An expedited foreclosure, also known as a fast-track foreclosure, is an action pursued by the lender of the mortgage which allows the lender to foreclose on a home more quickly than the typical foreclosure process would allow. The lender files a motion to expedite the foreclosure with the courts. The motion for an expedited foreclosure is also served to the homeowner. This motion is only granted to the lender if the lender can show that the home has been abandoned and may be at risk of harm.

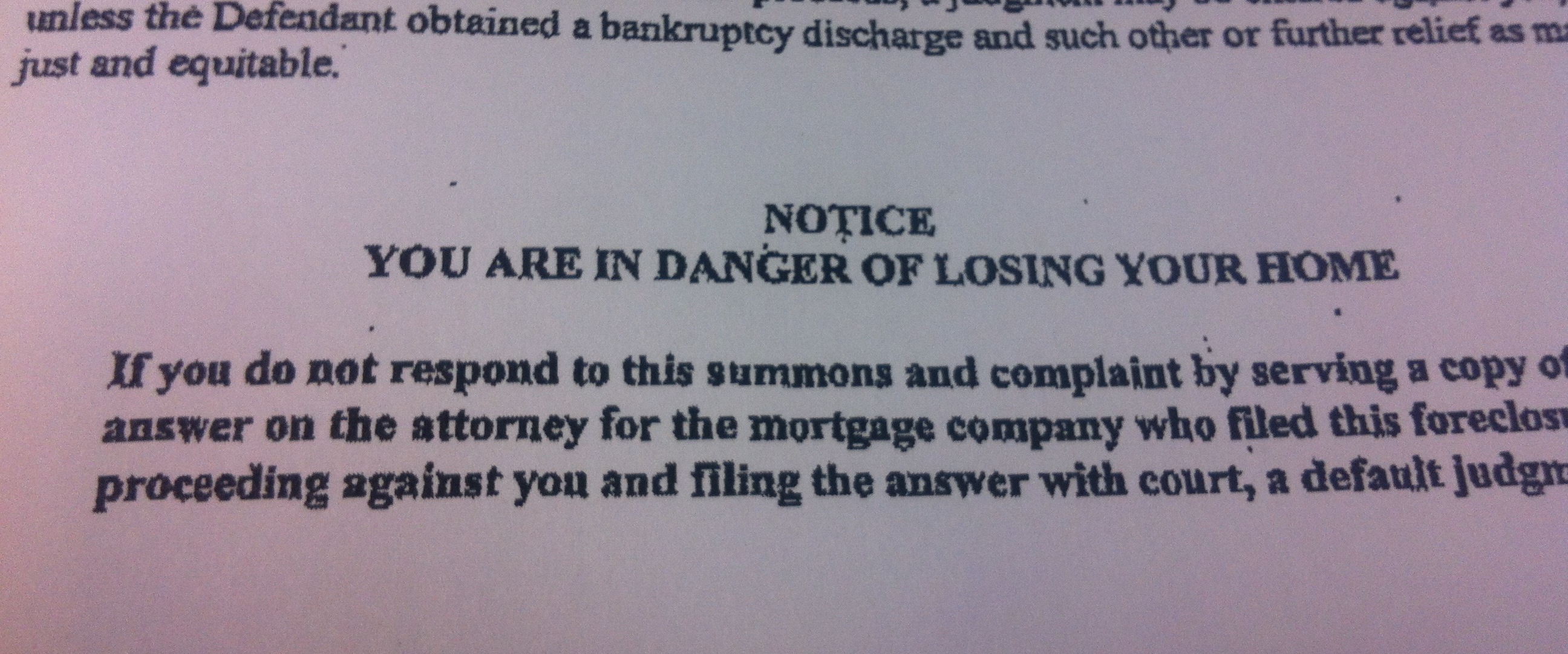

You can also receive a motion for expedited foreclosure when you are still living in the home. If this should happen to you, it is very important that you meet with a foreclosure defense attorney to review the documents. In most cases, you will want to hire a lawyer to make sure you follow all of the instructions and respond and object to the motion. This means you may have to submit evidence and attend a court hearing in order for the judge to decide whether or not you have abandoned the home.