ATTOM Data Solutions has released its April 2017 U.S. Foreclosure Market Data report, which shows that April's foreclosure activity is the lowest since November 2005.

ATTOM Data Solutions has released its April 2017 U.S. Foreclosure Market Data report, which shows that April's foreclosure activity is the lowest since November 2005.

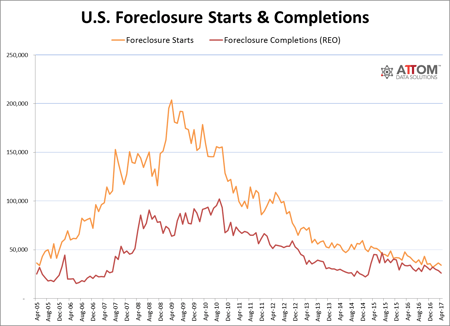

In April 2017 there were 77,049 foreclosure filings, which is a drop of 7% from the month before and a decline of 23% from a year ago. A foreclosure filing includes default notices, scheduled auctions, and bank repossessions.

The good performance of mortgages originated over the last seven years is a big part of the reason for foreclosure filings continuing to drop, ATTOM says. They do, however point to an issue with repeat foreclosures “on homeowners who often fell into default several years ago but have not been able to avoid foreclosure despite the housing recovery.”

Foreclosure Filings

For the country as a whole, 1 out of every 1,723 houses had a foreclosure filing in April 2017. But real estate is all about location, and some states have a bigger slice of the foreclosure pie than others.

In what's been a familiar story for a long time, New Jersey continues to lead the country with the highest foreclosure rate of any state with one in every 562 homes having a foreclosure filing in April 2017. That's more than three times the national average and a 1% increase from the same month last year.

Delaware and Maryland come in after New Jersey, followed by Illinois with one in every 1,083 homes having a foreclosure filing.

And some cities are doing much worse than any state. In April 2017 Atlantic City, New Jersey was the worst in the country with one in every 237 homes getting a foreclosure filing; Trenton, New Jersey had one in every 620; Rockford, Illinois had one in every 668; and Philadelphia had one in every 733.

Foreclosure Starts Down

34,085 properties started foreclosure in April 2017, which is a 6% drop from the month before and a 22% drop from the same month last year. The pre-recession average was 77,000 foreclosure starts per month, which is more than double what it was this April.

Foreclosure Completions

Completed foreclosures for April 2017 totaled 25,990, which is a 9% decline from the month before it and a 22% decline from the year before.

The bad news continues for New Jersey on completed foreclosures, which saw an increase of 45% from a year before.

The Repeat Foreclosure Problem

ATTOM's report also gives data on repeat foreclosure starts in five parts of the country. They define a repeat foreclosure start as “a foreclosure start (initial publicly recorded foreclosure notice starting the foreclosure process) filed on a property address-owner last name combination in 2016 with a previous foreclosure start on the same property address-owner combination in the last 10 years.”

ATTOM's report also gives data on repeat foreclosure starts in five parts of the country. They define a repeat foreclosure start as “a foreclosure start (initial publicly recorded foreclosure notice starting the foreclosure process) filed on a property address-owner last name combination in 2016 with a previous foreclosure start on the same property address-owner combination in the last 10 years.”

Of the regions measured, the five boroughs of New York had the highest percentage of repeat foreclosures for with 54%. Brooklyn had the highest repeat foreclosure rate of the five boroughs with 62%. Miami-Dade County, Florida had a 32% repeat foreclosure rate, and Essex County, New Jersey had 20%.

Loan Modification Affordability

The repeat foreclosure rate shows just how difficult it can be to stay out of foreclosure even if you avoid it once. In recent years a lot of homeowners fell behind on their mortgage, then got their loan reinstated with a government HAMP modification or in-house loan modification from their bank.

The only problem is that a lot of the loan modifications that allowed people to keep their homes weren't all that great, the payments were barely affordable, and the homeowners ended up back in foreclosure in short order.

If you need a loan modification to save your home, an experienced professional, such as a foreclosure defense attorney, may be able to negotiate a better loan modification than you can on your own. Without help, you'll never know if you're getting a fair deal that gives you the best odds of staying out of foreclosure for good.

Image courtesy of iosphere at FreeDigitalPhotos.net