The big banks have done a lot of wrong, but one of the most shameful things that they've done is deny deserving homeowners loan modifications. Many homeowners have lost their homes because of this. It would be one thing if banks simply denied these loan mods on the spot after accepting the modification applications, but instead, they usually lead homeowners on wild goose chases for months- or years- before denying their loan modification, or will often offer homeowners a loan modification, but with terms that are much worse than what homeowners deserve.

Jake Sterling

Recent Posts

[fa icon="clock-o"] Friday, October 18, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification lawyer, loan modification attorney, loan modification help

Read More »

Chicago, known for its trademark deep dish pizzas, is still being served a very deep dish of foreclosure trouble. The Windy City is taking steps to reduce the impact of the housing crisis, and has just passed a new city ordinance called "Keep Chicago Renting" that will protect renters from losing their homes to foreclosure. This ordinance is designed to help decrease the urban blight that follows foreclosure in many parts of the country. If there's any one city that can't afford further urban blight, it's Chicago, which is already being ravaged by a historic crime wave. This follows a statewide effort in Illinois that was intended to help empower homeowners in foreclosure.

[fa icon="clock-o"] Wednesday, October 16, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] illinois foreclosure lawyer

Read More »

Recently, the foreclosure process has been in a state of disarray, as banks, regulators and lawyers struggle to uncover issues and faults within the system. As a result of this confusion, some homeowners either currently in the foreclosure process or in danger of foreclosing may lack a clear direction or be unsure of what steps to take next. "It is imperative that these individuals reach out to their lender now to avoid an unwelcome outcome later. The most dangerous thing a homeowner can do is nothing," says Ethan Ewing, president of Bills.com.

Lenders typically lose money when they foreclose on a property, and because of this, they are often motivated to reach some sort of conclusion with struggling borrowers. It's important to recognize the fact that lenders will usually respond to a settlement offer made by a borrower. Homeowners concerned about their ability to continue paying on a mortgage should take advantage of the opportunity and reach out to their lender to open a line of communication.

[fa icon="clock-o"] Tuesday, October 15, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, mortgage fraud, Scam Alert

Read More »

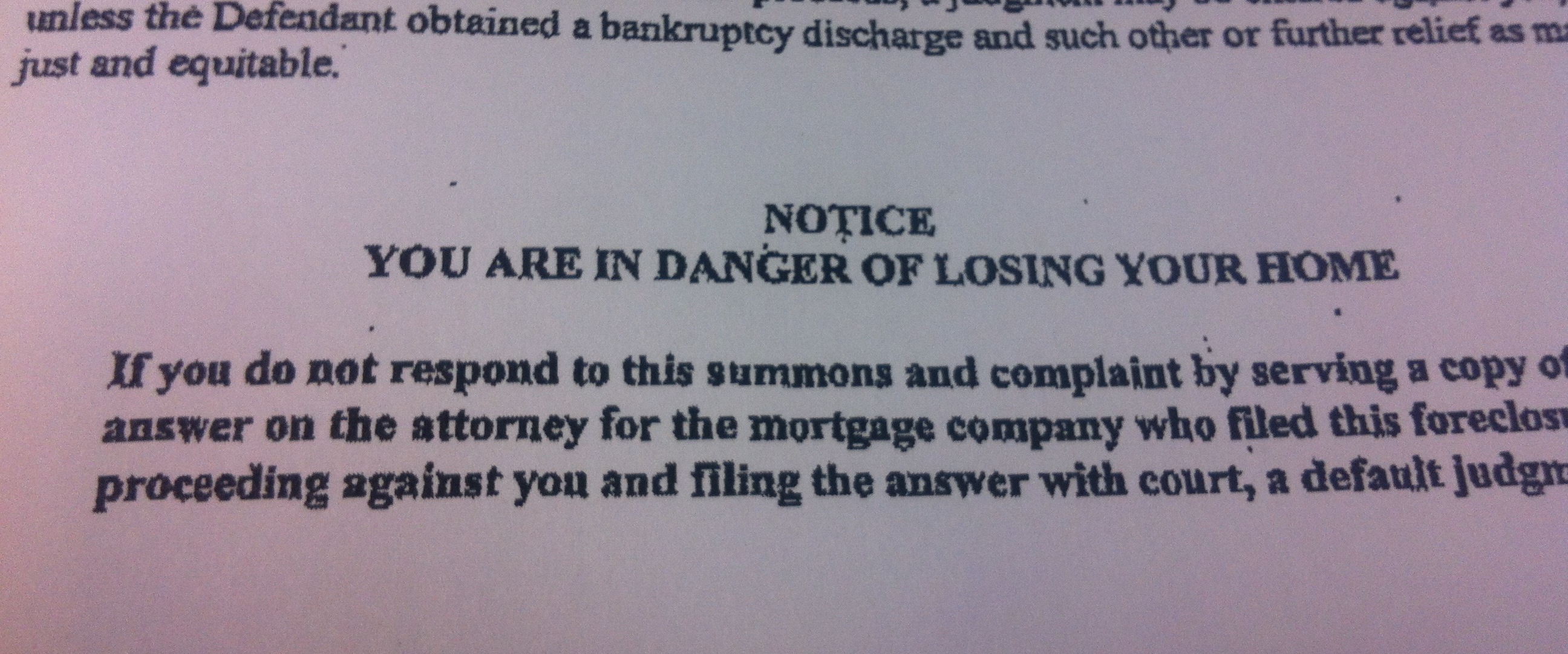

If you live in New York and have missed more than 3 mortgage payments. You are at serious risk of foreclosure. You have probably heard the news that New York's foreclosures are moving at a snail's pace, but the the fact is: they're speeding up.

[fa icon="clock-o"] Monday, October 14, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] foreclosure process in new york, new york foreclosure attorney

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

When we were retained (hired) by this New York homeowner in March 2013, the homeowner was several months past due on his Ocwen mortgage. Within 6 months, we changed his dire situation into a bright one.

This homeowner had experienced several hardships; the economic downturn had severely affected his business, and Superstorm Sandy didn't make matters any better. His mortgage payment was $3,659; high even by New York City standards. Worst of all, the homeowner was in grave danger of foreclosure.

[fa icon="clock-o"] Saturday, October 12, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] successful loan modifications

Read More »

The foreclosure crisis is finally slowing down, except in New Jersey.

Across the country, year-to-year foreclosure numbers have plummeted. For example, a report from August 2013 show that nationwide, foreclosures in July 2013 dropped about 25% when compared to July 2012. However, in New Jersey, foreclosures went up 89% during that same period. Although it has taken 2 1/2 years for the average foreclosure to be completed. New Jersey is speeding up the foreclosure process to clear out the foreclosure backlogs.

So why are there so many new foreclosure filings in New Jersey and how quickly are they moving through the system?

[fa icon="clock-o"] Friday, October 11, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] new jersey foreclosure attorney, foreclosure defense attorney new jersey

Read More »

Since its beginnings in 2007, the foreclosure crisis' effects were felt by people across every layer of social strata. Given the lavish spending habits of the rich and famous, it will probably serve as no surprise that some to the biggest names in entertainment suffered harshly during the economic downturn and endured foreclosure like millions of other Americans. Here are 6 celebrities that have experienced the worst part of the Great Recession; some in more interesting ways than others.

1. Rihanna

In 2009, Rihanna purchased a $6.9 million mansion in Beverly Hills, California. Allegedly, flooding from a "moderate rainstorm" in 2010 caused "extensive damage" to the house, and she famously defaulted on the home and sold it via short sale for $4.5 million in 2011. Her lawyers then sued the former owners of the home and several other parties for good measure. It seems that the pop singer didn't have a good enough "Umbrella" in place. By the end of the next year, the buyer had already put the home back on the market... for $9.95 million.

[fa icon="clock-o"] Wednesday, October 9, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, foreclosure defense

Read More »Being in debt has a bigger impact on your financial future than you might realize. Bad debts can continue to haunt you and your credit report for years, especially if you don't deal with it now. Here are some practical tips on how to get out of debt and stay out of debt.

[fa icon="clock-o"] Tuesday, October 8, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] understanding credit

Read More »

The government shutdown has affected many "normal" parts of American life, not to mention the lives of hundreds of thousands of furloughed federal employees. Although the most important question about the shutdown is "When and how will it end?" many Americans who are experiencing foreclosure or are at risk for foreclosure would like to know how their homes might be affected. After all, even without knowing how long the government shutdown will last, it could be argued that mortgage fraud and the ensuing financial crisis crisis debilitated Americans more than the government gridlock can or will.

[fa icon="clock-o"] Monday, October 7, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, foreclosure defense

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

One recurring trend today is that many people who received loan modifications in the early stages of the Great Recession are attempting to get new loan modifications now. Oftentimes, these people received loan modifications before they experienced their worst hardship, and had no safety net when their hardship hit.

This happened to a homeowner who was faced with a dire situation. He was one of the first people to receive a loan modification from the HAMP program. Shortly after receiving his modification, harder times hit. The homeowner lost his job, and the family was only depending on his wife's salary for support. By the time the homeowner connected with us, he was several months past due on his $1,730 FHA mortgage payment, and had just been served foreclosure.

[fa icon="clock-o"] Saturday, October 5, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification, successful loan modifications

Read More »