Difficult life events are all the more difficult when there's uncertainty that goes along with them. The worrying, waiting, and wondering about how things will work out makes it even harder to handle. That's especially true of a hardship that seven million Americans have experienced in recent years: foreclosure.

Difficult life events are all the more difficult when there's uncertainty that goes along with them. The worrying, waiting, and wondering about how things will work out makes it even harder to handle. That's especially true of a hardship that seven million Americans have experienced in recent years: foreclosure.

Everyone knows that if you stop paying your mortgage, your house will eventually be sold at auction or repossessed by the bank. What most people don't know is exactly how the process will unfold over what period of time, and how to determine if they can afford to keep their home and avoid foreclosure.

The foreclosure time line differs according to the laws in your state. There are free resources on this site that can help you understand them, including the differences between judicial and nonjudicial foreclosure. You need to be aware of that information if you've defaulted on your mortgage loan.

But the purpose of this post is to help you determine if you can afford to keep your home. Here's how:

Estimating Your Modified Loan Payment

The only hope many homeowners have to avoid foreclosure and keep their home is to get a loan modification, which alters at least one of the terms of the loan to make the monthly payment more affordable. This is done by lowering the interest rate, extending the amount of time the loan is financed for, and sometimes reducing the principal.

If approved for a loan mod with the federal government's Home Affordable Modification Program (HAMP), your payment will be reduced to 31% of your monthly gross income. Unlike refinancing your loan, modifying it does not require good credit, there are no closing costs, and no fees to apply.

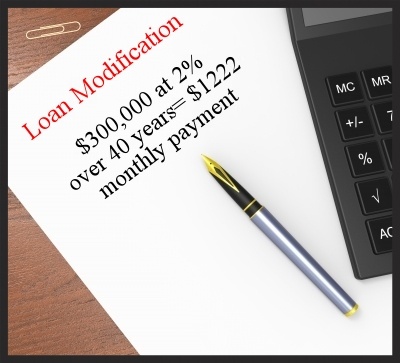

To get an idea if you could afford a modified loan, do some basic calculations based on a best case scenario. The best case to get you the cheapest monthly payment is that your loan term could be extended to 40 years and the interest rate could be lowered to 2%. Principal reductions are possible, but they're not typical and we won't consider it in this example.

Example:

Let's say you owe $300,000 on your mortgage including all the late fees and back taxes you've accumulated since you stopped making payments. If you were to get a loan modification that financed that amount at 2% interest rate for a 40 year loan term with 1.25% property tax and 0.5% PMI, your monthly payment would be $1,221. So you would need to show the bank that you make at least $3,939 in gross income a month to make the $1,221 payment 31% of your income. If you only make $2,900 a month, the payment would be 42% of your income, which is too high.

Try this for yourself. Grab your latest mortgage statement and go to www.mortgagecalculator.org. Type in your numbers with a 40 year term, 2% interest and see what the monthly mortgage payment is. If it's way more than 31% of what you make in a month, a loan modification might not be attainable unless you get a huge reduction in principal or start bringing in more income. (You can find 31% of your income by multiplying your income by 0.31.)

Calculating your proposed best case loan modification scenario can help you estimate how much you could save and if your income is in the ballpark. If your interest rate is 4% with 27 years left on your loan, you're not going to benefit as much as someone who has an 8% interest rate and 11 years to pay off their loan.

The higher your interest rate and the shorter the time left on your loan, the more room you have to save by taking advantage of today's historically low interest rates and stretching out the loan term. Even so, a small reduction of your mortgage payment can make the difference between keeping your home and being foreclosed on.

Too Much Money

The banks give loan modifications to people who can afford to keep their home, but are also in need of help. If you show them that you make too much money, you will be denied because it looks like your payment is already within your means. You need to show the bank that you fall in the Goldilocks zone, not so little income that you can't afford your home, but not so much that it looks like you don't deserve assistance either. Just right.

Most homeowners who apply for a loan modification on their own are denied, and it's usually because their income is too low or too high. Someone experienced with loan modifications can help you put your application together so it shows that your income is in the right range.

Some people can't afford to keep their home and will be joining the six million homeowners who have been foreclosed on. Others will be able to keep their home with a loan modification. Not knowing which group you'll end up in is the most stressful part for many homeowners. You can take some of the uncertainty and stress out of your situation by working with an experienced professional who understands your situation and has a proven record getting the best results possible for people like you.

Image courtesy of Stuart Miles at FreeDigitalPhotos.net