Approximately 250,000 families enter into foreclosure every 3 months due to delinquent home loan payments or delinquent property taxes. Each of these homeowners has one thing in common: they have to make the decision of whether or not to fight for their home. However, if you want to fight the foreclosure and keep your home, it's time to find a foreclosure defense attorney. Here are some reasons why:

[fa icon="clock-o"] Sunday, October 18, 2020 [fa icon="user"] Jordan Shealy [fa icon="folder-open'] stop foreclosure, loan modification lawyer, how to stop foreclosure, loan modification denied, loan modification attorney, successful loan modifications, foreclosure defense, prolong foreclosure, foreclosure, mortgage, lawyer, foreclosure defense attorney, mortgage debt, dos donts of foreclosure, foreclosure lawsuit, avoiding foreclosure, default judgment, consent to foreclosure, legal aid

Read More »

Mr. Cooper Loan Modification

We received a modification for our client's mortgage with Mr. Cooper. They were 10 months behind, and in an active foreclosure case. This new modification lowers their mortgage payments from $803.82 per month to $743.64.

Do you have a Mr. Cooper mortgage that's past due? See some of our other Mr. Cooper case results here.

[fa icon="clock-o"] Friday, May 15, 2020 [fa icon="user"] Jake Sterling [fa icon="folder-open'] successful loan modifications, foreclosure defense, cenlar loan modification, loan modification success, mr cooper loan modification

Read More ».png)

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Freedom, Seterus, Wells Fargo and SPS:

[fa icon="clock-o"] Friday, March 8, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications, sps loan modification, seterus loan modification, sps repayment plan, freedom mortgage loan modification, loan modification success

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen Mortgage & Carrington:

[fa icon="clock-o"] Friday, March 1, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, carrington loan modification, Rushmore loan modification, loan modification success

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

[fa icon="clock-o"] Friday, February 22, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] i have a foreclosure sale date, loan modification, successful loan modifications, carrington loan modification, loan modification success, mr cooper loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Mr. Cooper, Ocwen, Carrington, Bayview, Ditech, and Chase:

Mr. Cooper

- Yes! Our Mr. Cooper clients were an astounding 57 months (almost 5 years) and $52,913 + fees past due on their mortgage, but we helped them get a 3 month FHA-HAMP trial loan modification plan with $35.46 monthly savings.

[fa icon="clock-o"] Friday, August 31, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, carrington loan modification, bayview loan modification, ditech loan modification, loan modification success, mr cooper loan modification, chase loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

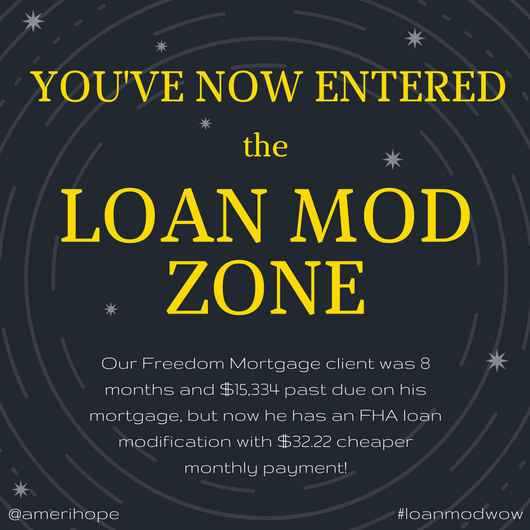

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Freedom Mortgage, Carrington, Wells Fargo, Capital One, Ditech, and Bayview:

Freedom Mortgage

Our Freedom Mortgage client was 8 months and $15,334 past due on his mortgage, but now he has an FHA loan modification with $32.22 cheaper monthly payment!

[fa icon="clock-o"] Friday, March 9, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications, carrington loan modification, bayview loan modification, ditech loan modification, capital one loan modifications, freedom mortgage loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

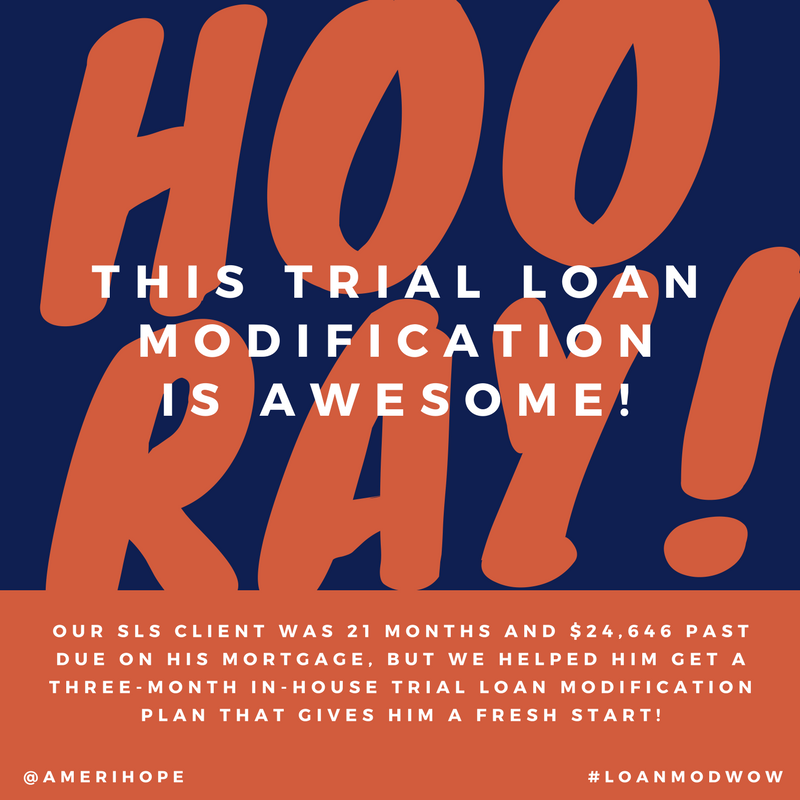

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus, Carrington, SLS, Penny Mac:

Seterus

Our Seterus clients were an unbelievable 91 months and $265,701 past due on their mortgage. We helped them get a final in-house loan modification with 3% lower interest rate, $471.53 lower monthly mortgage payment, and $149,666.01 interest-free deferment!

[fa icon="clock-o"] Friday, February 23, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] successful loan modifications, carrington loan modification, seterus loan modification, sls loan modification, penny mac loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Rushmore, Penny Mac, and BB&T:

Rushmore

Our Rushmore clients were 62 months (5 years) and $120,007.45 past due on their mortgage payments and had been served foreclosure. We got them a three-month in-house trial loan modification plan with a fresh start and opportunity for a permanent loan modification!

[fa icon="clock-o"] Friday, February 9, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, Rushmore loan modification, bb&t loan modification, penny mac loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen, Penny Mac, SPS, Wells Fargo, and Carrington:

Carrington

Yes! Our Carrington client was $12,525 past due on his mortgage with a $1,201.72 monthly payment and 6.25% interest rate, now he has a final loan modification with $910.31 payment and 4.125% interest rate for monthly savings of $291.41.

[fa icon="clock-o"] Friday, February 2, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, successful loan modifications, ocwen loan modification, carrington loan modification, sps loan modification, penny mac loan modification

Read More »