In late 2015 a homeowner in Orange County, Florida came to our law firm seeking assistance avoiding foreclosure. To protect his privacy, I'll call him Mr. Hannah.

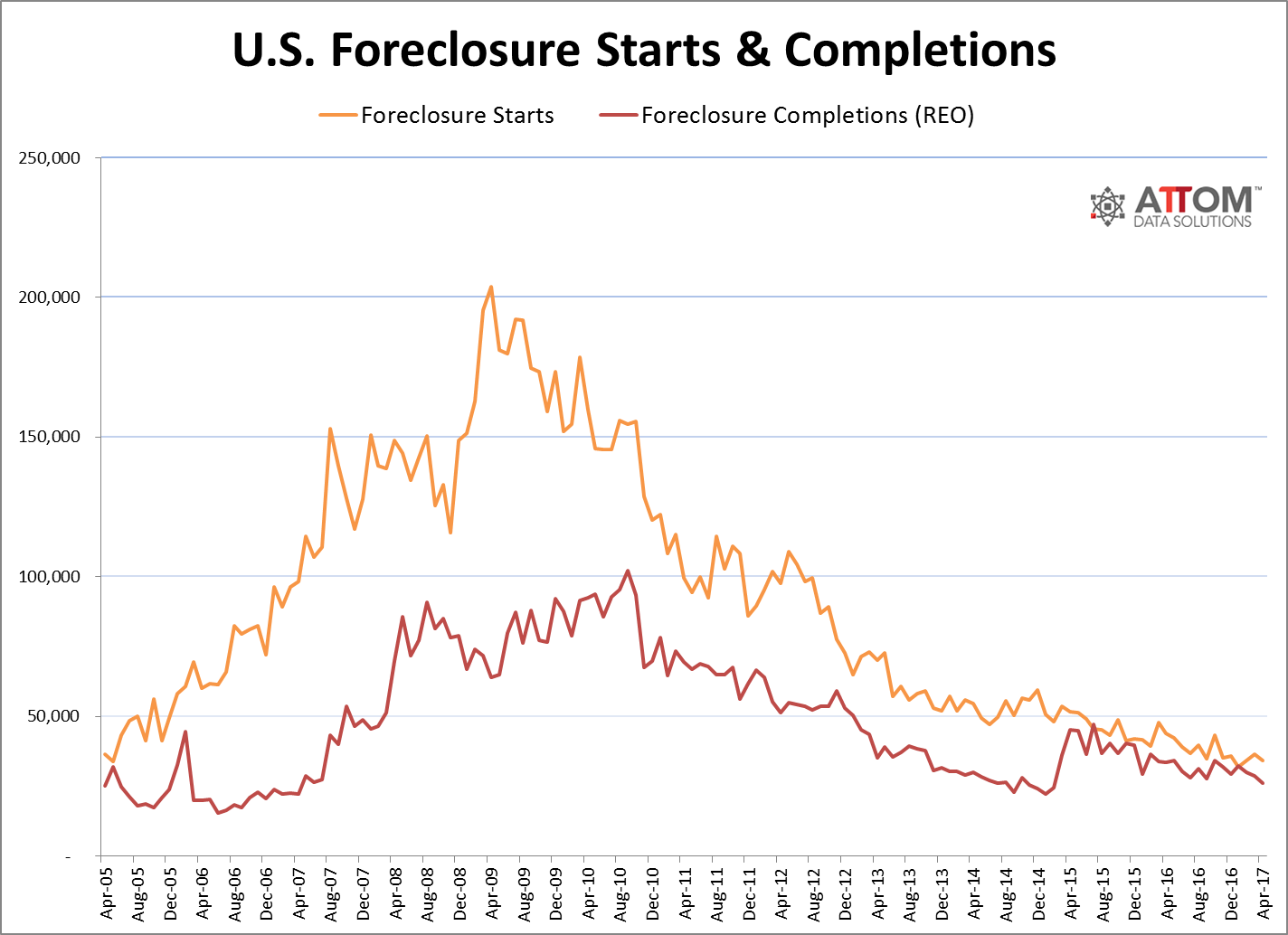

Mr. Hannah's home is in a great location in central Florida just a few miles from Walt Disney World. But being near the “most magical place on earth” didn't help him when, in 2010, he encountered a hardship and couldn't afford to make his mortgage payments to Wells Fargo. In 2011 he was served foreclosure papers.

By the time we were retained to represent him, Mr. Hannah's home was scheduled to be sold in a foreclosure auction.

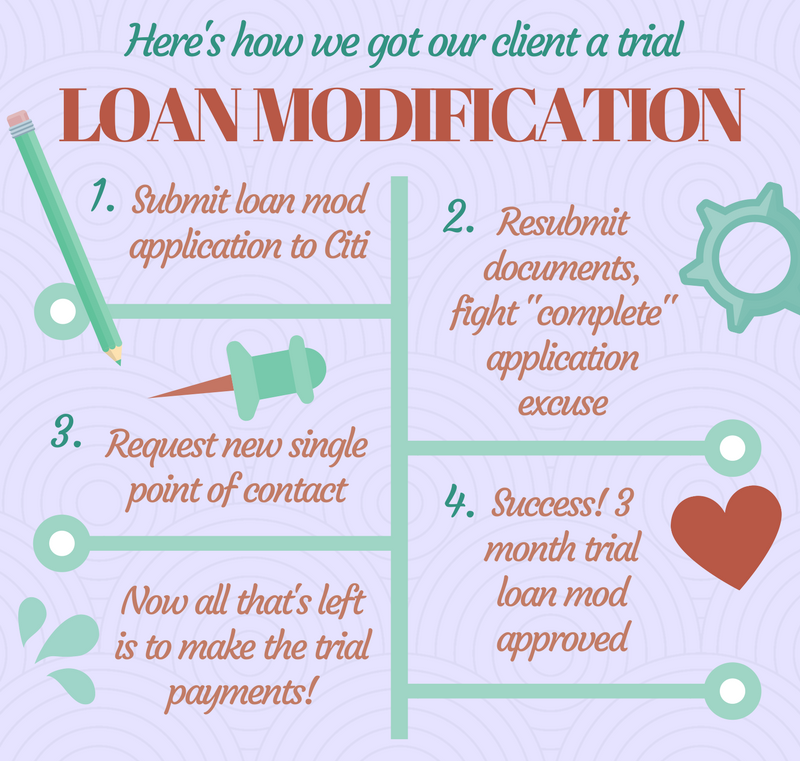

Our client told us that he wanted to pursue both a loan modification and a short sale at the same time. He figured that way if one didn't work out he would have the other option to fall back on. We've heard this from other clients in the past, but it doesn't work like that.