In April of 2016 the FHFA (Federal Housing Finance Authority) announced that it would be offering a one-time principal reduction modification program for eligible borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac.

In April of 2016 the FHFA (Federal Housing Finance Authority) announced that it would be offering a one-time principal reduction modification program for eligible borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac.

To be eligible for the program, FHFA said that the borrower must occupy the property and be 90 or more days delinquent as of March 1, 2016. The mark-to-market loan-to-value ratio must be 115% or greater, and the unpaid principal balance must be $250,000 or less.

At the time the program was announced it was estimated that about 33,000 people nationwide would be eligible for principal reductions. Now a new report from the FHFA estimates 30,761 are eligible because of changes in the housing market.

The FHFA states on their website that:

"The total number of underwater borrowers with a Fannie Mae or Freddie Mac loan has dropped by over 80 percent in the last four years. Of all underwater loans nationally, only about 2 percent are both severely delinquent and owned or guaranteed by Fannie Mae or Freddie Mac. The Principal Reduction Modification program is the final crisis-era modification program designed to give these borrowers a last opportunity to avoid foreclosure and stay in their homes.”

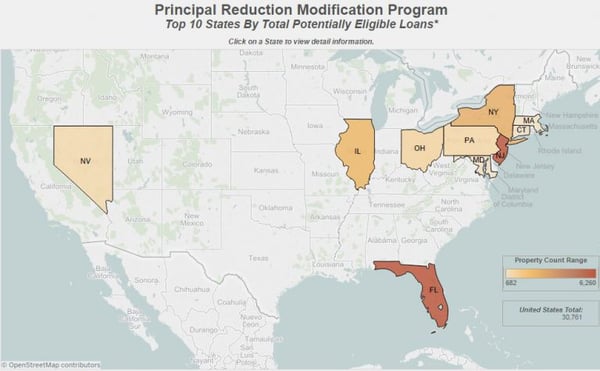

Principal Reduction Modification Eligibility by State

The new report from the FHFA includes an interactive online map that shows where potentially eligible borrowers live.

While the program is open to borrowers in every state, not all states have been equally affected by the foreclosure crisis. The list of states with the most potentially eligible borrowers looks like the usual suspects of states with high rates of foreclosure and long times to foreclose. More than half of the estimated 30,761 eligible borrowers live in just three states: Florida, New Jersey, and New York. That's no surprise because those states often rank among the worst in the country for number of foreclosures and zombie foreclosures.

More than three quarters of potentially eligible borrowers live in ten states:

- Florida – 6,260 potentially eligible borrowers

- New Jersey – 6,257 potentially eligible borrowers

- New York – 2,823 potentially eligible borrowers

- Illinois – 2,434 potentially eligible borrowers

- Ohio – 1,214 potentially eligible borrowers

- Pennsylvania – 1,109 potentially eligible borrowers

- Nevada – 1,032 potentially eligible borrowers

- Maryland – 726 potentially eligible borrowers

- Connecticut – 703 potentially eligible borrowers

- Massachusetts – 682 potentially eligible borrowers

Numbers 1 and 2, Florida and New Jersey, have by far the most potentially eligible borrowers, more than twice the number in the next state, New York.

The FHFA report also provides information on the average unpaid principal balance, days delinquent, and loan-to-value (LTV) ratio for each state.

In New Jersey the average unpaid principal balance for potentially eligible borrowers is $171,403, the average LTV is 163%, and the average days delinquent is 1,791.

Applying for the Principal Reduction Modification Program

Terms of the principal reduction modification program are similar to other modifications and include capitalizing the arrearages, reducing the interest rate, extending the loan term to 40 years, and forbearance of principal and arrearages, which can be forgiven.

Mortgage loan servicers are supposed to contact potentially eligible borrowers by October 15. All Principal Reduction Modification offers must be sent by December 31.

If you're having trouble paying your mortgage and think you meet the eligibility requirements for a principal reducing, HAMP, or other modification, don't wait for someone to contact you. FHFA recommends acting as soon as possible to try to save your home. It's not just this program that's ending at the end of 2016, it's HAMP (Home Affordable Modification Program) as well.

You can apply for a loan modification on your own with your loan servicer, but most who do so are denied. It's best to work with an experienced attorney who can defend you from foreclosure and help you apply for a loan modification at the same time.