Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

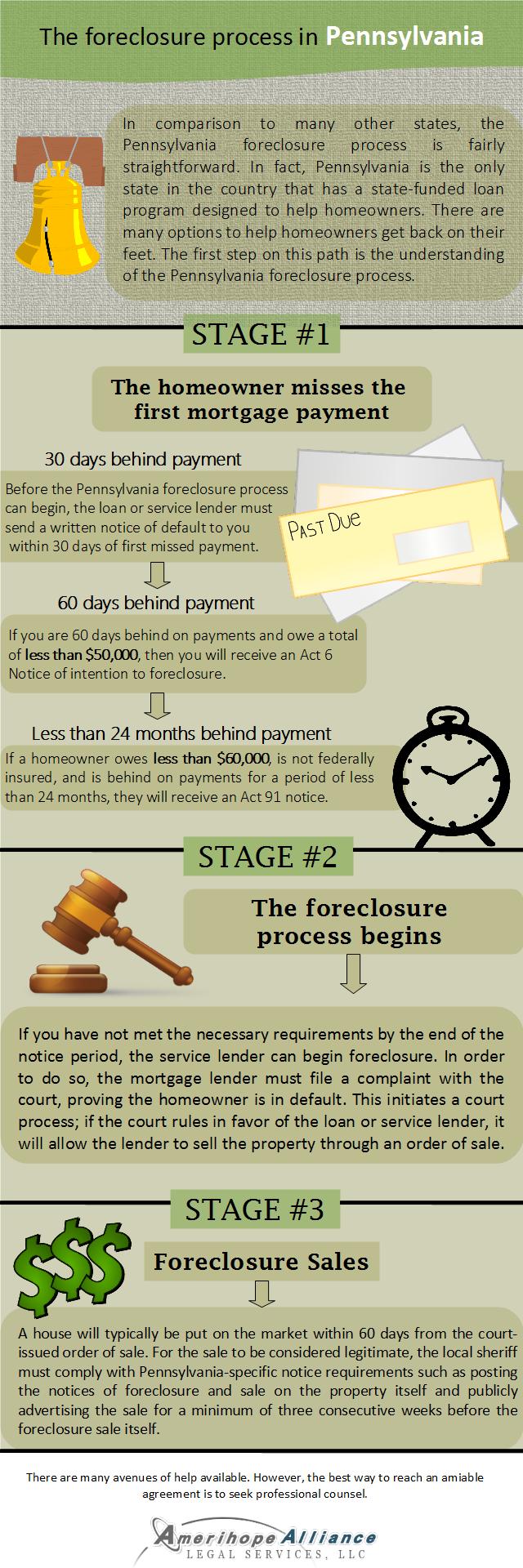

Aside from the infamous "subprime mortgages," one of the major contributors to the foreclosure crisis was banks giving out home loans at unfair terms. Many homeowners simply couldn't afford their homes once the economy slowed. One homeowner had experienced problems with getting on top of his loan for years; his entire situation changed when he spoke with us.

This homeowner hadn't paid on his mortgage since around the start of the mortgage crisis. In fact, he hadn't paid his mortgage for six years. In addition to being over $150,000 behind on paying his $2,000 monthly mortgage payment, our homeowner was paying an astronomically high 9.34% interest rate. Somehow, he had managed to stay out of foreclosure during that time, but he knew that wouldn't always be the case. That's when the homeowner retained (hired) us to help him modify his home loan in June 2013.

In 2009, President Obama introduced the Home Affordable Modification Program (also known as

In 2009, President Obama introduced the Home Affordable Modification Program (also known as