Caliber

Dios mio! Our client was 10 months and $21K past due with Caliber, but we got him a loan modification with a gargantuan monthly savings of $859!

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of the results from this week, which includes results from Caliber, SPS, and others:

Dios mio! Our client was 10 months and $21K past due with Caliber, but we got him a loan modification with a gargantuan monthly savings of $859!

[fa icon="clock-o"] Friday, August 5, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications, caliber loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of the results from this week, which includes results from Caliber, SPS, and others:

Our client was in foreclosure and 14 months past due to 21st Mortgage. We got them a fresh start with a final loan modification and a low fixed interest rate!

[fa icon="clock-o"] Friday, July 29, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, sps loan modification, caliber loan modification, asc loan modification

Read More »

Many homeowners have lost wages or experienced some hardship or hardships that caused them to fall behind on their mortgage payments. They're in desperate need of a solution before they're foreclosed on. Searching for any hope in a sea of despondence, they wonder if there's a way they could get their house for free.

These homeowners want to know if there's any way their house could be given to them as a form of retributive justice for all the illegal and unethical things their bank has done. There certainly doesn't seem to be a shortage of that. We've all heard the stories about predatory lending, robo-signing, and fraudulent foreclosure. Could that somehow be cause for a free house?

No. You won't get your home for free because of any bad behavior by the bank.

However, there is a technicality that could allow a homeowner to get their home for free.

[fa icon="clock-o"] Wednesday, July 27, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help

Read More »

Even under the best circumstances, everyone needs a vacation to get away from the grind of regular life, recharge their batteries, and spend some quality time with their loved ones. If you're behind on your mortgage or in foreclosure, you could probably use a stress-relieving vacation even more.

But is it appropriate to go on a vacation when you aren't paying your mortgage?

It depends on your particular circumstances, and what kind of money you're going to spend on your trip.

People generally don't stop paying their mortgage unless something went seriously wrong with their finances and/or life. We hear their stories all the time, and they're often tragic. Loss of income, cancer, divorce, and enormous debt burdens are all common for people who default on their mortgage. Nothing good causes a person to stop paying their mortgage.

[fa icon="clock-o"] Monday, July 25, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure, personal finance

Read More »

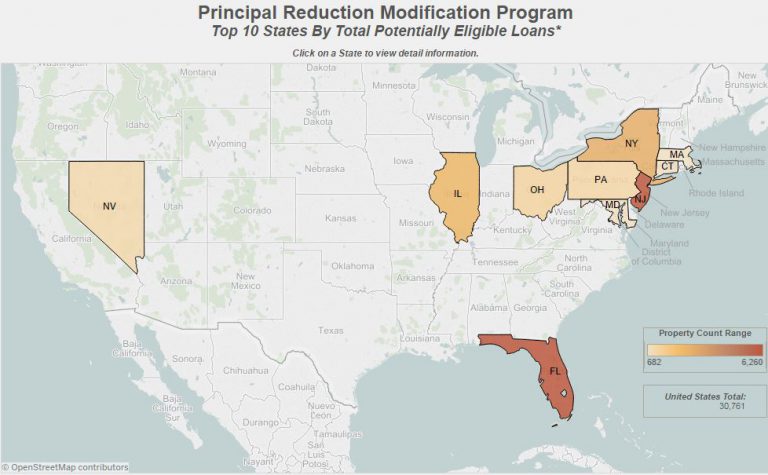

In April of 2016 the FHFA (Federal Housing Finance Authority) announced that it would be offering a one-time principal reduction modification program for eligible borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac.

To be eligible for the program, FHFA said that the borrower must occupy the property and be 90 or more days delinquent as of March 1, 2016. The mark-to-market loan-to-value ratio must be 115% or greater, and the unpaid principal balance must be $250,000 or less.

[fa icon="clock-o"] Saturday, July 23, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, principal reduction, FHFA

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

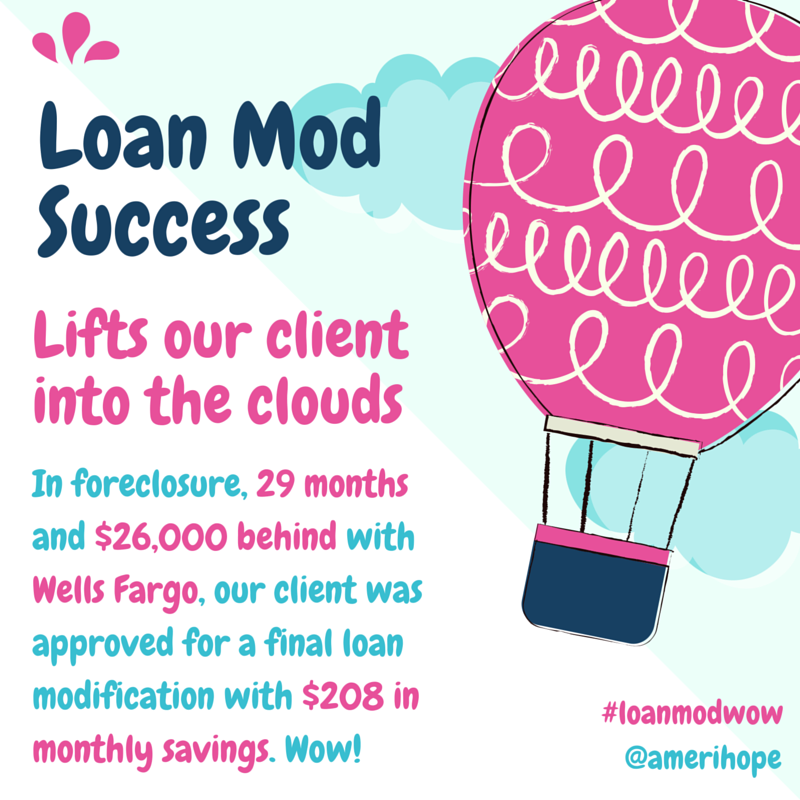

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Ocwen, Bank of America and others:

Our client was in foreclosure, 11 months and $18K past due with Carrington, but we got them a trial modification with a $208 cheaper payment and a fresh start!

[fa icon="clock-o"] Friday, July 22, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] bank of america loan modification, loan modification, successful loan modifications, ocwen loan modification, principal reduction, carrington loan modification

Read More »

New York Governor Andrew Cuomo recently signed legislation intended to prevent foreclosures and reduce the harm done by zombie properties in the Empire State.

Homeowners in New York already have some advantages that people in some other states don't. New York is a judicial foreclosure state, which means the bank has to go through the courts to foreclose on your home. That takes longer and affords homeowners more time to find a resolution.

Also, settlement conferences, which are a mediation between you and your lender, are mandatory for most foreclosure cases in New York. The purpose of the conference is for you and your bank to meet in person and come to some agreement that doesn't involve foreclosure.

[fa icon="clock-o"] Monday, July 18, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, new york foreclosure attorney, housing market, zombie foreclosure

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Ocwen, Seterus, and others:

Our client was behind on their $1,654/month payment to Ocwen, we got them a HAMP II trial loan modification with a $732 cheaper payment!

[fa icon="clock-o"] Friday, July 15, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, sps loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

In January of 2016 we were hired by a Florida homeowner to help him avoid becoming a former homeowner. Let's call him Mr. Cohen to protect his privacy. Mr. Cohen definitely needed the help of an experienced foreclosure defense attorney. After falling behind on his mortgage his home was scheduled to be sold at a foreclosure auction on April 13th, so we immediately got to work to stop the sale and find a permanent solution.

We rushed to submit a Request for Modification Assistance (RMA) to Rushmore Servicing, Mr. Cohen's loan servicer, that would permanently modify his mortgage loan and return it to normal servicing if accepted.

As the April sale date approached the RMA had not been reviewed by the bank, so we filed a motion with the court to cancel the foreclosure sale. The motion was granted and the April sale date was canceled and rescheduled for June 14.

[fa icon="clock-o"] Thursday, July 14, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, foreclosure defense

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Wells Fargo and others:

[fa icon="clock-o"] Friday, July 8, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications

Read More »Amerihope Alliance Legal Services is a leading loan modification and foreclosure defense law firm with attorneys licensed in 5 states. We have helped over 7,000 homeowners fight back and keep their homes.

Our goal is to provide valuable information to help homeowners who are trying to obtain a loan modification or to stop foreclosure. You may schedule a free consultation at any time.

Privacy Policy | Terms of Service | Site Map | Glossary | Contact Us

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

The hiring of a lawyer is an important decision that should not be based solely upon advertisements. This web site is designed for general information only. The facts and law in each case are different. We cannot and do not represent or guarantee a specific result in any given case. See our About Us page for our qualifications and experience.