If you're having trouble with your mortgage, you've probably heard about loan modifications. Modifying a mortgage loan involves making a permanent change to one or more of its terms. The interest rate can be lowered, the term can be extended, and principal and fees can be reduced.

[fa icon="clock-o"] Monday, September 12, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure defense, HAMP

Read More »

If you're having problems with your mortgage, it's a good idea to communicate with your bank to see if you can work with them for some sort of agreement to stay out of foreclosure.

Your bank can choose to give you an unemployment forbearance that temporarily suspends your mortgage payments because of a job loss, for example. Or, if you're already behind on your mortgage payments due to a hardship, you may be able to get a loan modification that reinstates your mortgage with a more affordable payment.

Loan modifications are the only option many homeowners have to keep their home. The terms of the loan, such as the length of the loan, the interest rate, and the principal balance can be changed.

Loan modifications are a life saver for those who get them. Unfortunately, many Wells Fargo borrowers end up disappointed when they don't get the results they're looking for after trying to deal with the bank on their own. And Wells Fargo has a reputation as one of the most difficult banks to work with for a loan modification.

[fa icon="clock-o"] Tuesday, September 6, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification lawyer, wells fargo loan modification, loan modification denied, loan modification

Read More »

If your mortgage is insured by the Federal Housing Administration (FHA) and you're struggling to keep your home, there's some good news that the FHA recently announced.

The FHA, which is part of the Department of Housing and Urban Development (HUD), announced “new procedures to strengthen the process mortgage servicers use to help struggling families avoid foreclosure and remain in their homes.”

FHA is accomplishing this by “streamlining its loss mitigation protocols that servicers must use when evaluating and deploying 'home retention options,' foreclosure alternatives that allow delinquent borrowers to retain their home.”

[fa icon="clock-o"] Tuesday, August 30, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, HAMP, hamp loan modification, fha

Read More »Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week, which include results from Greentree, Seterus, Ocwen, and others:

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week, which include results from Greentree, Seterus, Ocwen, and others:

Seterus

Our client was in foreclosure and $45k past due on payments to Seterus, but we helped them get a trial loan modification with a lower interest rate!

[fa icon="clock-o"] Friday, August 26, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, caliber loan modification, asc loan modification, citi loan modification, seterus loan modification, Greentree loan modification

Read More »

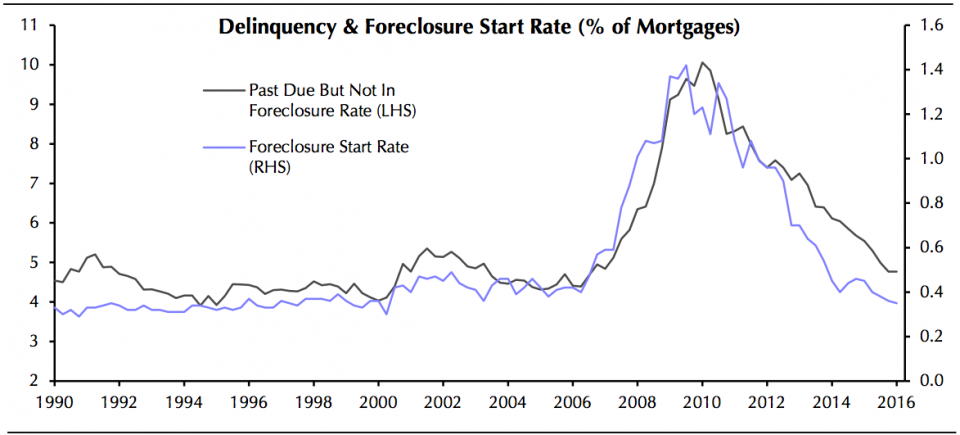

The recent financial crisis, housing crisis, and recession really did a number on homeowners. You didn't have to be an economist or real estate expert to know that there was a sharp increase in the number of foreclosures. All you had to do was turn on the news and you'd hear about it, or drive through any residential neighborhood and see the signs in front yards.

About seven million homeowners have experienced foreclosure since the start of the crisis. The wealth homeowners held in their homes evaporated as jobs were lost. That left many homeowners in the terrible position of being unable to afford their mortgage payment or sell their home because they owed more on it than it was worth.

[fa icon="clock-o"] Thursday, August 25, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure defense, housing market, foreclosure crisis

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

In February of 2015, we were hired by homeowners in Brooklyn, New York who wanted to avoid losing their home to foreclosure. To protect their privacy, we'll call them the Voshenkos.

The Voshenkos were in very serious trouble when they came to us. They were in foreclosure because they hadn't made a mortgage payment to Wells Fargo in more than five years. But they wanted to find a solution to keep their home, so we started working on their case.

[fa icon="clock-o"] Monday, August 22, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, new york foreclosure attorney, settlement conference

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week, which include results from Bank of America, Seterus, Ocwen, and others:

[fa icon="clock-o"] Friday, August 19, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, bank of america loan modification, loan modification, successful loan modifications, ocwen loan modification, asc loan modification, PNC loan modification success, citi loan modification, seterus loan modification, roundpoint loan modification, sls loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are eight (8) of the results from this week, which include results from Caliber, SPS, Ocwen, and others:

Ocwen

Trial loan modification achieved for our client's non owner occupied property with Ocwen. Investment properties are often more difficult to modify.

[fa icon="clock-o"] Friday, August 12, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications, ocwen loan modification, caliber loan modification

Read More »

The Home Affordable Modification Program (HAMP) is ending December 31, 2016.

It, along with the Home Affordable Refinance Program (HARP) and other programs, began in 2009 as part of the federal government's Making Home Affordable program (MHA), which was designed to help struggling homeowners avoid foreclosure after the housing and economic crisis that began in 2007.

HAMP is the principal component of MHA, and it sets guidelines and gives incentives to mortgage loan servicers to modify mortgages rather than foreclose. Sometimes known as 'the Obama Plan,' it's been a popular option for troubled homeowners.

[fa icon="clock-o"] Wednesday, August 10, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, HAMP, hamp loan modification, CFPB

Read More »

As a result of the ongoing housing crisis, mortgage loan modifications have become popular with distressed homeowners who need to reinstate their loan and get a more affordable payment. But not everyone who could benefit from modifying their mortgage understands what's actually involved and how to go about getting one. And some assume or have been told incorrect information.

What is a Loan Modification

A mortgage loan modification is a permanent change to one or more of the terms of your existing loan, such as the interest rate, term length, and principal balance. The purpose is to lower the monthly payment to an affordable portion of your income and allow you to avoid foreclosure. It is different from a refinance, which replaces your old loan with a completely new one.

Loan modifications are the only hope many people have for avoiding foreclosure and staying in their home. However, there are some common misconceptions, such as:

[fa icon="clock-o"] Monday, August 8, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, hamp loan modification, loan modification help, foreclosure

Read More »