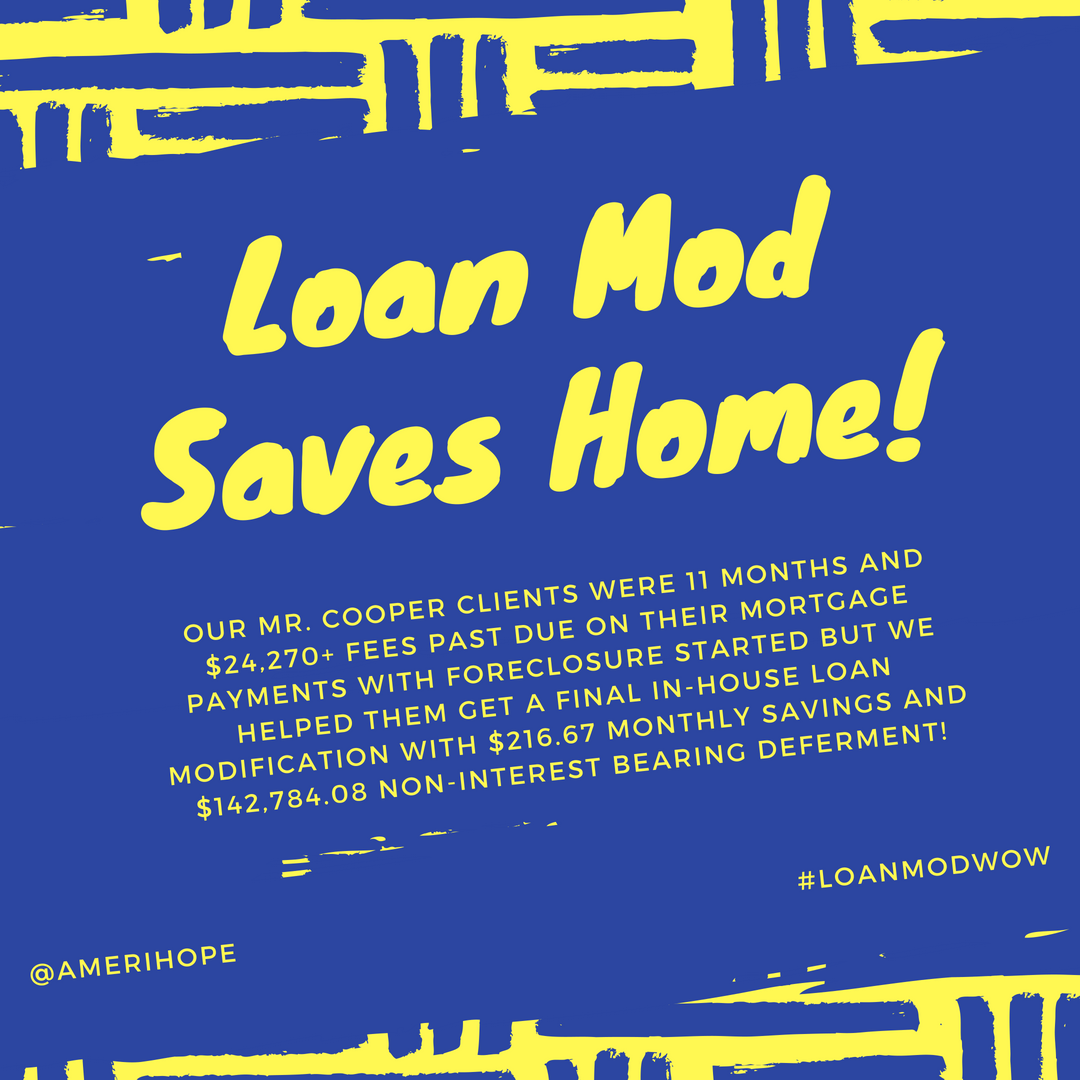

Mr. Cooper Loan Modification

We received a modification for our client's mortgage with Mr. Cooper. They were 10 months behind, and in an active foreclosure case. This new modification lowers their mortgage payments from $803.82 per month to $743.64.

Do you have a Mr. Cooper mortgage that's past due? See some of our other Mr. Cooper case results here.