Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

[fa icon="clock-o"] Friday, June 23, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications, PNC loan modification success, roundpoint loan modification, loan care loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Rushmore and First National Bank:

Rushmore

Our Rushmore client was $37,929.55 past due on her mortgage and in active foreclosure. Now, after completing her 3 month trial plan, she has gigantic savings of $763.79 on her monthly mortgage payment and a lower interest rate through a great permanent loan modification we helped obtain! Next step: foreclosure dismissal.

[fa icon="clock-o"] Friday, June 16, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, fifth third bank loan modification, Rushmore loan modification, first national bank loan modification

Read More »

The stakes are very high when fighting foreclosure, and disaster is often only narrowly averted. It's a challenge to deal with the courts, the banks and their attorneys, and get the best results. But an experienced professional can help you do just that.

A recent case, for clients I'll call the Bello sisters to protect their privacy, illustrates this well.

The Bellos are immigrants from Africa who own a home together in New Jersey. They were working hard trying to realize the American dream when a loss of income caused them to default on their mortgage payments to PHH Mortgage.

Since New Jersey is a judicial foreclosure state, they were served a summons and complaint, officially putting them into foreclosure. PHH hired an attorney to handle the case and try to take the Bello's home from them.

[fa icon="clock-o"] Monday, June 12, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] how to stop foreclosure, loan modification, foreclosure defense attorney new jersey, sheriff's sale

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus and SLS:

Seterus

Our Seterus client was $90,324.92 past due, but now has a final loan modification with $33,281.50 deferred and $140.74 cheaper payment!

[fa icon="clock-o"] Friday, June 9, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, seterus loan modification, sls loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus, Ocwen, Stearns Loan Care, Wells Fargo, SLS, and Bayview:

Seterus

After falling $54,604 behind on his mortgage, our Seterus client has a three month trial loan modification with $158.23 cheaper monthly payment!

[fa icon="clock-o"] Friday, June 2, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications, ocwen loan modification, seterus loan modification, bayview loan modification, sls loan modification, stearns loan care loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Shellpoint and PNC:

Shellpoint

Our Shellpoint client was $168,704.05 past due on thier mortgage, now they have been granted a final loan modification. Shellpoint approved a $9,511.99 principal reduction and lowered their monthly payment by $237.38!

[fa icon="clock-o"] Friday, May 26, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, PNC loan modification success, shellpoint loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with SLS, Chase, Caliber, PHH, and BSI Financial:

Chase

Our Chase clients were 20 months and $49,308+ past due on mortgage, now they have a permanent HAMP mod with $594.23 monthly savings and 0.65% lower interest rate!

[fa icon="clock-o"] Friday, May 19, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, caliber loan modification, citi loan modification, sls loan modification, chase loan modifications, us bank loan modification, phh loan modification, bsi loan modification success

Read More »

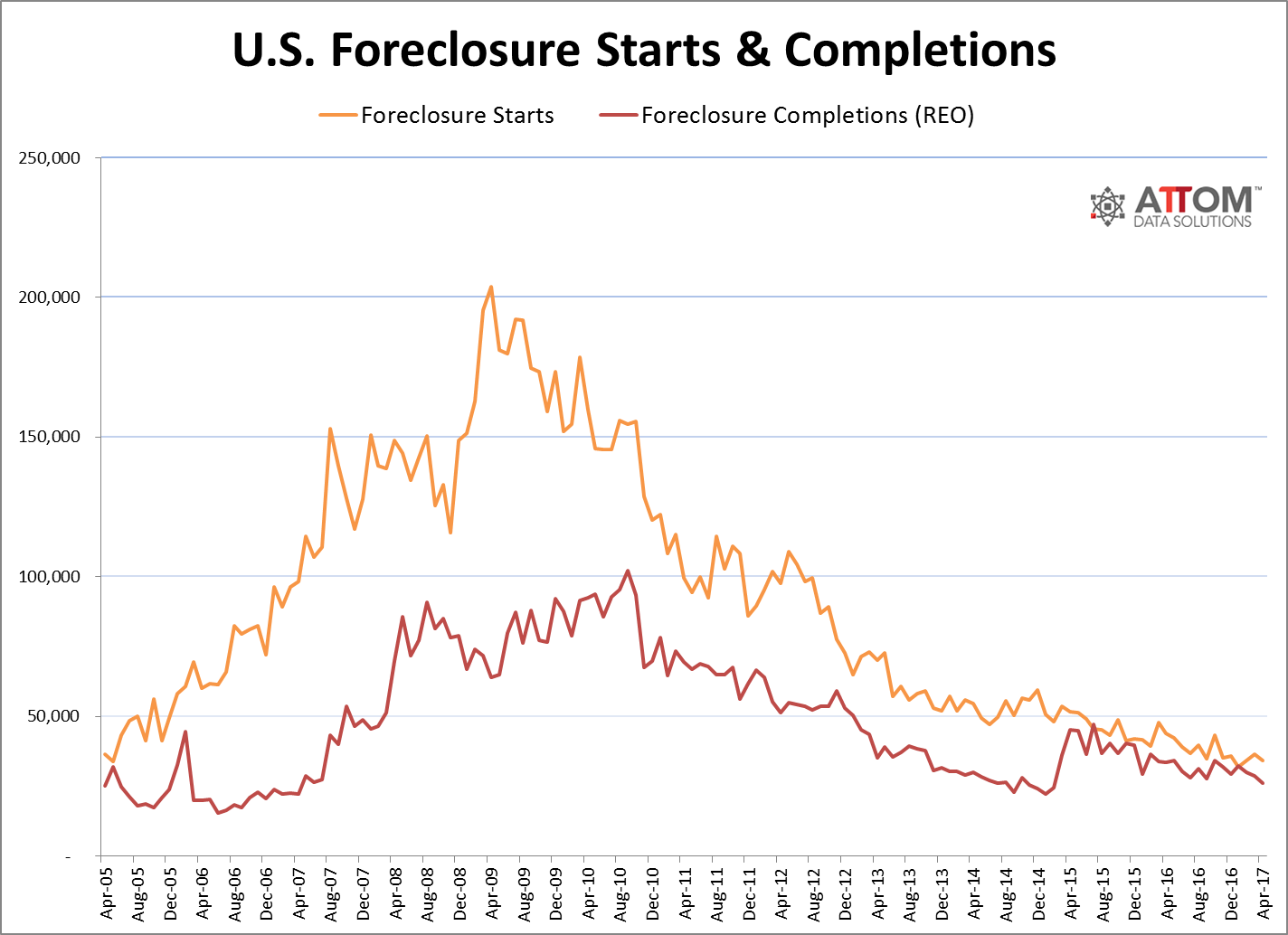

ATTOM Data Solutions has released its April 2017 U.S. Foreclosure Market Data report, which shows that April's foreclosure activity is the lowest since November 2005.

In April 2017 there were 77,049 foreclosure filings, which is a drop of 7% from the month before and a decline of 23% from a year ago. A foreclosure filing includes default notices, scheduled auctions, and bank repossessions.

The good performance of mortgages originated over the last seven years is a big part of the reason for foreclosure filings continuing to drop, ATTOM says. They do, however point to an issue with repeat foreclosures “on homeowners who often fell into default several years ago but have not been able to avoid foreclosure despite the housing recovery.”

[fa icon="clock-o"] Wednesday, May 17, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, florida foreclosure attorney, foreclosure, housing market

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen:

Ocwen Trial Loan Modification

4 months and $15,321 past due on mortgage, our Ocwen client is now approved for a 3-month in-house trial loan modification with massive monthly savings of $655.73!

[fa icon="clock-o"] Friday, May 12, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Bayview and a repayment plan with SPS:

Bayview Loan Modification

Our Bayview Loan Servicing client was $12,123.66 past due on their mortgage, but now has a trial loan mod with $56.85 cheaper payment! The first of three payments is due June 1, and we anticipate a final loan modification to be in writing by September.

[fa icon="clock-o"] Friday, May 5, 2017 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, bayview loan modification, sps repayment plan

Read More »