMP modification, you're helping society. Once approved for a PRIMP mod, the bank will rent out any spare or under-occupied rooms in your home to newly-paroled violent criminals. (A room is considered under-occupied if six or fewer people occupy it.)

“The government tries to help out struggling families, but what about a large, multi-national corporation like us? Other than the $56 billion we took from the government in the bailout, what have they done for us?” McShyster said in a satellite phone interview from his private island.

News of WTF Bank's new principal-increasing modification program comes just one week after they announced they'd be investing $200 million into their robo-signing and mortgage document fabrication division, which they hope will allow them to foreclose on homeowners even faster.

WTF Bank says it hopes PRIMP will serve as a model for other banks to create similar programs of their own.

If you're interested in getting a PRIMP modification, go to your local WTF Bank branch office and ask to speak to a representative.

P.S. What day is it? April 1. April fools!