Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Chase, Ocwen, Wells Fargo, and Mr. Cooper:

Chase

Our Chase client was 21 months and $42,505+ fees past due on his mortgage, but we helped him get an FHA partial claim loan modification (his second) with a fresh start!

After falling 32 months and $37,308.36 behind on her mortgage, which had been modified once before, we helped our Chase client get a three month FHA trial loan modification plan with the opportunity for a permanent mod!

Ocwen

After receiving a loan modification in 2011, our Ocwen clients fell 21 months and $17,505 past due on their mortgage payments, but we helped them get a 3 month FHA trial loan modification plan with cheaper monthly payment!

After receiving a loan modification in 2011, our Ocwen clients fell 21 months and $17,505 past due on their mortgage payments, but we helped them get a 3 month FHA trial loan modification plan with cheaper monthly payment!

Wells Fargo

19 months and $16,040.16+ fees past due on his mortgage, which had been modified before, we helped our Wells Fargo client get a six month repayment plan that allows him to avoid foreclosure and keep his home!

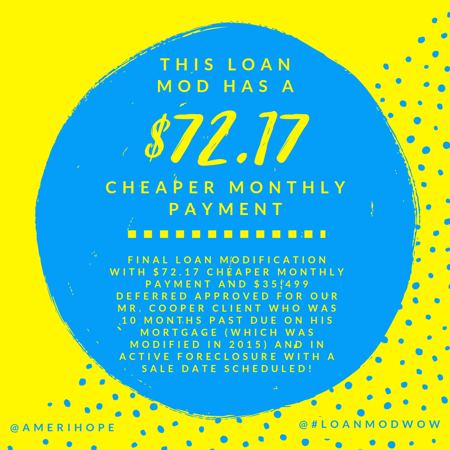

Mr. Cooper

Final loan modification with $72.17 cheaper monthly payment and $35,499 deferred approved for our Mr. Cooper client who was 10 months past due on his mortgage (which was modified in 2015) and in active foreclosure with a sale date scheduled!

Final loan modification with $72.17 cheaper monthly payment and $35,499 deferred approved for our Mr. Cooper client who was 10 months past due on his mortgage (which was modified in 2015) and in active foreclosure with a sale date scheduled!