The United States has sent a clear message to loan modification scammers and perpetrators of mortgage fraud: we're coming to get you.

[fa icon="clock-o"] Friday, September 13, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, mortgage fraud, Scam Alert

Read More »

[fa icon="clock-o"] Friday, August 30, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense, short sale

Read More »

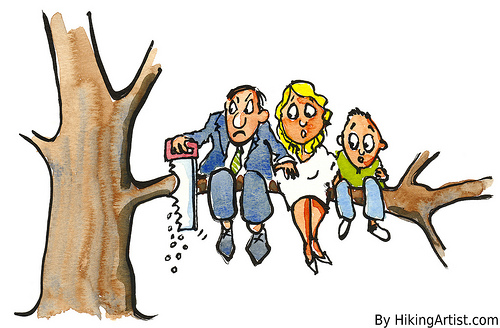

This is the final installment in a three part series about free loan modifications. You can read Part 1: Free Loan Modifications: Hope Now and Part 2: Free Loan Modifications: NACA Know How?

In Brief:

- Hope Now, NACA, and other free loan modification services have helped thousands of homeowners.

- There are 3 main drawbacks to these free services.

- These companies can't help you the way a foreclosure defense attorney can.

Are Homeowners Being helped by Free Loan Modification Programs Hope Now and NACA?

[fa icon="clock-o"] Monday, August 19, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

This is a three part series about free loan modificaitons. See last week's article: Free Loan Modifications - Part 1: Hope Now Alliance

In Brief:

- NACA started as a grassroots homeowner advocacy group.

- Like Hope Now Alliance, NACA has ties with the big banks.

- Homeowners are better off using other methods of foreclosure defense.

NACA's Story

The Neighborhood Assistance Corporation of America, or NACA for short, is as different from Hope Now (the subject of our last blog post) as can be. NACA started in the late 1980's as a local grassroots organization in Boston. It worked in concert with local trade organizations and unions to help rehabilitate neighborhoods and change housing laws, and the results of its work created positive ripples for homeowners throughout the United States. NACA continued to expand into a national entity into the mid 2000's, and forged agreements with most of the USA's top lenders to create favorable situations for homeowners in need. NACA even took the step of creating their own "fair" mortgage for homeowners, which was backed by the same big banks that NACA had signed agreements with.

[fa icon="clock-o"] Thursday, August 15, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

Many homeowners are reducing their living expenses and applying those savings to their monthly mortgage payments. Others are seeking a mortgage loan modification, which can be a lifeline for any homeowner faced with foreclosure.

"It's critical that homeowners understand exactly what they can afford because a loan modification that is ultimately unaffordable hurts everyone," says Michelle Jones, Senior Vice President of Counseling for Consumer Credit Counseling Service (CCCS) of Greater Atlanta. "We help consumers create a lean, sustainable budget that will support the family's housing costs."

Here are some simple steps that many homeowners have taken to help qualify for a loan modification:

[fa icon="clock-o"] Wednesday, August 14, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification

Read More »

In Brief:

- Hope Now Alliance was created by the Bush administration to save people from foreclosure.

- Due to its ties with the big banks, Hope Now isn't the best foreclosure defense alternative.

- Homeowners are better off using other methods of foreclosure defense.

In the wake of the foreclosure crisis, it's no surprise that there have been many "foreclosure rescue" schemes- some illegal and some legitamate- that have victimized homeowners in foreclosure, such as what that we've covered here and here. This has been especially true in states such as Illinois, Florida, and New Jersey, where the mortgage crisis was and is still at its worst. While the government has made an extensive effort to reign in illegal schemes, the government has never made a legitimate effort to change its own foreclosure recovery program for the better. Although Hope Now Alliance has assisted hundreds of thousands of homeowners, the question will always be "what if". What if it was more efficient? What if it offered homeowners better solutions? What if it wasn't bankrolled by the large banks? No one will ever know.

[fa icon="clock-o"] Friday, August 9, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

We often receive questions from our readers about the Foreclosure Process in Illinois.

Below are 5 common questions about foreclosure in Illinois.

Remember, if you have a question you can leave it in the comments below, or contact our law firm at 877-882-5338 us for a more private matter.

1.) How Does the new Illinois Foreclosure Law Affect Me?

From a reader in Bloomington, Illinois

The new foreclosure law in Illinois affects you because it protects you from a wrongful foreclosure.

[fa icon="clock-o"] Wednesday, August 7, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] illinois foreclosure lawyer, how to stop foreclosure, loan modification attorney, loan modification

Read More »Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to Ocwen Financial. This homeowner was locked into a monthly mortgage payment of $2,341.74 at an astronomically high 10.30% interest rate. He had already been offered a loan modification which he wasn't able to afford, and his home was about to be sold in foreclosure if he didn't do something quickly. However, this homeowner's situation changed completely in the months after he retained our firm this February 2013.

A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to Ocwen Financial. This homeowner was locked into a monthly mortgage payment of $2,341.74 at an astronomically high 10.30% interest rate. He had already been offered a loan modification which he wasn't able to afford, and his home was about to be sold in foreclosure if he didn't do something quickly. However, this homeowner's situation changed completely in the months after he retained our firm this February 2013.

[fa icon="clock-o"] Saturday, July 27, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A Florida homeowner was having difficulty paying his monthly mortgage payment and was fearful of losing his home. His fear was well-founded, because he was nearly 1.5 years behind and over $52,000 past due on his monthly mortgage payments to Bank of America. This situation was further exasperated by the high cost of his monthly payment: nearly $3,400 monthly.

A Florida homeowner was having difficulty paying his monthly mortgage payment and was fearful of losing his home. His fear was well-founded, because he was nearly 1.5 years behind and over $52,000 past due on his monthly mortgage payments to Bank of America. This situation was further exasperated by the high cost of his monthly payment: nearly $3,400 monthly.

[fa icon="clock-o"] Saturday, July 20, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »Disclaimer: these results should not be construed as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

[fa icon="clock-o"] Saturday, July 13, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »