A short sale, which is when a home is sold for less than what is required to pay off the mortgage, is more complex than a regular sale and takes longer to complete. How long it takes depends on many factors, but about six months is a common rough estimate from professionals with short sale experience.

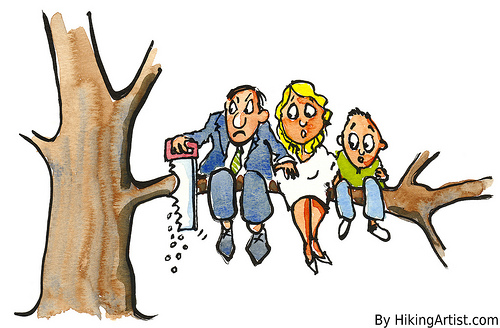

When someone takes out a loan for a home and its value drops to less than what they owe on the mortgage, that's called having negative equity or being underwater. As long as the monthly mortgage payment is affordable, negative equity is not the end of the world. You can just keep making payments and eventually you should have equity from paying down the loan and/or appreciation of the property.

But when a hardship such as a loss of income has left a homeowner unable to pay their mortgage, they don't have the option of waiting. In situations like that, getting rid of the home in a short sale can be better than going through foreclosure, as it keeps them in control of the process, can be less damaging to their credit, and may allow them to become a homeowner again in less time.