If you've fallen behind on your mortgage, it's a good idea to save some extra money to help you get through whatever solution you eventually reach and your life afterward.

If you've fallen behind on your mortgage, it's a good idea to save some extra money to help you get through whatever solution you eventually reach and your life afterward.

No matter what happens, whether it's the best case scenario, like a loan modification with a big principal reduction and low monthly payment and interest rate, or the worst, like losing your home to foreclosure, having a bigger financial cushion is always a good thing.

You can never have too much money. (If you can, that's the kind of problem we'd all like to have.)

Americans aren't the best savers in the world. 1 in 3 Americans has no retirement savings, and many households don't have enough cash savings to survive a $500 emergency, much less a mortgage crisis that costs tens or hundreds of thousands of dollars. The good news is that just about anybody can save some money with a little bit of effort. Here are a few suggestions on how to do that.

Money-Saving Tips In Foreclosure

1. Turn down the thermostat

This is an oldie, but a goodie. If you live in an area with cold winters, you can turn the thermostat down a couple degrees and put a sweater on to keep warm during the colder months. The temperature can also be lowered a little more at night while you're in bed. Put an extra blanket on the bed or wear pajamas and you won't even notice until you get a lower electric or heating bill. Over time it can make for a significant savings.

Alternatively, in warmer climates, control how often you're running the air conditioner. Recommended temperatures for cost-savings are setting the air conditioner to 78° for cooling, and up to 86° when you leave the house. Energy.Gov states that each degree up or down on the thermostat can affect your bill by 3%-5%.

See: How to Program a Thermostat to Save Money

2. Bring your lunch to work

Eating out is super convenient, but it's a luxury that gets to be expensive when you do it too much, and you need to cut down on nonessential luxuries until you get out of financial trouble. Packing a lunch is a little more work, and maybe not as tasty, but well worth the savings.

See: Buying Your Lunch is a Terrible Idea

3. Shop at discount grocery stores

Your town probably has a discount grocery store that sells food for less than the regular grocery chain you prefer. Stores like Aldis, Safeway, and Sav-A-Lot offer no frills and fewer options and brand names than other stores, but you can usually get the same foods for a lot cheaper. It can be a little less convenient if you have to make two trips to get everything you want, but the money you'll save is well worth it.

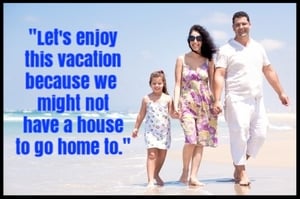

4. Don't take a vacation

This should be a no-brainer, but some people spend like everything's fine even when they're in foreclosure. Being in foreclosure is a financial crisis, and not the best time to be taking a vacation. The exceptions would be if you've already paid for a non-refundable trip, are taking a cheap vacation, or you have good income and savings and are doing everything you can to get your mortgage back on track. If you do take a trip, make sure you won't be missing a hearing date before you go out of town. Missing a mediation, trial, or conference regarding your foreclosure case could hurt your chances of getting the outcome you want.

This should be a no-brainer, but some people spend like everything's fine even when they're in foreclosure. Being in foreclosure is a financial crisis, and not the best time to be taking a vacation. The exceptions would be if you've already paid for a non-refundable trip, are taking a cheap vacation, or you have good income and savings and are doing everything you can to get your mortgage back on track. If you do take a trip, make sure you won't be missing a hearing date before you go out of town. Missing a mediation, trial, or conference regarding your foreclosure case could hurt your chances of getting the outcome you want.

5. Reduce spending on coffee and other small daily purchases

There's a phenomenon known as the latte factor, which describes how spending a small amount of money daily, on an item like coffee, can cost a lot money over time.

There's a phenomenon known as the latte factor, which describes how spending a small amount of money daily, on an item like coffee, can cost a lot money over time.

$5 / day X 30 days / month = $150 per month

$150 / month X 12 months = $1,800 per year

The latte factor is devious because there's no pain in spending a few dollars at a time, but when you look back you realize you've spent a small fortune at Starbucks, one coffee at a time.

6. Save the money you would have spent on mortgage payment

If you still have a job, but aren't making mortgage payments, put the money you would have spent on your mortgage to the side. Pretend you're paying your mortgage to yourself, or at least as much of it as you have. It can take years from the time you stop paying your mortgage until a resolution is reached, so that's a lot of months, or partial months' worth of mortgage payments to be saved. You could save some serious money by doing this.

Remember, you don't have to cut out all luxuries and pleasures in your life to save some money. The point is to be aware of what you're doing and how small amounts of money add up to large sums over time. It's not that you can't ever eat out or get a coffee from Starbucks, you just can't do it every day if you're trying to save money. Saving $5 one day isn't much, but saving $5 every day for a year is $1,825, and that's nothing to sneeze at.

How To Save

Cutting down on your spending is only half the battle. Once you've done that, how do you actually save?

Make Saving Automatic

The best way to save is to automate the process and pay yourself first. Have your bank automatically transfer money each month from your checking into your savings account and/or have some money taken from each paycheck to go into a savings account. It's much more difficult to remember to save each month and have the discipline to hold some money back than it is to just have an amount automatically taken out. Bank of America has instructions for account holders looking to set up recurring, automatic transfers.

Pay Yourself First

And pay yourself first. If you pay your other expenses first, and yourself last, you won't have the money left over. So pay yourself first.

And pay yourself first. If you pay your other expenses first, and yourself last, you won't have the money left over. So pay yourself first.

Having a little extra cash will help whether you end up getting the loan modification of your dreams or losing your home to foreclosure. If you get a great loan modification you can save your cash for another rainy day or put it toward your investments and retirement. If you lose your home, you will need cash to secure new housing. First and last month's rent and a security deposit for an apartment is a big chunk of change.

Falling behind on your mortgage is a very serious matter. You should consider getting professional help if you find yourself in that situation. An experienced foreclosure defense attorney could help you get as much time as possible in your home and increase your odds of getting the best loan modification.

Images courtesy of Sira Anamwong at FreeDigitalPhotos.net