For any homeowner, the prospect of losing their home because they can’t make the mortgage payments can be a frightening experience. Since the Great Recession began, many borrowers have experienced problems making ends meet because of losing a job, divorce, medical issues and other situations.

In addition, during the real estate boom, it was common for borrowers to get duped into take on risky adjustable-rate mortgages (ARMs) to get into homes they could not otherwise afford. ARMs have low “teaser rates” for at least the first year. This feature helps borrowers qualify bigger mortgages.

After the introductory rate expires, the lender can adjust the interest rate on the loan at predetermined intervals, which can send monthly payments skyrocketing.

Do not pay fees to debt relief companies that promise that they can negotiate a pay off and stop the payday loan companies from calling you. They can't. They charge a consumer for an attorney to send their payday loan company a cease and desist letter and a letter of negotiation. Neither of these letters with help you in any way more than you can help yourself. These type of scam companies are preying on payday loan consumer's fears.

Do not pay fees to debt relief companies that promise that they can negotiate a pay off and stop the payday loan companies from calling you. They can't. They charge a consumer for an attorney to send their payday loan company a cease and desist letter and a letter of negotiation. Neither of these letters with help you in any way more than you can help yourself. These type of scam companies are preying on payday loan consumer's fears.

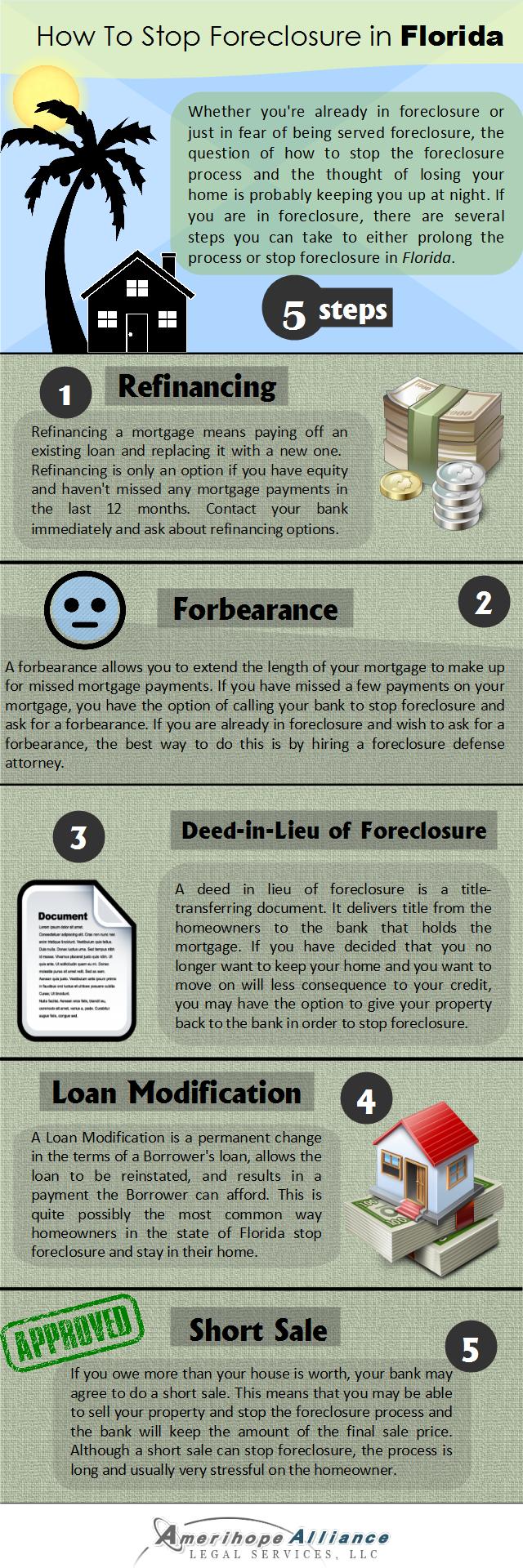

Florida may be in the Southernmost part of the United States, but it was and still is the center of the foreclosure crisis. Even today, thousands of Floridians are served with foreclosure papers every month. Florida is a judicial foreclosure state, meaning that foreclosures have to proceed through through the court system in order to be completed. This combination of judicial foreclosure and the severity of the foreclosure crisis has created what is consistently the nation's largest backlog of foreclosure cases; a problem which Florida's government had not addressed until recently.

Florida may be in the Southernmost part of the United States, but it was and still is the center of the foreclosure crisis. Even today, thousands of Floridians are served with foreclosure papers every month. Florida is a judicial foreclosure state, meaning that foreclosures have to proceed through through the court system in order to be completed. This combination of judicial foreclosure and the severity of the foreclosure crisis has created what is consistently the nation's largest backlog of foreclosure cases; a problem which Florida's government had not addressed until recently.