If you are struggling to pay your mortgage, it's encouraged that you speak with an experienced and knowledgeable foreclosure defense attorney who can properly inform you of the best solutions for your specific situation. Not to mention that on average, a defended foreclosure usually takes anywhere from one to two years or longer.

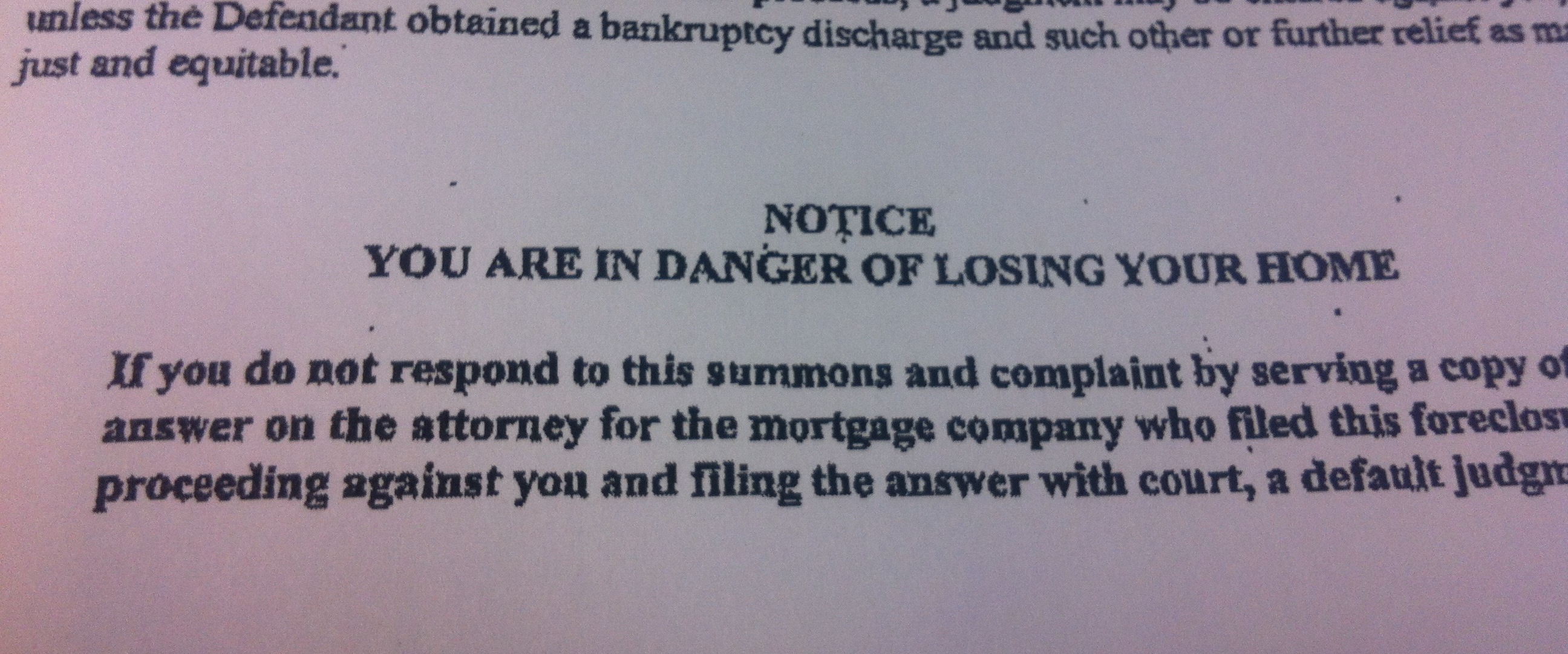

Each foreclosure case is different and has complicated nuances that can ultimately make or break the case. For example if you have been served with a foreclosure lawsuit in Florida and New York you have 20 days to file a proper legal response in court. In Illinois, you have 30 days to reply. In New Jersey, you have 35 days. In your reply you can:

- Accept the Claim -OR-

- Dispute the Claim – Perhaps your loan servicer didn't follow proper foreclosure procedures or the foreclosing party can’t prove it owns your loan. Maybe your loan servicer made a serious error with your account such as misapplying funds, failing to credit payments to the account, or charging unreasonable and non-allowable fees. Or you’re in the military and as an active military service-member you have some special protections against foreclosure and have certain rights under the Service-members Civil Relief Act (SCRA). -OR-

- Claim Affirmative Defenses – Which means that without denying responsibility, you may claim that the foreclosing bank had contributing negligence or perhaps there is an expiration of the Statute of Limitations.

Failure to file a legally satisfactory Answer could result in default being entered against you and not being able to fight the foreclosure.

The Attorney’s Role