So you're experiencing every homeowner's worst nightmare: the 'f' word. Foreclosure. The stress it causes is a serious threat to your health. People in foreclosure are at an increased risk of suicide and mental and physical health problems. And, of course, you will eventually lose your house if you don't resolve the situation.

So you're experiencing every homeowner's worst nightmare: the 'f' word. Foreclosure. The stress it causes is a serious threat to your health. People in foreclosure are at an increased risk of suicide and mental and physical health problems. And, of course, you will eventually lose your house if you don't resolve the situation.

You're far from the only one in foreclosure and in desperate need of a home-saving resolution. Fortunately, there happens to be a great one out there called a loan modification.

Modifying your mortgage loan involves making a permanent change to one or more of its terms so the monthly payment is lowered to a level you can afford. The interest rate can be moved to as low as 2% and the term can be lengthened to as much as 40 years.

Loan modifications can be granted through the federal government's Home Affordable Modification Program (HAMP) and through a lender's in-house modification programs.

Financial And Emotional Costs of Loan Modifications

Unlike refinancing your loan, there are no closing costs for modifying your loan. There's also no cost to apply.

Well, there are no financial costs. But the time, energy, and emotional costs can be considerable.

Ask someone who's applied for a loan modification on their own what's so hard about it and they're likely to tell you that nearly everything about the process causes them frustration and anxiety. First you have to contact your loan servicer to see if you're eligible. The customer service representative you get on the phone is often in another country, such as India. And, although they're polite, they're often reading from a script and aren't able to answer any questions that are beyond the scope of said script.

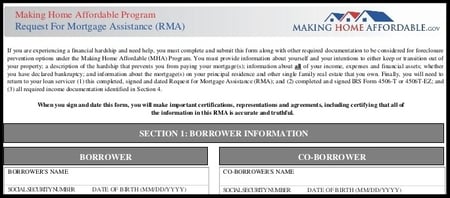

If you determine that you're eligible, then you have to gather all the documentation needed to apply. Your loan modification application is called a Request for Modification Assistance (RMA). The documentation required to apply for a loan modification is similar to what's needed to get a mortgage in the first place. See the full list of documents here.

If you determine that you're eligible, then you have to gather all the documentation needed to apply. Your loan modification application is called a Request for Modification Assistance (RMA). The documentation required to apply for a loan modification is similar to what's needed to get a mortgage in the first place. See the full list of documents here.

Upon sending in your completed application, it's not uncommon for the servicer to ask for some documents to be sent in again. This is one of the most common and anger-inducing complaints from applicants. They went to the trouble of completing the application, but the bank's negligence requires some things to be sent in again.

After all the documents have been sent in, sometimes servicers say that they just plain lost the entire application. This understandably causes a lot of anger. It may seem a little too convenient of an excuse, but there's no way no to prove it.

A lot of the above challenges have been improved upon from the early days of loan modifications. Servicers are now required to maintain adequate levels of trained staff and have to seriously consider each and every application.

Being Denied

But what hasn't changed is that many applications are denied, especially for people who apply on their own. Some say that as many as nine out of ten people who apply for a loan modification on their own are denied. That's the reward you get for overcoming all the obstacles to getting your application considered.

As you can see, it takes a lot of work just to get your request for modification assistance to be considered. All the while you're waiting, worrying, and wondering about what's going to happen. And when you do get your application looked at you get denied. If that happens to you, you may not have spent a penny, but you've used a lot of time and effort and have nothing to show for it. There's a better way.

The Smart Way

The better way to get a home-saving loan modification is to get help from a qualified professional. Like anything, it helps to have someone with experience on your side. Without it, you can waste time trying to reinvent the wheel instead of going for what's been proven to work.

When foreclosure's barreling down on you like a freight train, the best attorney to hire is one that has extensive experience getting loan modifications and defending homeowners from foreclosure.

Foreclosure defense can benefit you by drawing the foreclosure process out, giving you more time to achieve your objectives. It's useful even if you can't keep your home because it can allow you to stay in the house for months or years without making a mortgage payment. That way you can save money and plan before you exit the home in a short sale, deed in lieu of foreclosure, or cash for keys agreement.

Having an experienced attorney working for you can give you better odds of getting the loan modification or foreclosure alternative you want. It can also reduce the anxiety you feel about your situation.

The fees of a reputable foreclosure defense attorney may be more reasonable than you'd expect and are well worth it when they help you save your home. And they can help you avoid the considerable emotional cost of not knowing if you're doing the right thing and what your future holds.

Image courtesy of iosphere at FreeDigitalPhotos.net